Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Big Company commenced operations in 2010 and continues to operate a successful business. Required: Using the information below, determine the Net Income for

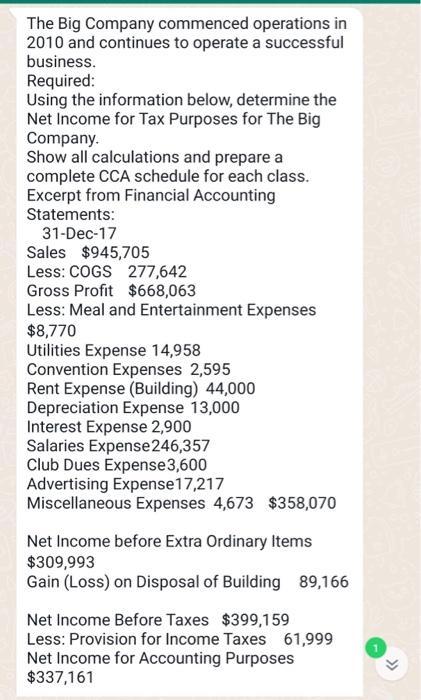

The Big Company commenced operations in 2010 and continues to operate a successful business. Required: Using the information below, determine the Net Income for Tax Purposes for The Big Company. Show all calculations and prepare a complete CCA schedule for each class. Excerpt from Financial Accounting Statements: 31-Dec-17 Sales $945,705 Less: COGS 277,642 Gross Profit $668,063 Less: Meal and Entertainment Expenses $8,770 Utilities Expense 14,958 Convention Expenses 2,595 Rent Expense (Building) 44,000 Depreciation Expense 13,000 Interest Expense 2,900 Salaries Expense 246,357 Club Dues Expense 3,600 Advertising Expense17,217 Miscellaneous Expenses 4,673 $358,070 Net Income before Extra Ordinary Items $309,993 Gain (Loss) on Disposal of Building 89,166 Net Income Before Taxes $399,159 Less: Provision for Income Taxes 61,999 Net Income for Accounting Purposes $337,161

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

CCA Schedule Class 1 Gross Profit 668063 Less Meal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started