the benefit of international trade are derived from

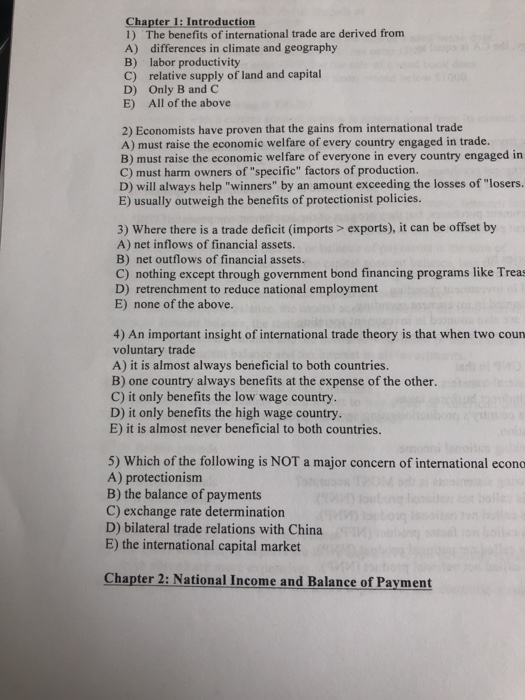

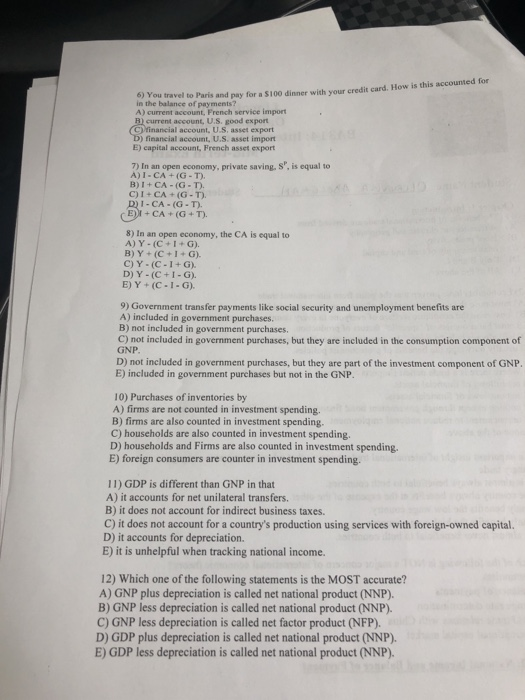

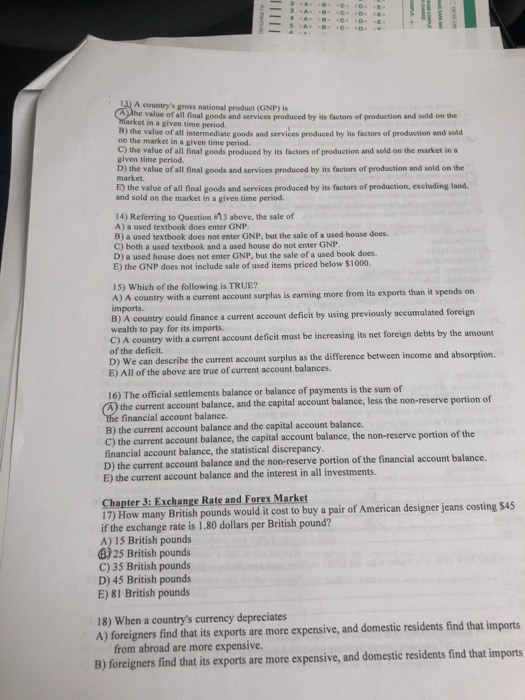

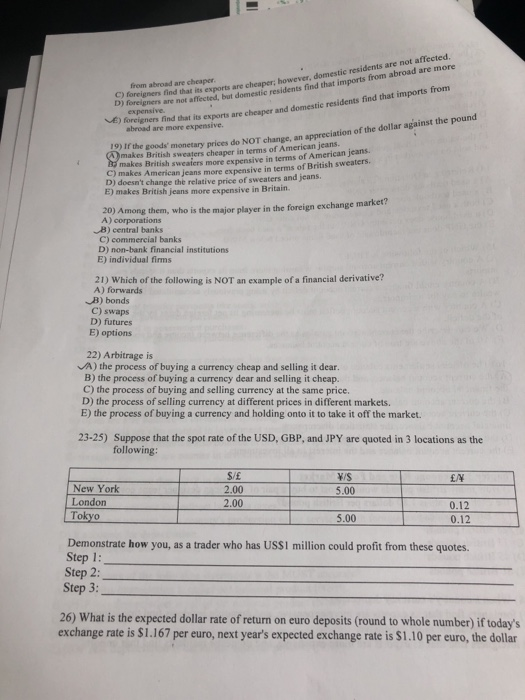

Chapter 1: Introduction 1) The benefits of international trade are derived from A) differences in climate and geography B) labor productivity C) relative supply of land and capital D) Only B and C E) All of the above 2) Economists have proven that the gains from international trade A) must raise the economic welfare of every country engaged in trade. B) must raise the economic welfare of everyone in every country engaged in C) must harm owners of "specific" factors of production. D) will always help "winners" by an amount exceeding the losses of "losers. E) usually outweigh the benefits of protectionist policies. 3) Where there is a trade deficit (imports> exports), it can be offset by A) net inflows of financial assets. B) net outflows of financial assets. C) nothing except through government bond financing programs like Treas D) retrenchment to reduce national employment E) none of the above. 4) An important insight of international trade theory is that when two coun voluntary trade A) it is almost always beneficial to both countries. B) one country always benefits at the expense of the other. C) it only benefits the low wage country. D) it only benefits the high wage country. E) it is almost never beneficial to both countries. 5) Which of the following is NOT a major concern of international econo A) protectionism B) the balance of payments C) exchange rate determination DJ bilateral trade relations with China D) bilateral trade relations with China E) the international capital market Chapter 2: National Income and Balance of Payment You travel to Paris and pay for a $100 dinner with your credit card. How is this accounted for in the balance of payments? A) current account, French service import B) current account, U.S. good export C) financial account, U.S. asset export b) financial account, U.S. asset import E) capital account, French asset export 7) In an open economy, private saving, s', is equal to A) I-CA+ (G-T). B) + CA-(G-T). c) + CA +(G-T). D) I-CA-(G-T). E + CA +(G+T). 8) In an open economy, the CA is equal to A) Y-(C+I+G). B) Y+(C+I+G). C) Y-(C-1+G). D) Y-(C +I-G). E) Y + (C - I-G). 9) Government transfer payments like social security and unemployment benefits are A) included in government purchases. B) not included in government purchases. C) not included in government purchases, but they are included in the consumption component of GNP D) not included in government purchases, but they are part of the investment component of GNP. E) included in government purchases but not in the GNP. 10) Purchases of inventories by A) firms are not counted in investment spending. B) firms are also counted in investment spending. C) households are also counted in investment spending. D) households and Firms are also counted in investment spending. E) foreign consumers are counter in investment spending. 11) GDP is different than GNP in that A) it accounts for net unilateral transfers. B) it does not account for indirect business taxes. C) it does not account for a country's production using services with foreign-owned capital. D) it accounts for depreciation. E) it is unhelpful when tracking national income. 12) Which one of the following statements is the MOST accurate? A) GNP plus depreciation is called net national product (NNP). B) GNP less depreciation is called net national product (NNP). C) GNP less depreciation is called net factor product (NFP). D) GDP plus depreciation is called net national product (NNP). E) GDP less depreciation is called net national product (NNP). 12) A country's gross national product (CNP) is the value of all final goods and services produced by its factors of production and sold on the market in a given time period By the value of all intermediate goods and services produced by its factors of production and sold on the market in a given time period. C) the value of all final goods produced by its factors of production and sold on the market in a given time period. D) the value of all final goods and services produced by its factors of production and sold on the market E) the value of all final goods and services produced by its factors of production, excluding land, and sold on the market in a given time period. 14) Referring to Question above, the sale of A) a used textbook does enter GNP. B) a used textbook does not enter GNP, but the sale of a used house does. C) both a used textbook and a used house do not enter GNP. D) a used house does not enter GNP, but the sale of a used book does E) the GNP does not include sale of used items priced below $1000. 15) Which of the following is TRUE? A) A country with a current account surplus is earning more from its exports than it spends on imports. B) A country could finance a current account deficit by using previously accumulated foreign wealth to pay for its imports. C) A country with a current account deficit must be increasing its net foreign debts by the amount of the deficit. D) We can describe the current account surplus as the difference between income and absorption. E) All of the above are true of current account balances. 16) The official settlements balance or balance of payments is the sum of A) the current account balance, and the capital account balance, less the non-reserve portion of The financial account balance. B) the current account balance and the capital account balance. C) the current account balance, the capital account balance, the non-reserve portion of the financial account balance, the statistical discrepancy. D) the current account balance and the non-reserve portion of the financial account balance. E) the current account balance and the interest in all investments. Chapter 3: Exchange Rate and Forex Market 17) How many British pounds would it cost to buy a pair of American designer Jeans costing $45 if the exchange rate is 1.80 dollars per British pound? A) 15 British pounds 25 British pounds C) 35 British pounds D) 45 British pounds E) 81 British pounds 18) When a country's currency depreciates A) foreigners find that its exports are more expensive, and domestic residents find that imports from abroad are more expensive. B) foreigners find that its exports are more expensive, and domestic residents find that imports from abroad are cheaper C) foreigners find that is er i nd that its exports are cheaper; however, domestic residents are not affected. are not affected, but domestic residente find that imports from abroad are more D expensive eners find that is parts are shape and deste residents find that impons from ad are more expensive i ation of the dollar against the pound ods monetary prices do NOT chang makes British sweaters cheaper in terms of American jeans makes British sweaters more expensive in terms of American jeans C) makes American Jeans more expensive in terms of British sweaters D) doesn't change the relative price of sweaters and jeans. E) makes British jeans more expensive in Britain 20) Among them, who is the major player in the foreign exchange market A) corporations B) central banks C) commercial banks D) non-bank financial institutions E) individual firms 21) Which of the following is NOT an example of a financial derivative? A) forwards B) bonds C) swaps D) futures E) options 22) Arbitrage is A) the process of buying a currency cheap and selling it dear. B) the process of buying a currency dear and selling it cheap. C) the process of buying and selling currency at the same price. D) the process of selling currency at different prices in different markets. E) the process of buying a currency and holding onto it to take it off the market. 23-25) Suppose that the spot rate of the USD, GBP, and JPY are quoted in 3 locations as the following: EN SE 2.00 2.00 VS 5.00 New York London Tokyo 5.00 0.12 Demonstrate how you, as a trader who has USSI million could profit from these quotes. Step 1: Step 2: Step 3: xpected dollar rate of return on euro deposits (round to whole number) if today's exchange rate is $1.167 per euro, next year's expected exchange rate is $1.10 per euro, the dollar interest rate is 10%, and the core interest rate is 5%? A) 1096 B) 1196 C) 06 D)-156 E) None of the above 2) If the dollar interest rate is 10 percent the une interest rate is 6 percent, then A) an investor should invest only in dollars if the expected dollar depreciation against the euro is 4 percent. B) an investor should invest only in curas if the expected dollar depreciation against the euro is 4 percent. C) an investor should be indifferent between dollars and euros if the expected dollar depreciation against the euro is 4 percent. D) an investor should invest only in dollars. E) an investor should invest only in euros. 1.113 per - Suppose that the one-year forward price of euros in terms of dollars is equal to euro. Further, assume that the spot exchange rate is $1.05 per euro, and the interest rate on dollar deposits is 10 percent and on euro it is 4 percent. Under these assumptions A) interest parity does not hold. B) interest parity does hold. C) it is hard to tell whether interest parity does or does not hold. D) interest parity fluctuates. E) Not enough information is given to answer the question. Chapter 4: Money, Interest Rate, and Exchange Rate 29) Individuals base their demand for an asset on A) the expected return the asset offers compared with the returns offered by other assets. B) the riskiness of the asset's expected return. C) the asset's liquidity. D) the expected return, how risky that expected return is, and the asset's liquidity. E) the aesthetic qualities of the asset. 30) The aggregate real money demand schedule L(R,Y) A) slopes upward because a fall in the interest rate raises the desired real money holdings of each household and firm in the economy. B) slopes downward because a fall in the interest rate reduces the desired real money holdings of each household and firm in the economy. C) has a zero slope because a fall in the interest rate keeps constant the desired real money holdings of each household and firm in the economy. D) slopes downward because a fall in the interest rate raises the desired real money holdings of each household and firm in the economy. E) slopes downward because a rise in the interest rate makes consumers less focused on the liquidity of their assets. 31) For a given level of NP, changes in interest rates cause movements along the L(R.Y) schedule. B) real GNP, changes in interest rates cause a decrease of the L(RY) schedule. C) real GNP, changes in interest rates cause an increase of the L(R,Y) schedule. D) nominal CNP, changes in interest MONPchanges interest rates increase in the LR,Y) schedule al GNP changes in interest rates cause movement along the LRY) schedule. N sing the exchange rate and if there is in e mand for money, the interest rate will fall, and the supply of money will rise will ply of money, the interest rate will and if there is initially an exces demande supply of money, the interest rate will rise, and if there is initially an excess o initially an excess demand, it p ply of money, the interest rate will fall, and if there is also an excess demand, will D) excess SUD w a fall rapidly. of money, the interest rate will rise, and if there is also an excess demand, 33) A reduction in a country's money supply causes A) is currency to depreciate in the foreign exchange market Its Currency to a c t in the foreign exchange market. C) does not affect its currency in the foreign market D) does affect its currency in the foreign market in an ambiguous manor. E) affects other countries currency in the foreign market 34) Which of the following can help to explain why higher inflation may lead to currency appreciations? A) The interest rate is not the prime target of monetary policy B) Most central banks adjust their policy interest rates expressly so as to keep inflation in check C) Central banks increase the money supply leading to overshooting of the exchange rate. D) Inflation will increase the purchasing power of a currency. E) The world market does not adjust their currency trade to reflect inflation 35) After a permanent increase in the money supply A) the exchange rate overshoots in the short run. B) the exchange rate overshoots in the long run. C) the exchange rate smoothly depreciates in the short run. D) the exchange rate smoothly appreciates in the short run. E) the exchange rate remains the same. 36) A permanent increase in a country's money supply A) causes a more than proportional increase in its price level. B) causes a less than proportional increase in its price level. C) causes a proportional increase in its price level. D) leaves its price level constant in long-run equilibrium. E) causes an inversely proportional fall in its price level. 37) If individuals are holding more money than they desire A) they will attempt to reduce their liquidity by using money to purchase goods. B) they will attempt to reduce their liquidity by using money to purchase interest-bearing assets. C) they will attempt to reduce their liquidity by converting real money holdings into nominal money holdings D) they will keep their holdings constant. E) they will not know what to do 18) Money Als menores change B) a unit of acum of value (D) a legal tender that can be EXCEPT 39) The goal of home ownership is A) not to pay rent B) capital gain. C) the pleasure of having a sheer O two of the above answers. E) all of the above answers o derate exchange rate movements without Chapter 7: Fixed Exchange Rate and Fore 40) A system of managed v ention ting exchange rate is A system in which to moderate exchange keeping exchange rates rigidly fixed a system in which governments use flexible exchange rates in which the f e male movements without keeping exchange rates rigidly fixed ng them before they may in which t o h attempt to moderate exchange rate movements without keeping exchange rates rigidly fixed. E) a system in which governments use extensive fiscal policy to discourage exchange rate movements 41) Which one of the following statements is most correct? A) If central banks are not sterilizing and the home country has a balance of payments surplus. any associated increase in a foreign central bank's claims on the home country implies a decreased foreign money supply. B) If central banks are not sterilizing and the home country has a balance of payments surplus, any associated decrease in a foreign central bank's claims on the home country implies a decreased foreign money demand C) If central banks are not sterilizing and the home country has a balance of payments surplus, any associated decrease in a foreign central bank's claims on the home country implies a decreased foreign money supply. D) If central banks are not sterilizing and the home country has a balance of payments shortage, any associated decrease in a foreign central bank's claims on the home country implies a decreased foreign money supply. E) If central banks are not sterilizing and the home country has a balance of payments shortage, any associated decrease in a foreign central bank's claims on the home country implies an increased domestic money supply. 42) Which one of the following statements is the MOST accurate? A) Under a fixed exchange rate, central bank monetary tools are powerless to affect the economy's money supply. B) Under a flexible exchange rate, central bank monetary tools are powerless to affect the economy's money supply or its output. C) Under a fixed exchange rate, fiscal policy tools are powerless to affect the economy's money supply or its output. bank monetary tools are powerless to affect the exchange rate central bank monetary tools are powerless to affect the conomy' Onder a fixed exchange rate sentralbank monetary tools are power economy's money supply or its output E) Under a dirty float exchange rate, central ba onomy's money supply or its output Fiscal expansion under fixed exchange rates will have what temporan A) the money supply will decrease Bloutput will decrease C) the exchange rate will increase D) the exchange rate will decrease E) there will be no effect e what temporary effect? 44) Which one of the following statements is the MOST accurate where I meanse per foreign currency in the textbook? A) A delation occurs when the central bank lower the domestic currency price of foreign currency. E, and a revaluation occurs when the central bank raises E. B) A devaluation occurs when the central bank raises the domestic currency price of foreign currency, E, and a revaluation occurs when the central bank lowers E. C) Devaluation occurs when the domestic currency price of foreign currency. E, raises and a revaluation occurs when E is lowered D) A devaluation occurs when the central bank of the forein country raises the domestic currency price of foreign currency, and a revaluation occurs when the central bank of the foreign country lowers E. E) A devaluation occurs when the central bank raises the foreign currency price of domestic currency, E, and a revaluation occurs when the central bank lowers E. 45) Using China as an example for fixing exchange rates, which one of the following statements is the MOST accurate? A) Devaluation causes a decrease in output, a reduction in current account, a decrease in official reserves, and a contraction of the money supply. B) Devaluation causes a rise in output, an improvement in current account, a rise in official reserves, and an expansion of the money supply. C) Devaluation causes a rise in output, reduces export, and a rise in official reserves. D) Devaluation causes a rise in output and an expansion of the money supply. E) Devaluation causes a rise in official reserves, and an expansion of the money supply. 46) The expectation of future devaluation causes a balance of payments crisis marked by A) a sharp rise in reserves and a fall in the home interest rate below the world interest rate. B) a sharp fall in reserves and an even bigger fall in the home interest rate below the world interest rate. C) a sharp fall in reserves and a rise in the home interest rate above the world interest rate. D) a sharp rise in reserves and an even greater rise in the home interest rate above the world Interest. E) a sharp rise in reserves and a rise in the home interest rate to the level of the world interest. 47) Currency crises may result from A) central bank balance sheets with higher liabilities than assets. B) political upheaval leading to lowering exports. C) a reconfiguration of central bank balance sheets. D) speculative attacks on the currency or central banks purchasing excessive amounts of government bonds to increase money supply. Chapter 1: Introduction 1) The benefits of international trade are derived from A) differences in climate and geography B) labor productivity C) relative supply of land and capital D) Only B and C E) All of the above 2) Economists have proven that the gains from international trade A) must raise the economic welfare of every country engaged in trade. B) must raise the economic welfare of everyone in every country engaged in C) must harm owners of "specific" factors of production. D) will always help "winners" by an amount exceeding the losses of "losers. E) usually outweigh the benefits of protectionist policies. 3) Where there is a trade deficit (imports> exports), it can be offset by A) net inflows of financial assets. B) net outflows of financial assets. C) nothing except through government bond financing programs like Treas D) retrenchment to reduce national employment E) none of the above. 4) An important insight of international trade theory is that when two coun voluntary trade A) it is almost always beneficial to both countries. B) one country always benefits at the expense of the other. C) it only benefits the low wage country. D) it only benefits the high wage country. E) it is almost never beneficial to both countries. 5) Which of the following is NOT a major concern of international econo A) protectionism B) the balance of payments C) exchange rate determination DJ bilateral trade relations with China D) bilateral trade relations with China E) the international capital market Chapter 2: National Income and Balance of Payment You travel to Paris and pay for a $100 dinner with your credit card. How is this accounted for in the balance of payments? A) current account, French service import B) current account, U.S. good export C) financial account, U.S. asset export b) financial account, U.S. asset import E) capital account, French asset export 7) In an open economy, private saving, s', is equal to A) I-CA+ (G-T). B) + CA-(G-T). c) + CA +(G-T). D) I-CA-(G-T). E + CA +(G+T). 8) In an open economy, the CA is equal to A) Y-(C+I+G). B) Y+(C+I+G). C) Y-(C-1+G). D) Y-(C +I-G). E) Y + (C - I-G). 9) Government transfer payments like social security and unemployment benefits are A) included in government purchases. B) not included in government purchases. C) not included in government purchases, but they are included in the consumption component of GNP D) not included in government purchases, but they are part of the investment component of GNP. E) included in government purchases but not in the GNP. 10) Purchases of inventories by A) firms are not counted in investment spending. B) firms are also counted in investment spending. C) households are also counted in investment spending. D) households and Firms are also counted in investment spending. E) foreign consumers are counter in investment spending. 11) GDP is different than GNP in that A) it accounts for net unilateral transfers. B) it does not account for indirect business taxes. C) it does not account for a country's production using services with foreign-owned capital. D) it accounts for depreciation. E) it is unhelpful when tracking national income. 12) Which one of the following statements is the MOST accurate? A) GNP plus depreciation is called net national product (NNP). B) GNP less depreciation is called net national product (NNP). C) GNP less depreciation is called net factor product (NFP). D) GDP plus depreciation is called net national product (NNP). E) GDP less depreciation is called net national product (NNP). 12) A country's gross national product (CNP) is the value of all final goods and services produced by its factors of production and sold on the market in a given time period By the value of all intermediate goods and services produced by its factors of production and sold on the market in a given time period. C) the value of all final goods produced by its factors of production and sold on the market in a given time period. D) the value of all final goods and services produced by its factors of production and sold on the market E) the value of all final goods and services produced by its factors of production, excluding land, and sold on the market in a given time period. 14) Referring to Question above, the sale of A) a used textbook does enter GNP. B) a used textbook does not enter GNP, but the sale of a used house does. C) both a used textbook and a used house do not enter GNP. D) a used house does not enter GNP, but the sale of a used book does E) the GNP does not include sale of used items priced below $1000. 15) Which of the following is TRUE? A) A country with a current account surplus is earning more from its exports than it spends on imports. B) A country could finance a current account deficit by using previously accumulated foreign wealth to pay for its imports. C) A country with a current account deficit must be increasing its net foreign debts by the amount of the deficit. D) We can describe the current account surplus as the difference between income and absorption. E) All of the above are true of current account balances. 16) The official settlements balance or balance of payments is the sum of A) the current account balance, and the capital account balance, less the non-reserve portion of The financial account balance. B) the current account balance and the capital account balance. C) the current account balance, the capital account balance, the non-reserve portion of the financial account balance, the statistical discrepancy. D) the current account balance and the non-reserve portion of the financial account balance. E) the current account balance and the interest in all investments. Chapter 3: Exchange Rate and Forex Market 17) How many British pounds would it cost to buy a pair of American designer Jeans costing $45 if the exchange rate is 1.80 dollars per British pound? A) 15 British pounds 25 British pounds C) 35 British pounds D) 45 British pounds E) 81 British pounds 18) When a country's currency depreciates A) foreigners find that its exports are more expensive, and domestic residents find that imports from abroad are more expensive. B) foreigners find that its exports are more expensive, and domestic residents find that imports from abroad are cheaper C) foreigners find that is er i nd that its exports are cheaper; however, domestic residents are not affected. are not affected, but domestic residente find that imports from abroad are more D expensive eners find that is parts are shape and deste residents find that impons from ad are more expensive i ation of the dollar against the pound ods monetary prices do NOT chang makes British sweaters cheaper in terms of American jeans makes British sweaters more expensive in terms of American jeans C) makes American Jeans more expensive in terms of British sweaters D) doesn't change the relative price of sweaters and jeans. E) makes British jeans more expensive in Britain 20) Among them, who is the major player in the foreign exchange market A) corporations B) central banks C) commercial banks D) non-bank financial institutions E) individual firms 21) Which of the following is NOT an example of a financial derivative? A) forwards B) bonds C) swaps D) futures E) options 22) Arbitrage is A) the process of buying a currency cheap and selling it dear. B) the process of buying a currency dear and selling it cheap. C) the process of buying and selling currency at the same price. D) the process of selling currency at different prices in different markets. E) the process of buying a currency and holding onto it to take it off the market. 23-25) Suppose that the spot rate of the USD, GBP, and JPY are quoted in 3 locations as the following: EN SE 2.00 2.00 VS 5.00 New York London Tokyo 5.00 0.12 Demonstrate how you, as a trader who has USSI million could profit from these quotes. Step 1: Step 2: Step 3: xpected dollar rate of return on euro deposits (round to whole number) if today's exchange rate is $1.167 per euro, next year's expected exchange rate is $1.10 per euro, the dollar interest rate is 10%, and the core interest rate is 5%? A) 1096 B) 1196 C) 06 D)-156 E) None of the above 2) If the dollar interest rate is 10 percent the une interest rate is 6 percent, then A) an investor should invest only in dollars if the expected dollar depreciation against the euro is 4 percent. B) an investor should invest only in curas if the expected dollar depreciation against the euro is 4 percent. C) an investor should be indifferent between dollars and euros if the expected dollar depreciation against the euro is 4 percent. D) an investor should invest only in dollars. E) an investor should invest only in euros. 1.113 per - Suppose that the one-year forward price of euros in terms of dollars is equal to euro. Further, assume that the spot exchange rate is $1.05 per euro, and the interest rate on dollar deposits is 10 percent and on euro it is 4 percent. Under these assumptions A) interest parity does not hold. B) interest parity does hold. C) it is hard to tell whether interest parity does or does not hold. D) interest parity fluctuates. E) Not enough information is given to answer the question. Chapter 4: Money, Interest Rate, and Exchange Rate 29) Individuals base their demand for an asset on A) the expected return the asset offers compared with the returns offered by other assets. B) the riskiness of the asset's expected return. C) the asset's liquidity. D) the expected return, how risky that expected return is, and the asset's liquidity. E) the aesthetic qualities of the asset. 30) The aggregate real money demand schedule L(R,Y) A) slopes upward because a fall in the interest rate raises the desired real money holdings of each household and firm in the economy. B) slopes downward because a fall in the interest rate reduces the desired real money holdings of each household and firm in the economy. C) has a zero slope because a fall in the interest rate keeps constant the desired real money holdings of each household and firm in the economy. D) slopes downward because a fall in the interest rate raises the desired real money holdings of each household and firm in the economy. E) slopes downward because a rise in the interest rate makes consumers less focused on the liquidity of their assets. 31) For a given level of NP, changes in interest rates cause movements along the L(R.Y) schedule. B) real GNP, changes in interest rates cause a decrease of the L(RY) schedule. C) real GNP, changes in interest rates cause an increase of the L(R,Y) schedule. D) nominal CNP, changes in interest MONPchanges interest rates increase in the LR,Y) schedule al GNP changes in interest rates cause movement along the LRY) schedule. N sing the exchange rate and if there is in e mand for money, the interest rate will fall, and the supply of money will rise will ply of money, the interest rate will and if there is initially an exces demande supply of money, the interest rate will rise, and if there is initially an excess o initially an excess demand, it p ply of money, the interest rate will fall, and if there is also an excess demand, will D) excess SUD w a fall rapidly. of money, the interest rate will rise, and if there is also an excess demand, 33) A reduction in a country's money supply causes A) is currency to depreciate in the foreign exchange market Its Currency to a c t in the foreign exchange market. C) does not affect its currency in the foreign market D) does affect its currency in the foreign market in an ambiguous manor. E) affects other countries currency in the foreign market 34) Which of the following can help to explain why higher inflation may lead to currency appreciations? A) The interest rate is not the prime target of monetary policy B) Most central banks adjust their policy interest rates expressly so as to keep inflation in check C) Central banks increase the money supply leading to overshooting of the exchange rate. D) Inflation will increase the purchasing power of a currency. E) The world market does not adjust their currency trade to reflect inflation 35) After a permanent increase in the money supply A) the exchange rate overshoots in the short run. B) the exchange rate overshoots in the long run. C) the exchange rate smoothly depreciates in the short run. D) the exchange rate smoothly appreciates in the short run. E) the exchange rate remains the same. 36) A permanent increase in a country's money supply A) causes a more than proportional increase in its price level. B) causes a less than proportional increase in its price level. C) causes a proportional increase in its price level. D) leaves its price level constant in long-run equilibrium. E) causes an inversely proportional fall in its price level. 37) If individuals are holding more money than they desire A) they will attempt to reduce their liquidity by using money to purchase goods. B) they will attempt to reduce their liquidity by using money to purchase interest-bearing assets. C) they will attempt to reduce their liquidity by converting real money holdings into nominal money holdings D) they will keep their holdings constant. E) they will not know what to do 18) Money Als menores change B) a unit of acum of value (D) a legal tender that can be EXCEPT 39) The goal of home ownership is A) not to pay rent B) capital gain. C) the pleasure of having a sheer O two of the above answers. E) all of the above answers o derate exchange rate movements without Chapter 7: Fixed Exchange Rate and Fore 40) A system of managed v ention ting exchange rate is A system in which to moderate exchange keeping exchange rates rigidly fixed a system in which governments use flexible exchange rates in which the f e male movements without keeping exchange rates rigidly fixed ng them before they may in which t o h attempt to moderate exchange rate movements without keeping exchange rates rigidly fixed. E) a system in which governments use extensive fiscal policy to discourage exchange rate movements 41) Which one of the following statements is most correct? A) If central banks are not sterilizing and the home country has a balance of payments surplus. any associated increase in a foreign central bank's claims on the home country implies a decreased foreign money supply. B) If central banks are not sterilizing and the home country has a balance of payments surplus, any associated decrease in a foreign central bank's claims on the home country implies a decreased foreign money demand C) If central banks are not sterilizing and the home country has a balance of payments surplus, any associated decrease in a foreign central bank's claims on the home country implies a decreased foreign money supply. D) If central banks are not sterilizing and the home country has a balance of payments shortage, any associated decrease in a foreign central bank's claims on the home country implies a decreased foreign money supply. E) If central banks are not sterilizing and the home country has a balance of payments shortage, any associated decrease in a foreign central bank's claims on the home country implies an increased domestic money supply. 42) Which one of the following statements is the MOST accurate? A) Under a fixed exchange rate, central bank monetary tools are powerless to affect the economy's money supply. B) Under a flexible exchange rate, central bank monetary tools are powerless to affect the economy's money supply or its output. C) Under a fixed exchange rate, fiscal policy tools are powerless to affect the economy's money supply or its output. bank monetary tools are powerless to affect the exchange rate central bank monetary tools are powerless to affect the conomy' Onder a fixed exchange rate sentralbank monetary tools are power economy's money supply or its output E) Under a dirty float exchange rate, central ba onomy's money supply or its output Fiscal expansion under fixed exchange rates will have what temporan A) the money supply will decrease Bloutput will decrease C) the exchange rate will increase D) the exchange rate will decrease E) there will be no effect e what temporary effect? 44) Which one of the following statements is the MOST accurate where I meanse per foreign currency in the textbook? A) A delation occurs when the central bank lower the domestic currency price of foreign currency. E, and a revaluation occurs when the central bank raises E. B) A devaluation occurs when the central bank raises the domestic currency price of foreign currency, E, and a revaluation occurs when the central bank lowers E. C) Devaluation occurs when the domestic currency price of foreign currency. E, raises and a revaluation occurs when E is lowered D) A devaluation occurs when the central bank of the forein country raises the domestic currency price of foreign currency, and a revaluation occurs when the central bank of the foreign country lowers E. E) A devaluation occurs when the central bank raises the foreign currency price of domestic currency, E, and a revaluation occurs when the central bank lowers E. 45) Using China as an example for fixing exchange rates, which one of the following statements is the MOST accurate? A) Devaluation causes a decrease in output, a reduction in current account, a decrease in official reserves, and a contraction of the money supply. B) Devaluation causes a rise in output, an improvement in current account, a rise in official reserves, and an expansion of the money supply. C) Devaluation causes a rise in output, reduces export, and a rise in official reserves. D) Devaluation causes a rise in output and an expansion of the money supply. E) Devaluation causes a rise in official reserves, and an expansion of the money supply. 46) The expectation of future devaluation causes a balance of payments crisis marked by A) a sharp rise in reserves and a fall in the home interest rate below the world interest rate. B) a sharp fall in reserves and an even bigger fall in the home interest rate below the world interest rate. C) a sharp fall in reserves and a rise in the home interest rate above the world interest rate. D) a sharp rise in reserves and an even greater rise in the home interest rate above the world Interest. E) a sharp rise in reserves and a rise in the home interest rate to the level of the world interest. 47) Currency crises may result from A) central bank balance sheets with higher liabilities than assets. B) political upheaval leading to lowering exports. C) a reconfiguration of central bank balance sheets. D) speculative attacks on the currency or central banks purchasing excessive amounts of government bonds to increase money supply