Answered step by step

Verified Expert Solution

Question

1 Approved Answer

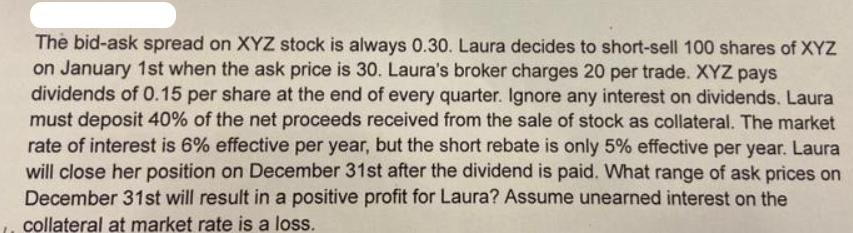

The bid-ask spread on XYZ stock is always 0.30. Laura decides to short-sell 100 shares of XYZ on January 1st when the ask price

The bid-ask spread on XYZ stock is always 0.30. Laura decides to short-sell 100 shares of XYZ on January 1st when the ask price is 30. Laura's broker charges 20 per trade. XYZ pays dividends of 0.15 per share at the end of every quarter. Ignore any interest on dividends. Laura must deposit 40% of the net proceeds received from the sale of stock as collateral. The market rate of interest is 6% effective per year, but the short rebate is only 5% effective per year. Laura will close her position on December 31st after the dividend is paid. What range of ask prices on December 31st will result in a positive profit for Laura? Assume unearned interest on the ,. collateral at market rate is a loss.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the range of ask prices on December 31st that will result in a positive profit for Laur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started