Question

The beta of a security (a) is always larger than one (b) can be negative (c) expresses the security's sensitivity to the return of

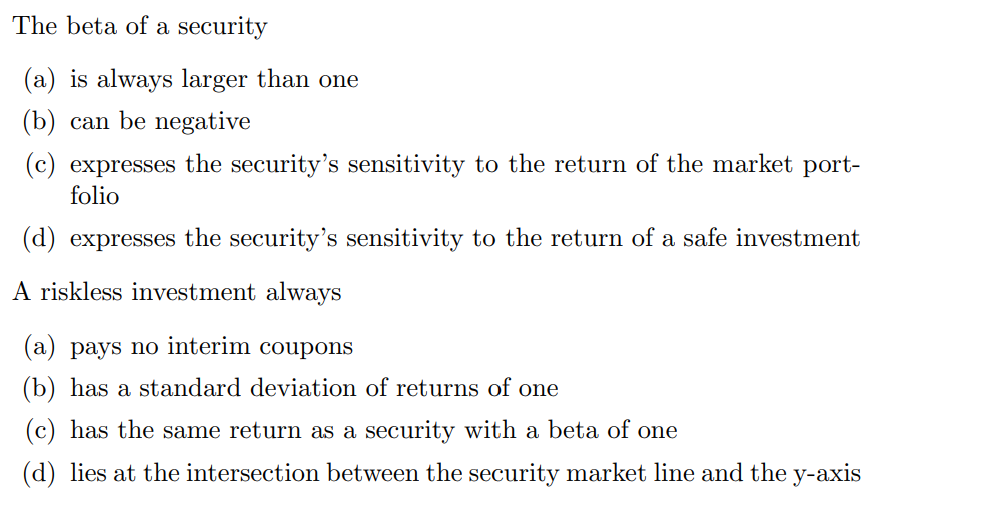

The beta of a security (a) is always larger than one (b) can be negative (c) expresses the security's sensitivity to the return of the market port- folio (d) expresses the security's sensitivity to the return of a safe investment A riskless investment always (a) pays no interim coupons (b) has a standard deviation of returns of one (c) has the same return as a security with a beta of one (d) lies at the intersection between the security market line and the y-axis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image shows two sets of multiplechoice questions each related to financial concepts specifically beta in finance and the characteristics of a risk...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Ethics for Scientists and Engineers

Authors: Edmund G. Seebauer, Robert L. Barry

1st Edition

9780195698480, 195134885, 195698487, 978-0195134889

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App