Question

The below figure is Figure 1 from Ball and Brown [Ball, R. and Brown, P. (1968). An empirical evaluation of accounting income numbers, Journal of

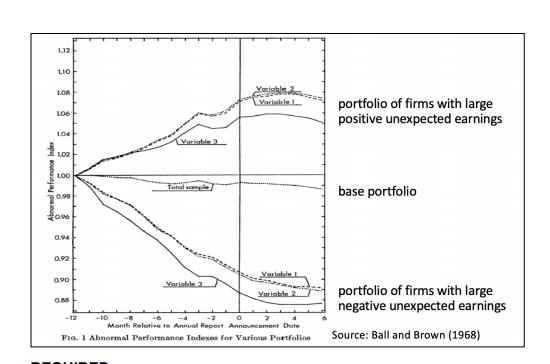

The below figure is Figure 1 from Ball and Brown [Ball, R. and Brown, P. (1968). An empirical evaluation of accounting income numbers, Journal of Accounting Research 6(2): p. 169]. Focus on the portfolio of firms with large positive unexpected earnings (good news firms) and the portfolio of firms with large negative unexpected earnings (bad news firms). The figure shows cumulative returns for these two portfolios around the earnings announcement date (0), i.e., the date when a firm discloses the most important information from the annual financial statements.

i) Describe the return patterns that you observe for the two portfolios. [3 marks]

ii) Explain what you can learn about the relative importance of accounting information compared to other information sources from the above figure. [4 marks]

iii) Based on the above figure, discuss whether accounting information can serve a valuation objective in practice.

1.12 Performance Index 1.10 1.08 106 1.04 11.02 8 1.00 70.99 20.96 0.94 0,92 0.90 0.45 Variable 3 -12 Total sample Variable 3. Variable 0 Variable J -6 -4 -2 -10 - 2 Month Relative to Annual Report Announcement Date FIG. 1 Abnormal Performance Indexes for Various Portfolion Variable 2 portfolio of firms with large positive unexpected earnings base portfolio portfolio of firms with large negative unexpected earnings Source: Ball and Brown (1968)

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation i The below figure is Figure 1 from B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started