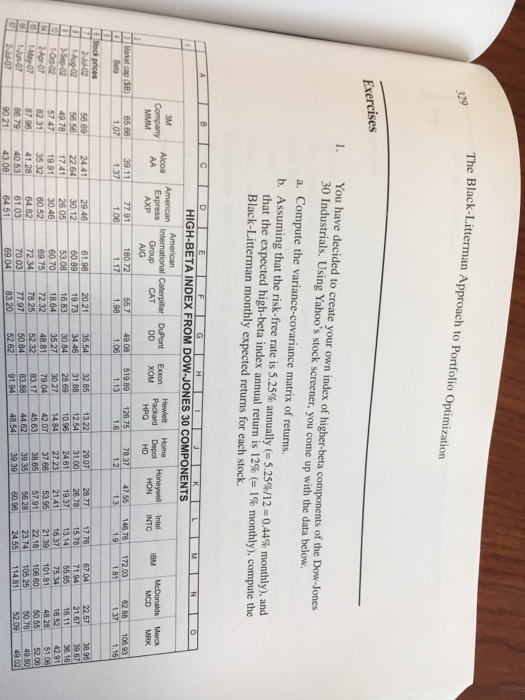

The Black-Litterman Approach to Portfolio Optimization Exercises You have 30 Industrials. Using Yahoo's stock screener 1. ecided to create your own index of higher-beta components of the Dow-Jones you come up with the data below. a. Compute the variance-covariance matrix of returns b. Assuming that the risk-free rate is 5.25% annually (-5.25%/12 0.44% monthly), and that the expected high-beta index annual return is 12% (-1% monthly), compute the Black-Litterman monthly expected returns for each stock. HIGH-BETA INDEX FROM DOW-JONES 30 COMPONENTS International Caterpillar DuPont Exxon Hewlett Home Packard Depot 3M MMM AA Express 6566- Express Group CA McDonalds Merck Company, Alca Amercan American HON INTC XOM HPO AIG 39 11t 557.?4908 1.98 1.06 1.13 519.89.-126.75 ?7837 ?4755-146.76- 172.03-?6288-10693 ?Une plse 7791. 1.06 ?18072 135.54 6.69 2441 29 56.56 2264 30.12 49.7817.426.05 1973 3446 31.88 12.54 31.00 26.78 1578 7194 16.83 30 84 28 69 10.96 24.6 39.87 53.08 16.52 42.91 51.06 0c-02 57471991 30.4660.70 18.64 3527 3027 1484 2723 214 16.37 7534 Apr-07 79.04 42.07 37.66 5395 21.3 101.81 48285 82 31 -35 32 60 52 87.96 41.28 64.82 86.79 4053 6103 0 21 43.08 64.51 69.75 72.32 48.81 72.34 7 70001 7797 5084 8388 4462 3935?? 78.25 52 32 83.17 4563 3865 5791 2218 10660 055 52 7649.80 5904 8320 5262 9194 48543939 6098 2455 11481 5209 49 02 93-16 98 49 38 39 36 42 51 52 57 67 11 17 98 89 08 70 75 34 03 04 XP 77 26 30 7, . 11 35 1 56 56 49 57 82 87 86 The Black-Litterman Approach to Portfolio Optimization Exercises You have 30 Industrials. Using Yahoo's stock screener 1. ecided to create your own index of higher-beta components of the Dow-Jones you come up with the data below. a. Compute the variance-covariance matrix of returns b. Assuming that the risk-free rate is 5.25% annually (-5.25%/12 0.44% monthly), and that the expected high-beta index annual return is 12% (-1% monthly), compute the Black-Litterman monthly expected returns for each stock. HIGH-BETA INDEX FROM DOW-JONES 30 COMPONENTS International Caterpillar DuPont Exxon Hewlett Home Packard Depot 3M MMM AA Express 6566- Express Group CA McDonalds Merck Company, Alca Amercan American HON INTC XOM HPO AIG 39 11t 557.?4908 1.98 1.06 1.13 519.89.-126.75 ?7837 ?4755-146.76- 172.03-?6288-10693 ?Une plse 7791. 1.06 ?18072 135.54 6.69 2441 29 56.56 2264 30.12 49.7817.426.05 1973 3446 31.88 12.54 31.00 26.78 1578 7194 16.83 30 84 28 69 10.96 24.6 39.87 53.08 16.52 42.91 51.06 0c-02 57471991 30.4660.70 18.64 3527 3027 1484 2723 214 16.37 7534 Apr-07 79.04 42.07 37.66 5395 21.3 101.81 48285 82 31 -35 32 60 52 87.96 41.28 64.82 86.79 4053 6103 0 21 43.08 64.51 69.75 72.32 48.81 72.34 7 70001 7797 5084 8388 4462 3935?? 78.25 52 32 83.17 4563 3865 5791 2218 10660 055 52 7649.80 5904 8320 5262 9194 48543939 6098 2455 11481 5209 49 02 93-16 98 49 38 39 36 42 51 52 57 67 11 17 98 89 08 70 75 34 03 04 XP 77 26 30 7, . 11 35 1 56 56 49 57 82 87 86