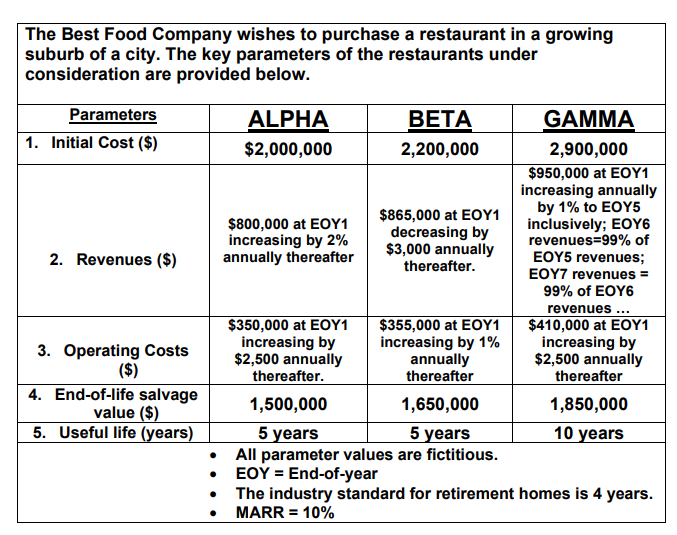

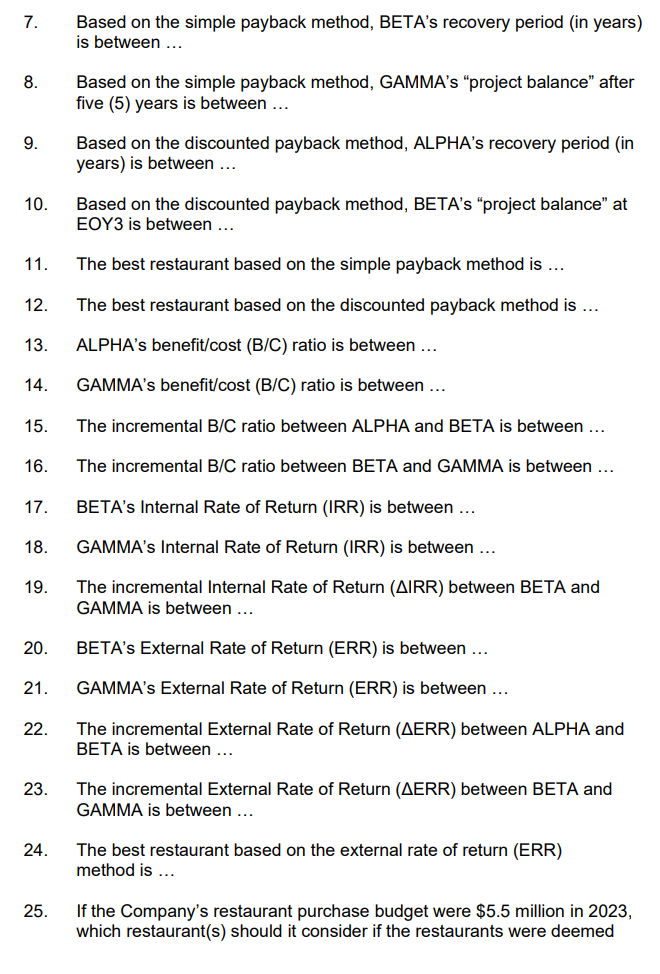

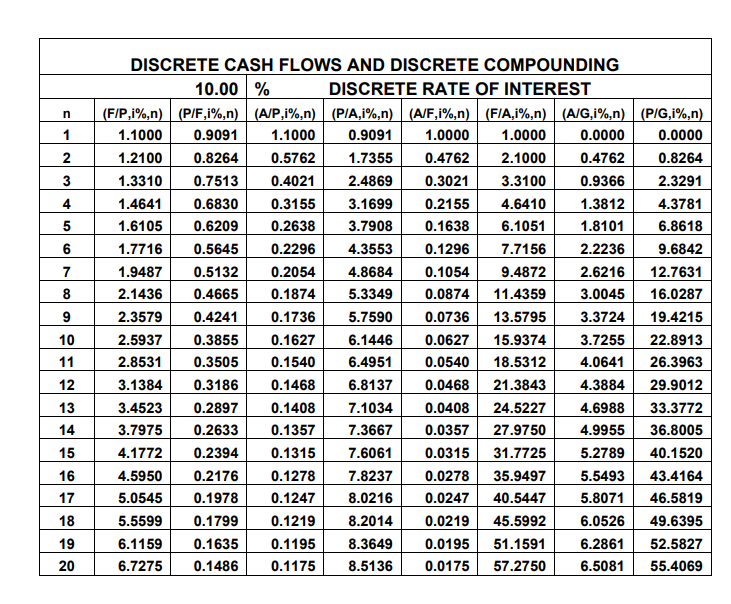

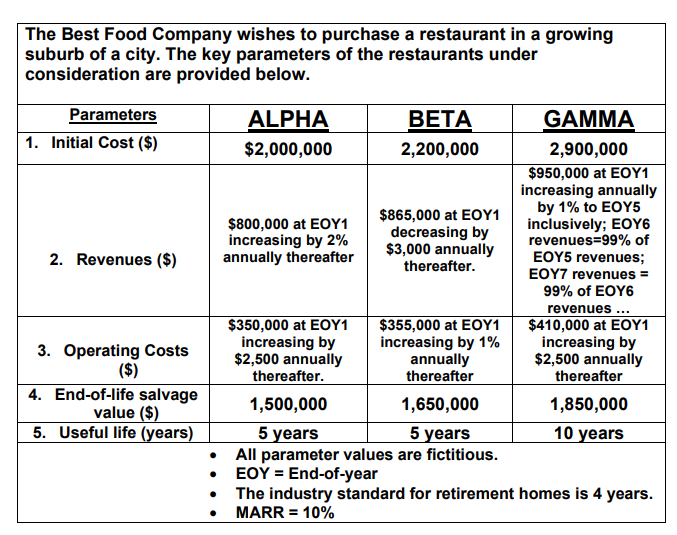

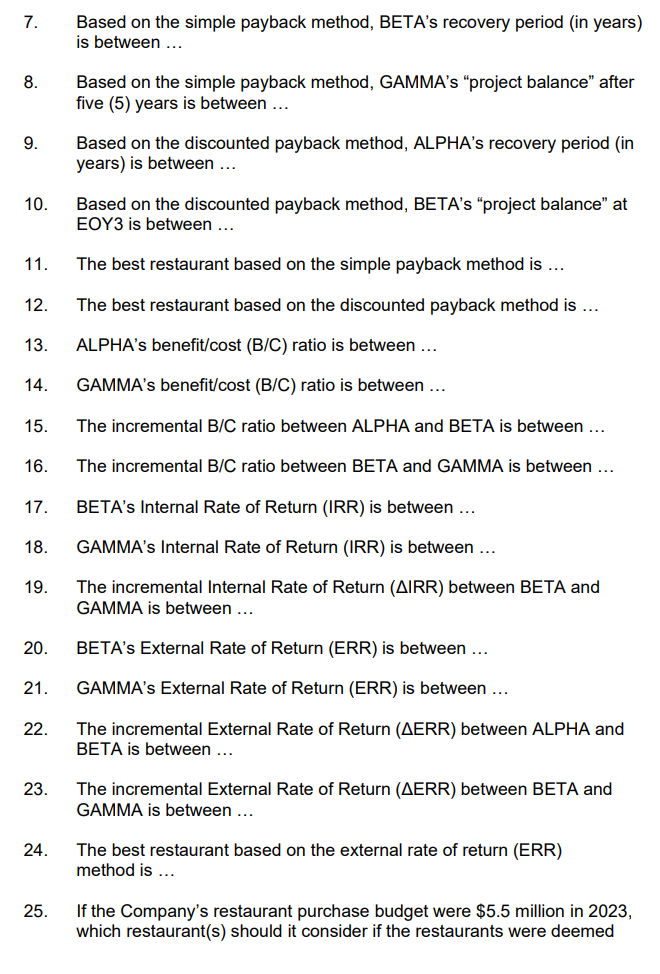

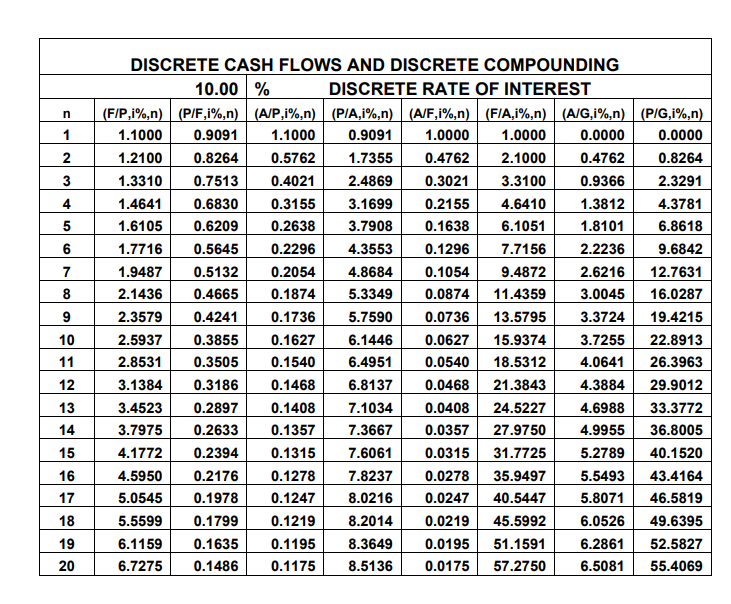

The Best Food Company wishes to purchase a restaurant in a growing suburb of a citv. The kev narameters of the restaurants under 7. Based on the simple payback method, BETA's recovery period (in years) is between ... 8. Based on the simple payback method, GAMMA's "project balance" after five (5) years is between ... 9. Based on the discounted payback method, ALPHA's recovery period (in years) is between ... 10. Based on the discounted payback method, BETA's "project balance" at EOY3 is between ... 11. The best restaurant based on the simple payback method is ... 12. The best restaurant based on the discounted payback method is ... 13. ALPHA's benefit/cost (B/C) ratio is between ... 14. GAMMA's benefit/cost (B/C) ratio is between ... 15. The incremental B/C ratio between ALPHA and BETA is between ... 16. The incremental B/C ratio between BETA and GAMMA is between ... 17. BETA's Internal Rate of Return (IRR) is between ... 18. GAMMA's Internal Rate of Return (IRR) is between ... 19. The incremental Internal Rate of Return (IRR) between BETA and GAMMA is between ... 20. BETA's External Rate of Return (ERR) is between ... 21. GAMMA's External Rate of Return (ERR) is between ... 22. The incremental External Rate of Return ( ERR) between ALPHA and BETA is between ... 23. The incremental External Rate of Return ( ERR) between BETA and GAMMA is between ... 24. The best restaurant based on the external rate of return (ERR) method is ... 25. If the Company's restaurant purchase budget were $5.5 million in 2023 , which restaurant(s) should it consider if the restaurants were deemed DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING The Best Food Company wishes to purchase a restaurant in a growing suburb of a citv. The kev narameters of the restaurants under 7. Based on the simple payback method, BETA's recovery period (in years) is between ... 8. Based on the simple payback method, GAMMA's "project balance" after five (5) years is between ... 9. Based on the discounted payback method, ALPHA's recovery period (in years) is between ... 10. Based on the discounted payback method, BETA's "project balance" at EOY3 is between ... 11. The best restaurant based on the simple payback method is ... 12. The best restaurant based on the discounted payback method is ... 13. ALPHA's benefit/cost (B/C) ratio is between ... 14. GAMMA's benefit/cost (B/C) ratio is between ... 15. The incremental B/C ratio between ALPHA and BETA is between ... 16. The incremental B/C ratio between BETA and GAMMA is between ... 17. BETA's Internal Rate of Return (IRR) is between ... 18. GAMMA's Internal Rate of Return (IRR) is between ... 19. The incremental Internal Rate of Return (IRR) between BETA and GAMMA is between ... 20. BETA's External Rate of Return (ERR) is between ... 21. GAMMA's External Rate of Return (ERR) is between ... 22. The incremental External Rate of Return ( ERR) between ALPHA and BETA is between ... 23. The incremental External Rate of Return ( ERR) between BETA and GAMMA is between ... 24. The best restaurant based on the external rate of return (ERR) method is ... 25. If the Company's restaurant purchase budget were $5.5 million in 2023 , which restaurant(s) should it consider if the restaurants were deemed DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING