Answered step by step

Verified Expert Solution

Question

1 Approved Answer

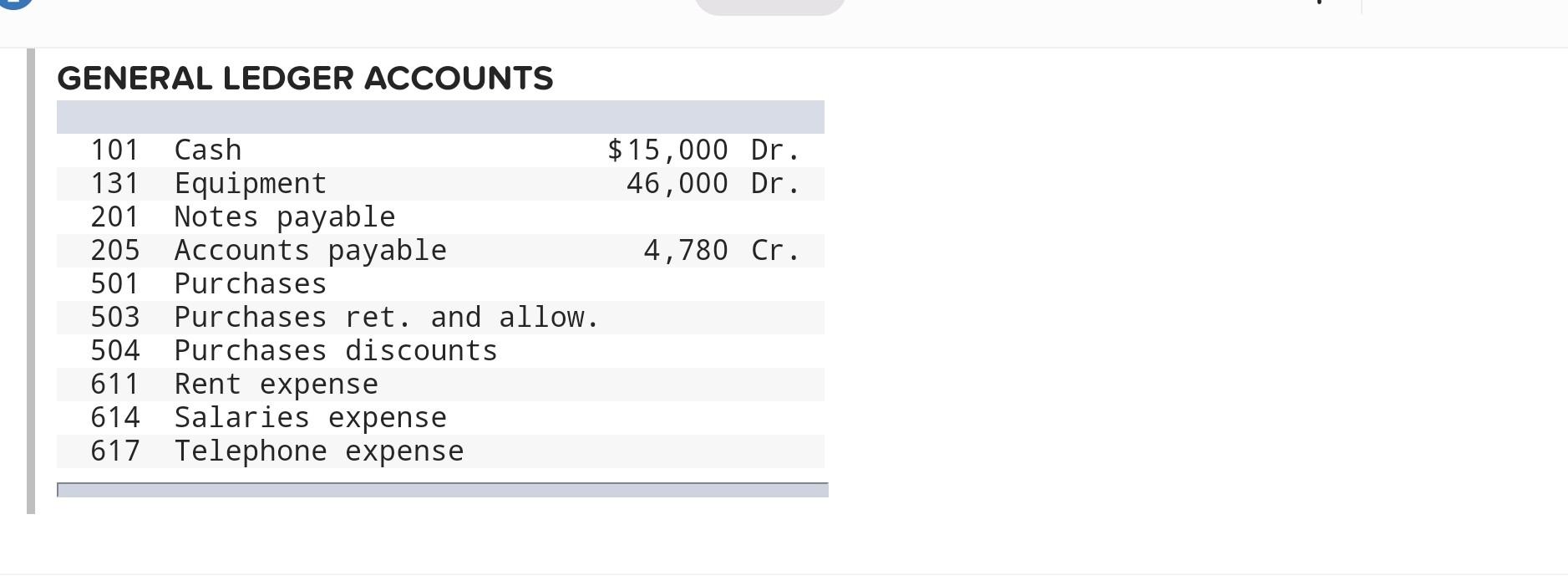

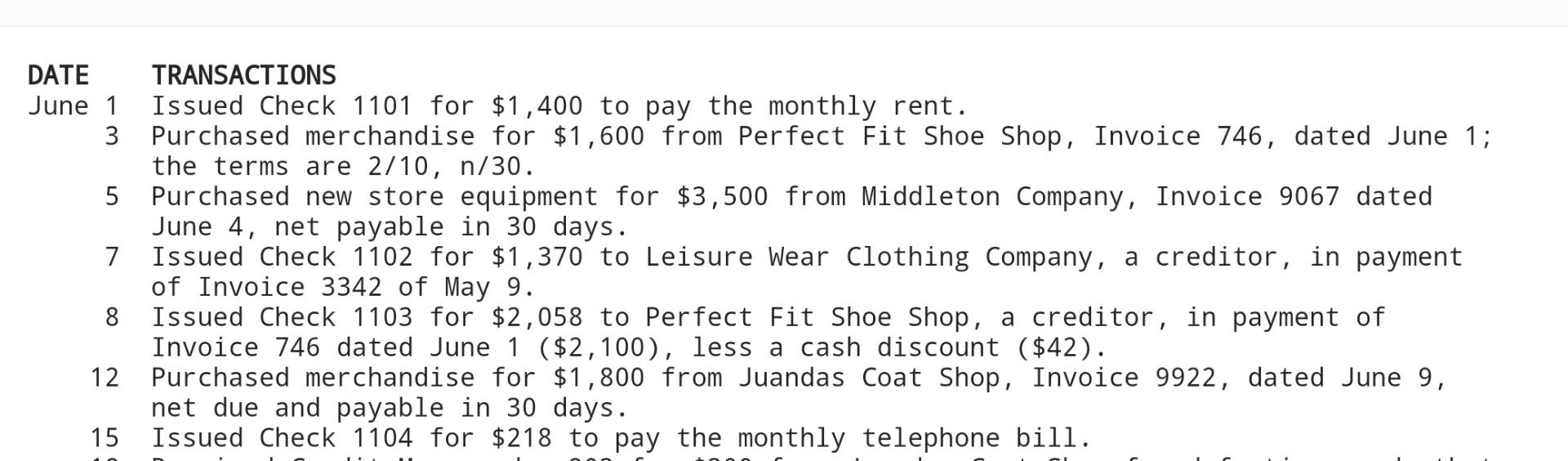

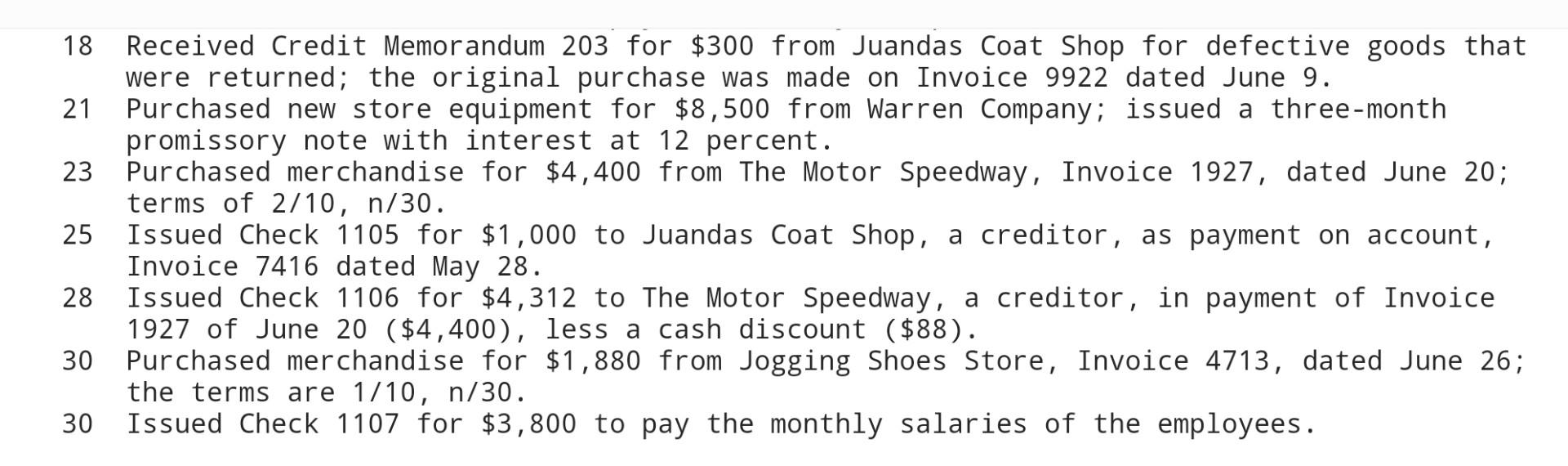

The Bike and Hike Outlet is a retail store. Transactions involving purchases and cash payments for the firm during June 20X1 are listed below, as

The Bike and Hike Outlet is a retail store. Transactions involving purchases and cash payments for the firm during June 20X1 are listed below, as are the general ledger accounts used to record these transactions.

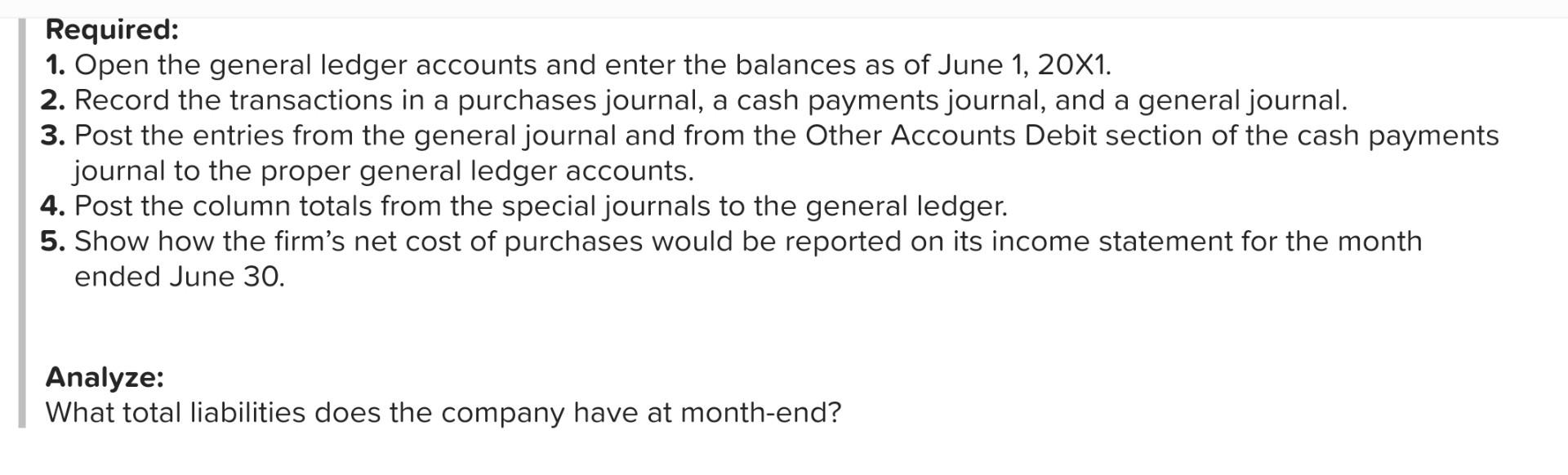

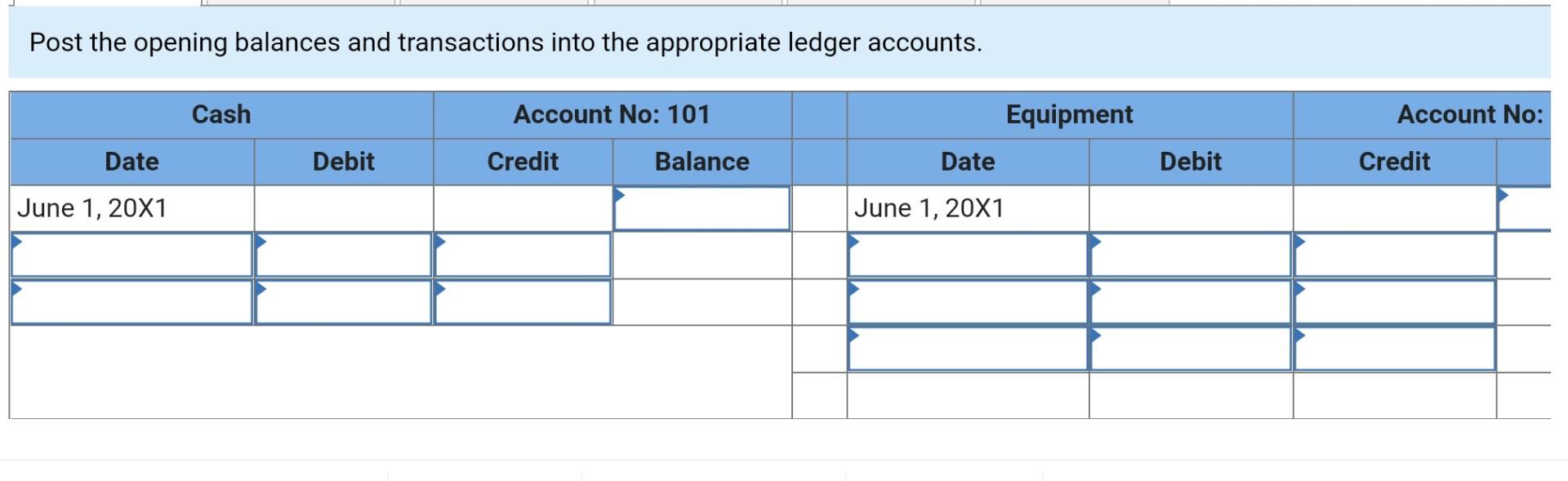

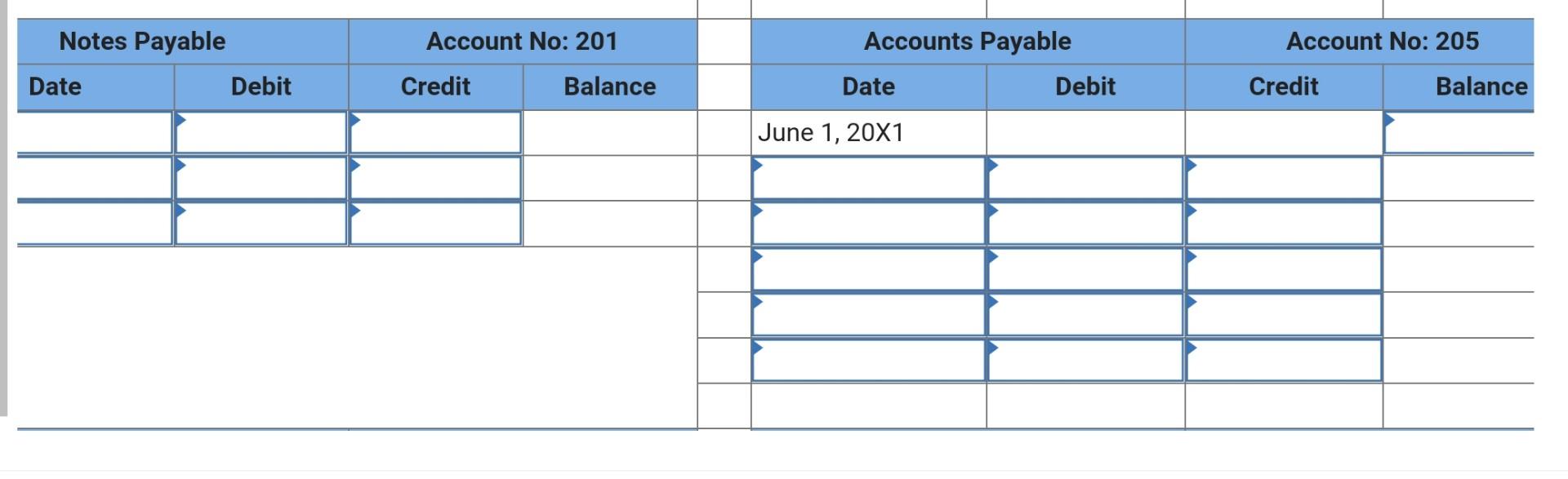

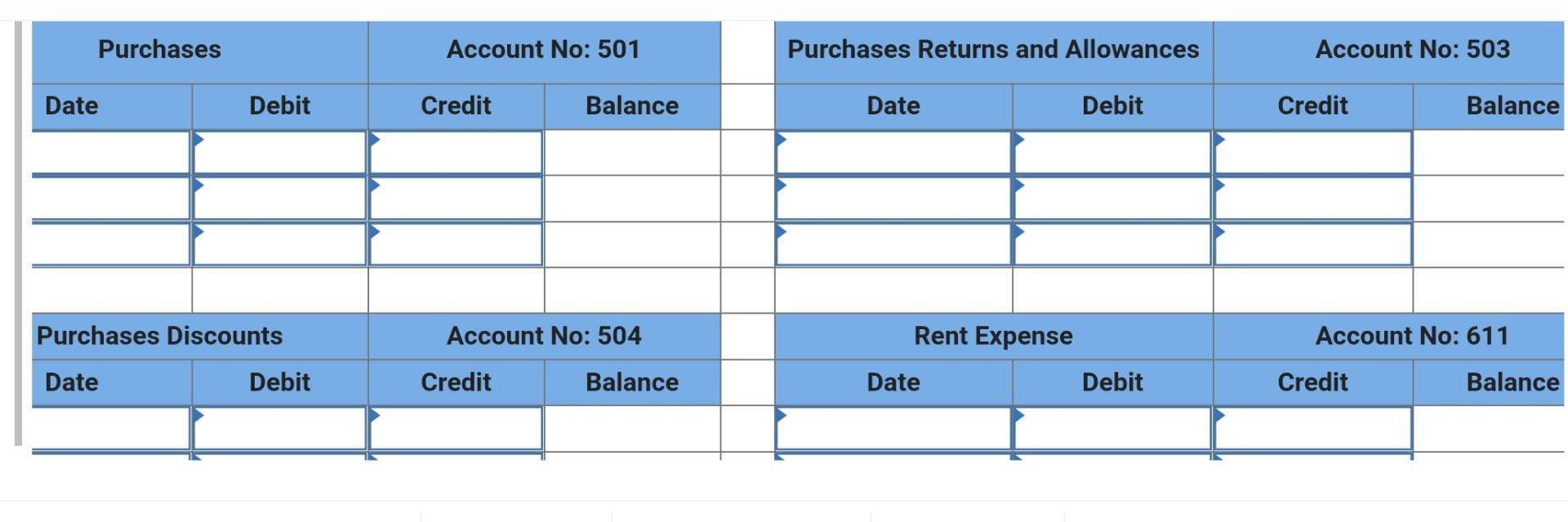

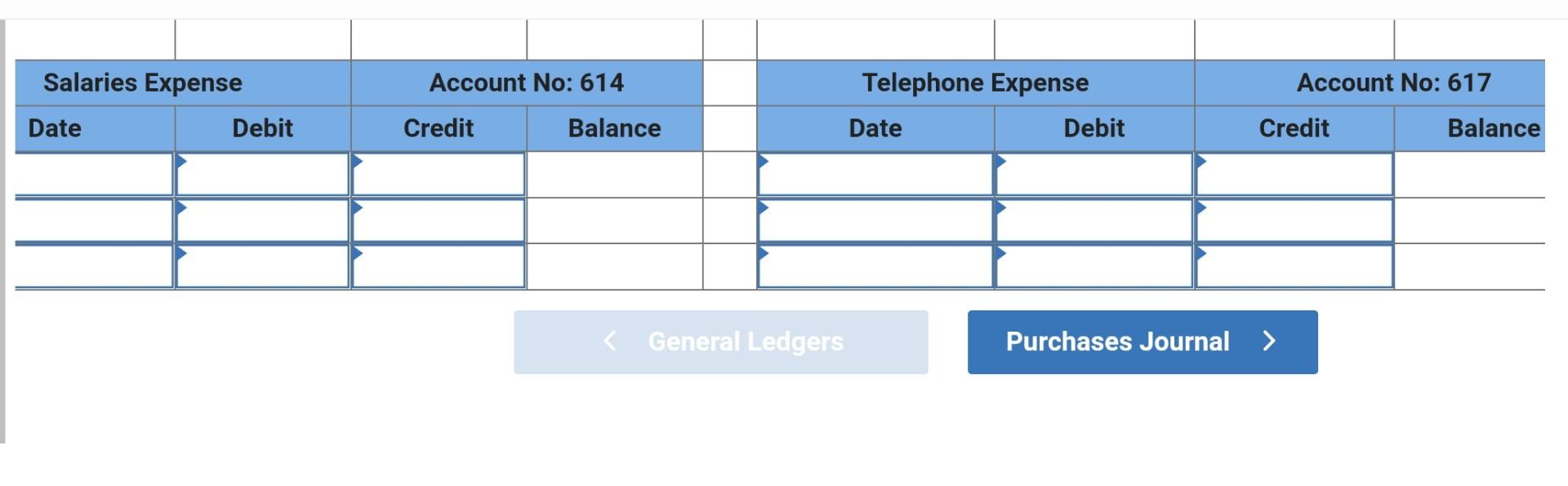

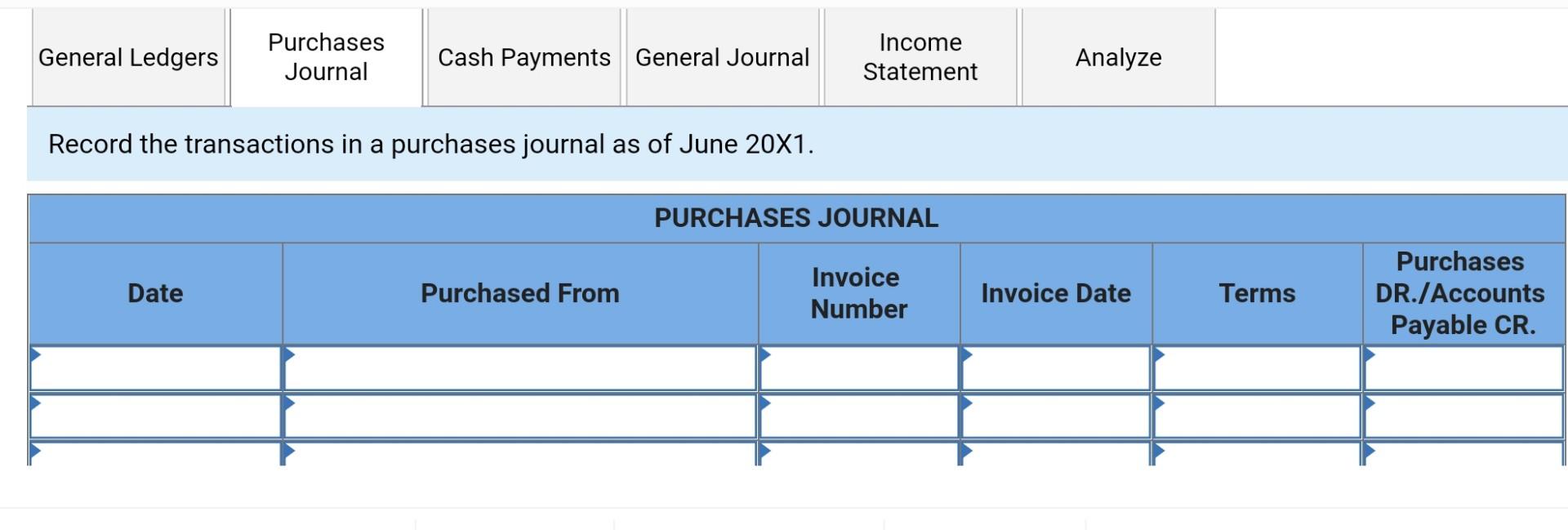

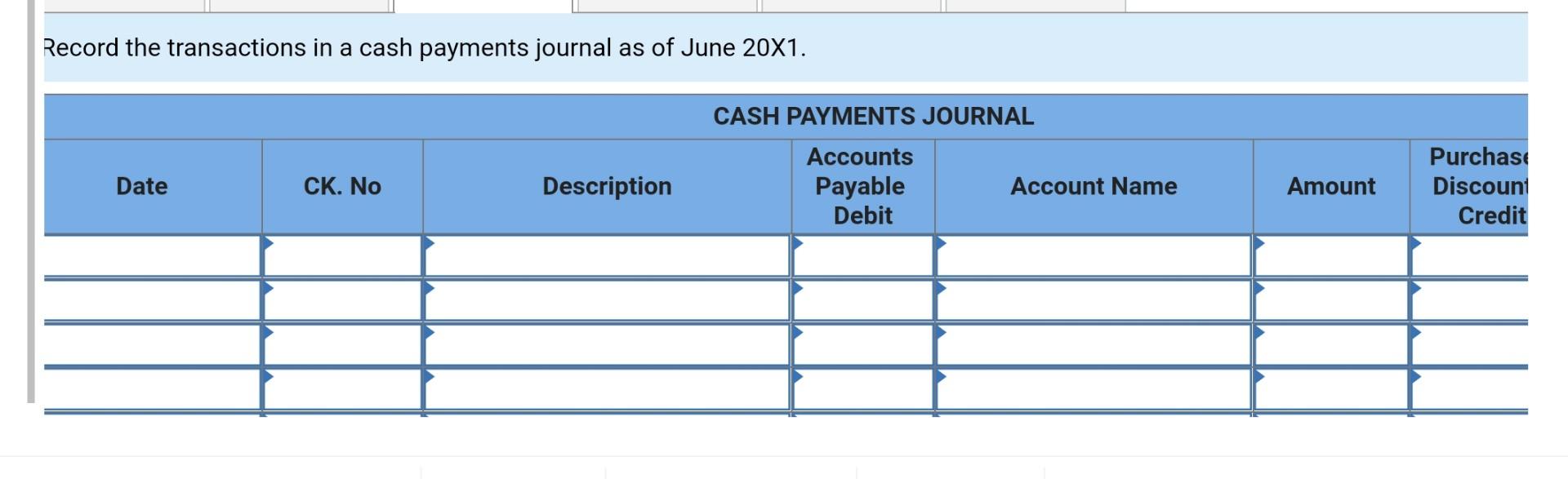

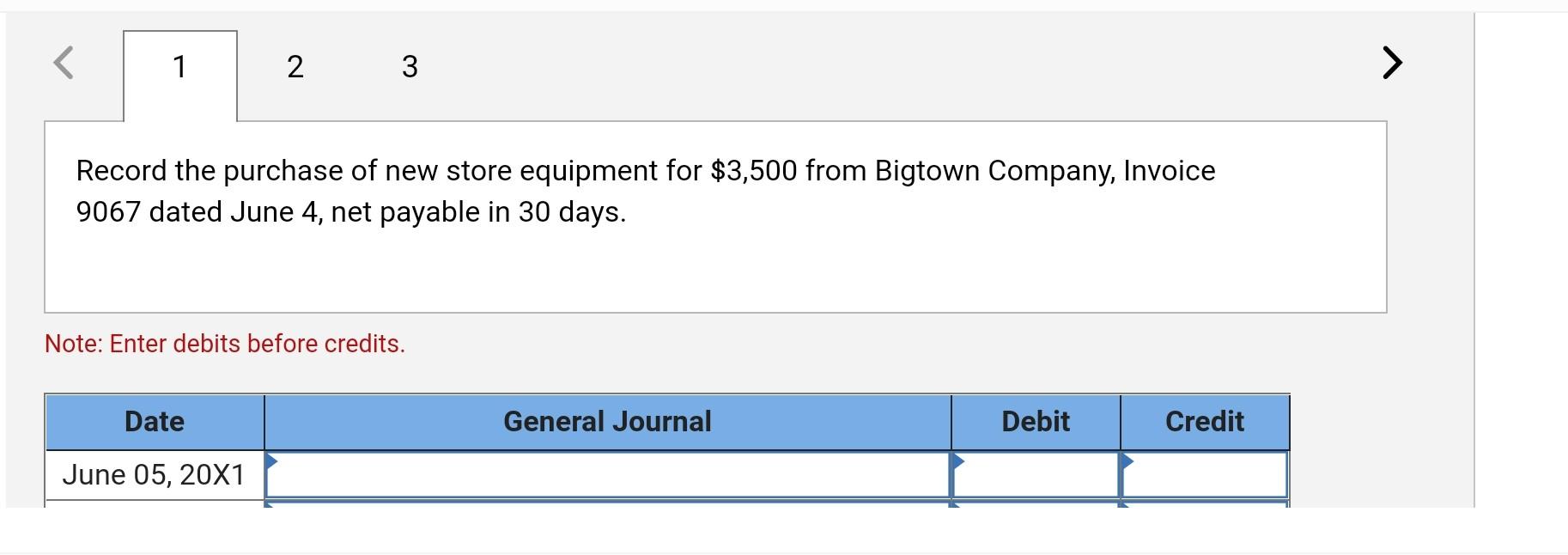

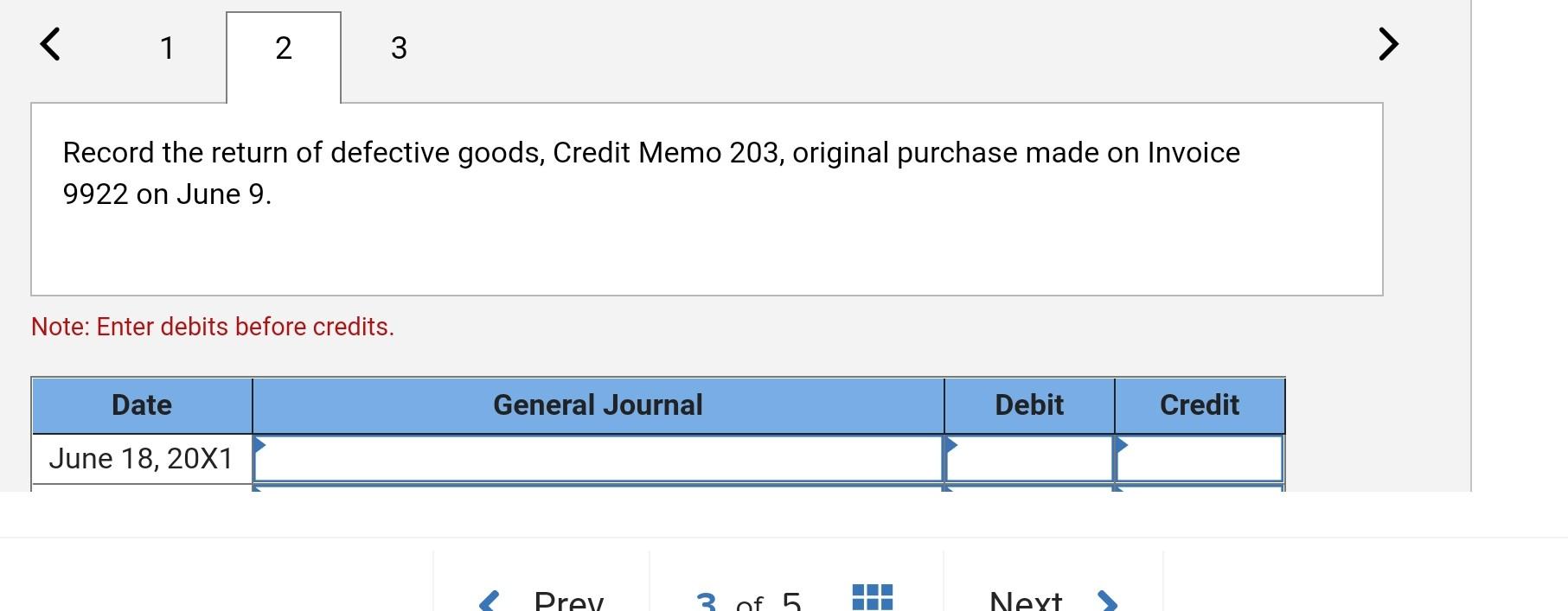

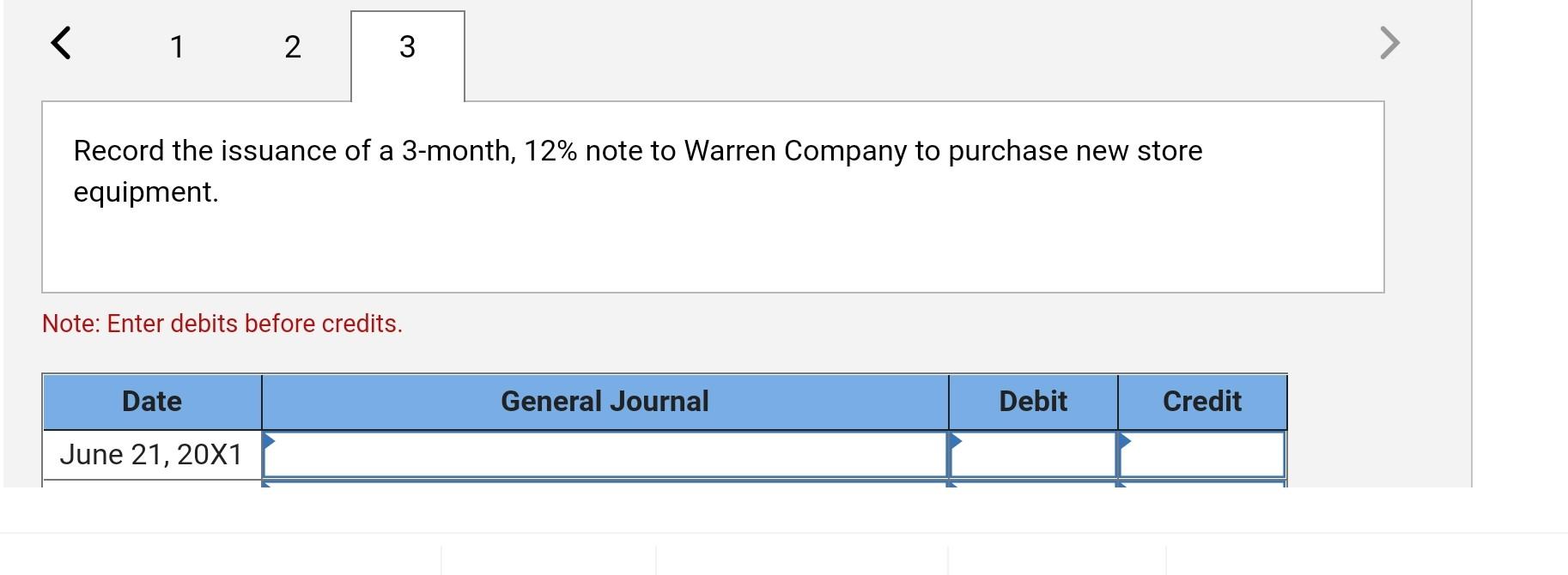

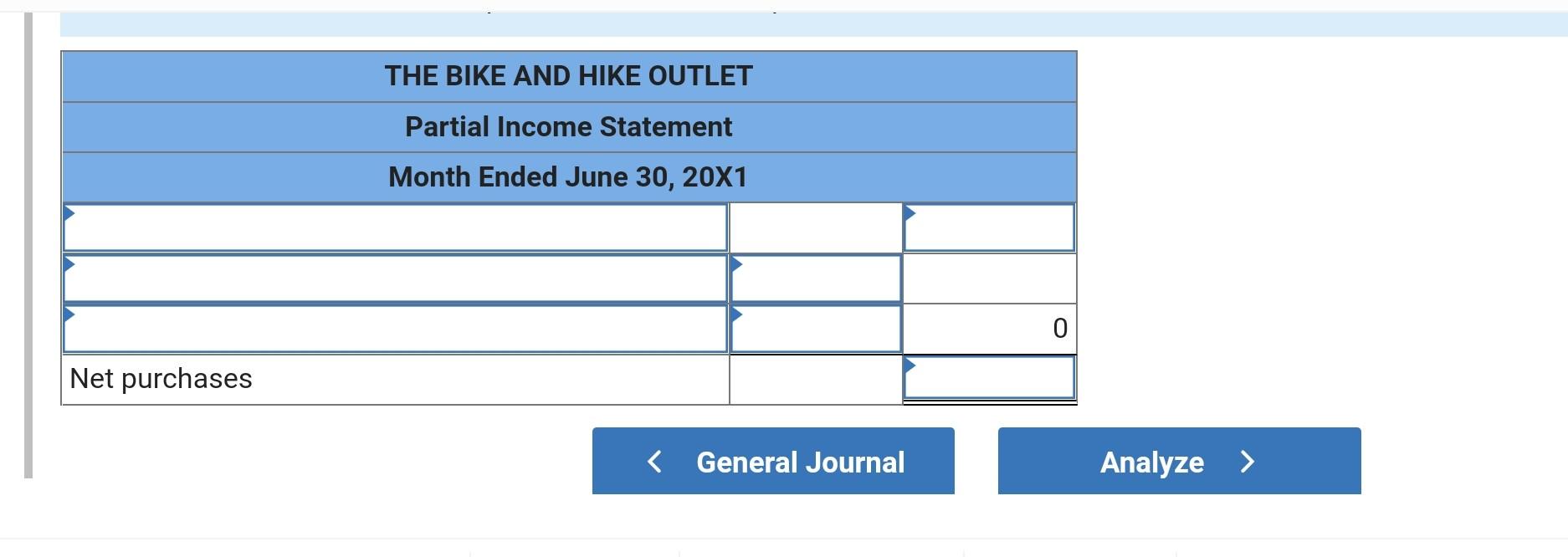

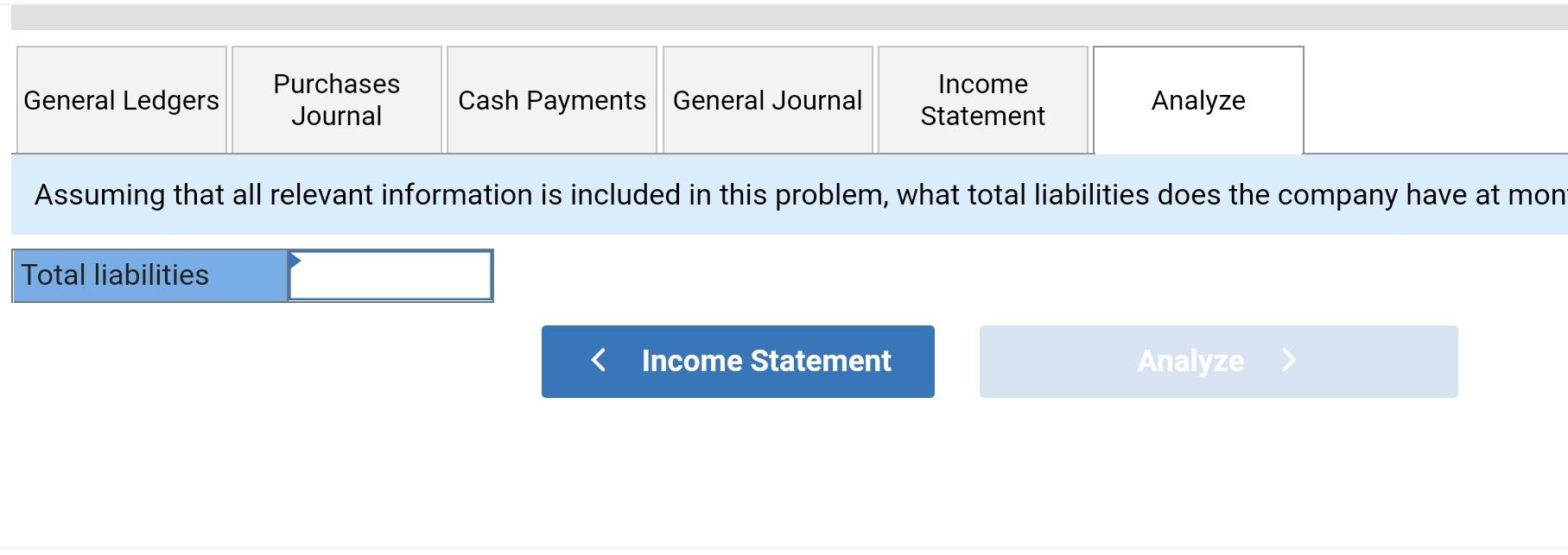

GENERAL LEDGER CCOUNTS DATEJune135Purchasednewstoreequipmentfor$3,500fromMiddletonCompany,Invoice9067dated4June4,netpayablein30days.7IssuedCheck1102for$1,370toLeisureWearClothingCompany,acreditor,inpaymentofInvoice3342ofMay9.8IssuedCheck1103for$2,058toPerfectFitShoeShop,acreditor,inpaymentof12Invoice746datedJune1($2,100)lessacashdiscount$42).12Purchasedmerchandisefor$1,800fromJuandasCoatShop,Invoice9922,datedJune9,15IssuedCheck1104for$218topaythemonthlytelephonebill.TRANSACTIONSIssuedCheck1101for$1,400topaythemonthlyrent.Purchasedmerchandisefor$1,600fromPerfectFitShoeShop,Invoice746,datedJune1;thetermsare2/10,n/30. 18 Received Credit Memorandum 203 for $300 from Juandas Coat Shop for defective goods that were returned; the original purchase was made on Invoice 9922 dated June 9. 21 Purchased new store equipment for $8,500 from Warren Company; issued a three-month promissory note with interest at 12 percent. 23 Purchased merchandise for $4,400 from The Motor Speedway, Invoice 1927, dated June 20; terms of 2/10,n/30. 25 Issued Check 1105 for $1,000 to Juandas Coat Shop, a creditor, as payment on account, Invoice 7416 dated May 28 28 Issued Check 1106 for $4,312 to The Motor Speedway, a creditor, in payment of Invoice 1927 of June 20($4,400), less a cash discount ($88). 30 Purchased merchandise for \$1,880 from Jogging Shoes Store, Invoice 4713, dated June 26; the terms are 1/10,n/30. 30 Issued Check 1107 for $3,800 to pay the monthly salaries of the employees. Required: 1. Open the general ledger accounts and enter the balances as of June 1, 20X1. 2. Record the transactions in a purchases journal, a cash payments journal, and a general journal. 3. Post the entries from the general journal and from the Other Accounts Debit section of the cash payments journal to the proper general ledger accounts. 4. Post the column totals from the special journals to the general ledger. 5. Show how the firm's net cost of purchases would be reported on its income statement for the month ended June 30. Analyze: What total liabilities does the company have at month-end? Post the opening balances and transactions into the appropriate ledger accounts. L General Ledgers Purchases Journal > Record the transactions in a purchases journal as of June 201. Record the transactions in a cash payments journal as of June 201. Record the purchase of new store equipment for $3,500 from Bigtown Company, Invoice 9067 dated June 4 , net payable in 30 days. Note: Enter debits before credits. Record the return of defective goods, Credit Memo 203, original purchase made on Invoice 9922 on June 9. Note: Enter debits before credits. Record the issuance of a 3-month, 12% note to Warren Company to purchase new store equipment. Note: Enter debits before credits. Assuming that all relevant information is included in this problem, what total liabilities does the company have at mor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started