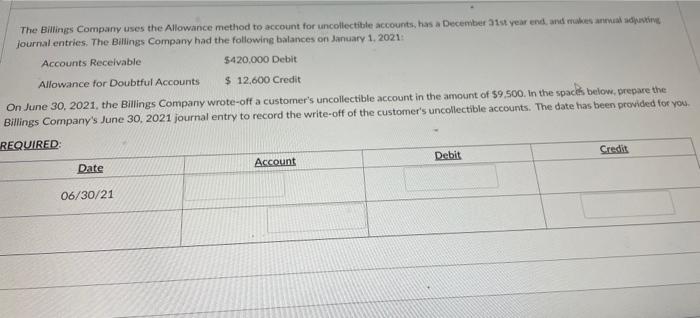

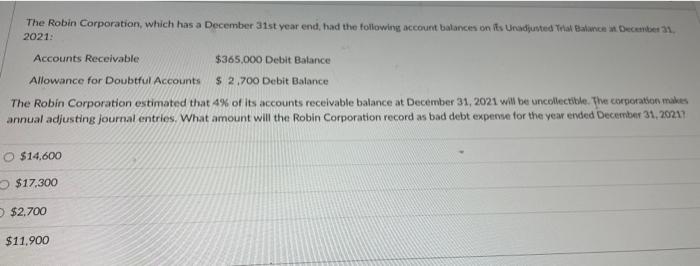

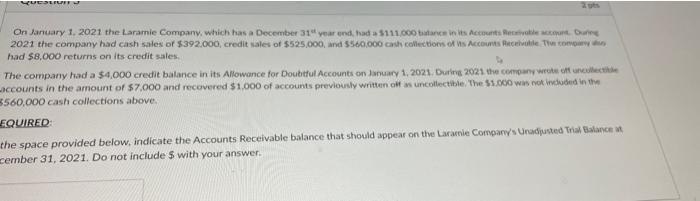

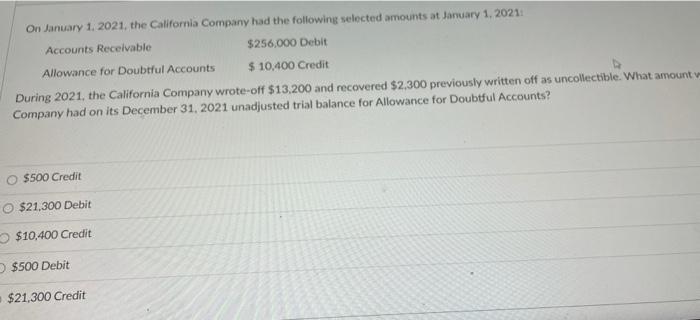

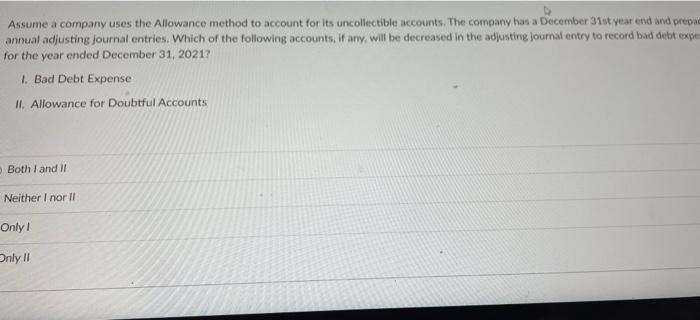

The Billings Company uses the Allowance method to account for uncollectible accounts, has a December 31st year end and makes www diputro journal entries. The Billings Company had the following balances on January 1, 2021 Accounts Receivable $420,000 Debit Allowance for Doubtful Accounts $ 12,600 Credit On June 30, 2021, the Billings Company wrote-off a customer's uncollectible account in the amount of $9.500. In the space below, prepare the Billings Company's June 30, 2021 journal entry to record the write-off of the customer's uncollectible accounts. The date has been provided for you REQUIRED Credit Debit Account Date 06/30/21 The Robin Corporation, which has a December 31st year end, had the following account balances on fils Unadjusted Trial Balance December 2021: Accounts Receivable $365,000 Debit Balance Allowance for Doubtful Accounts $ 2,700 Debit Balance The Robin Corporation estimated that 4% of its accounts receivable balance at December 31, 2021 will be uncollectible. The corporation makes annual adjusting journal entries. What amount will the Robin Corporation record as bad debt experve for the year ended December 31, 20211 $14,600 $17.300 $2.700 $11.900 LUESE On January 1, 2021 the Laramie Company, which has a December 31 year and had a $111.000 stanice in its Account Revalent. During 2021 the company had cash sales of $392.000, credit sales of $525.000, and $560,000 cash collections of Vis Account Receive Two had $8,000 returns on its credit sales, The company had a $4.000 credit balance in its Allowance for Doubtful Accounts on June 1, 2021. Durin 2021 the company wrote ostanete accounts in the amount of $7.000 and recovered $1.000 of accounts previously written of uncollectible. The $1.000 win no duded in the 560,000 cash collections above EQUIRED the space provided below, indicate the Accounts Receivable balance that should appear on the Laranle Company's Uradiusted Tria lance cember 31, 2021. Do not include $ with your answer. On January 1, 2021, the California Company had the following selected amounts at January 1, 2021 $256,000 Debit Accounts Receliable $ 10,400 Credit Allowance for Doubtful Accounts During 2021, the California Company wrote-off $13,200 and recovered $2,300 previously written off as uncollectible. What amount Company had on its December 31, 2021 unadjusted trial balance for Allowance for Doubtful Accounts? $500 Credit $21.300 Debit $10,400 Credit $500 Debit $21,300 Credit Assume a company uses the Allowance method to account for its uncollectible accounts. The company has a December 31st year end and prepa annual adjusting journal entries. Which of the following accounts, if any, will be decreased in the adjusting Joumal entry to record bad debt exper for the year ended December 31, 2021? 1. Bad Debt Expense II. Allowance for Doubtful Accounts Both I and II Neither I nor Il Only 1 Only