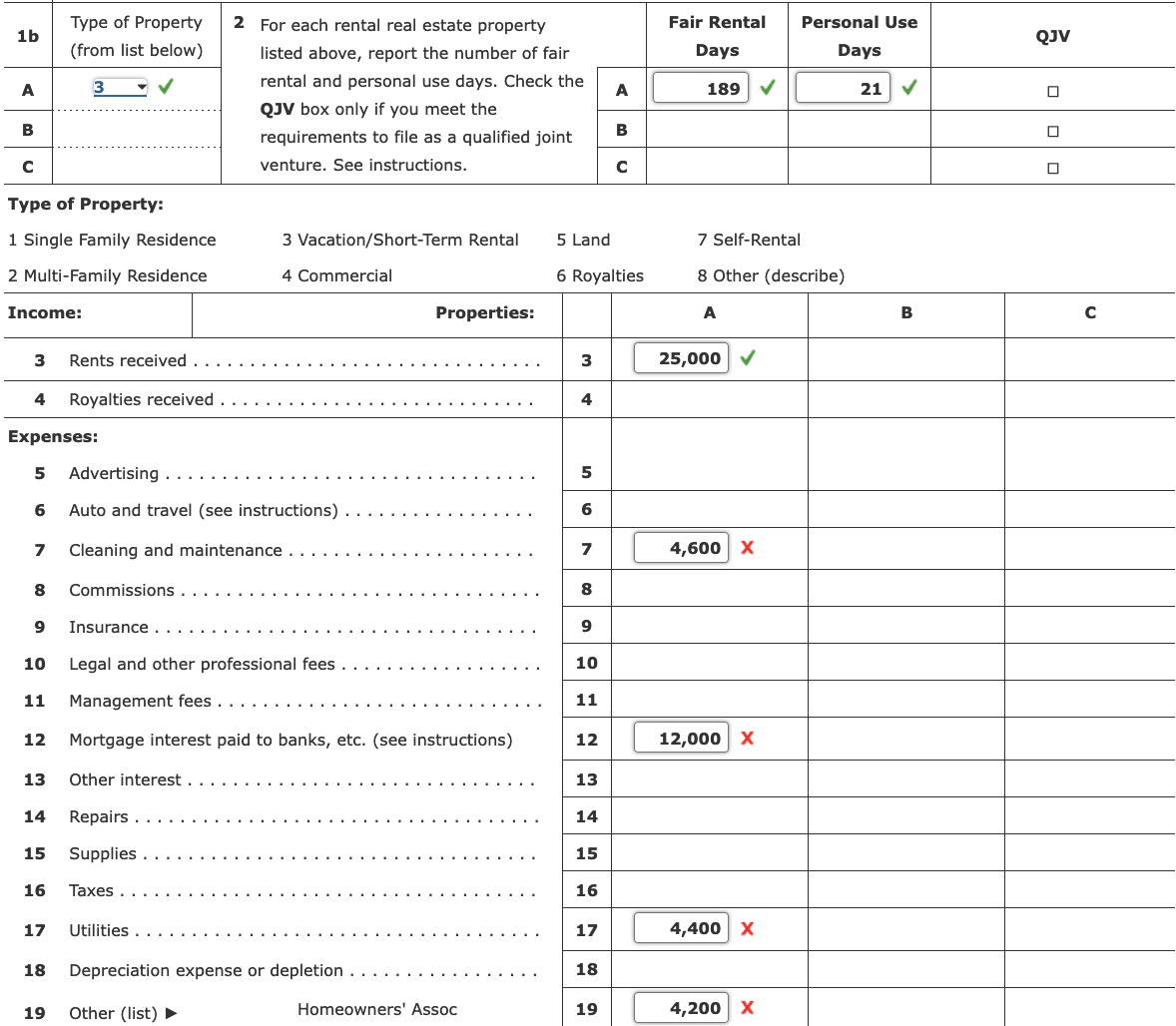

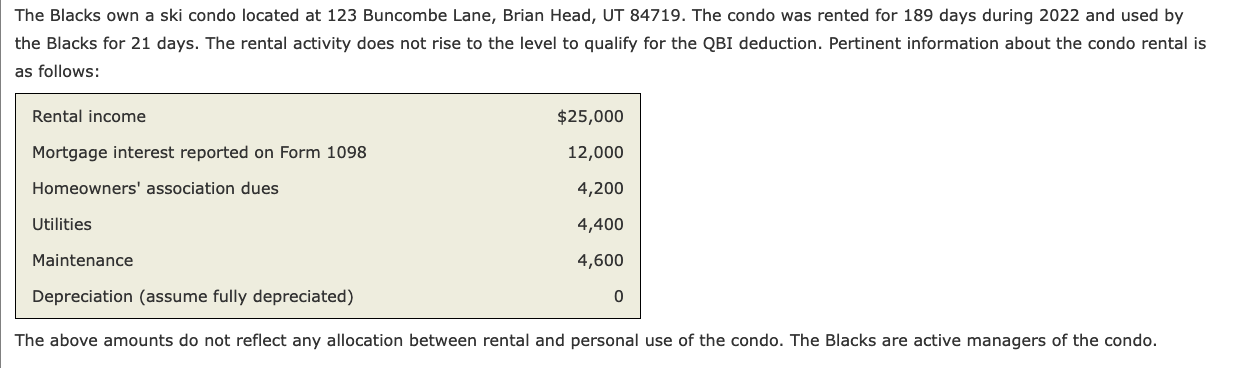

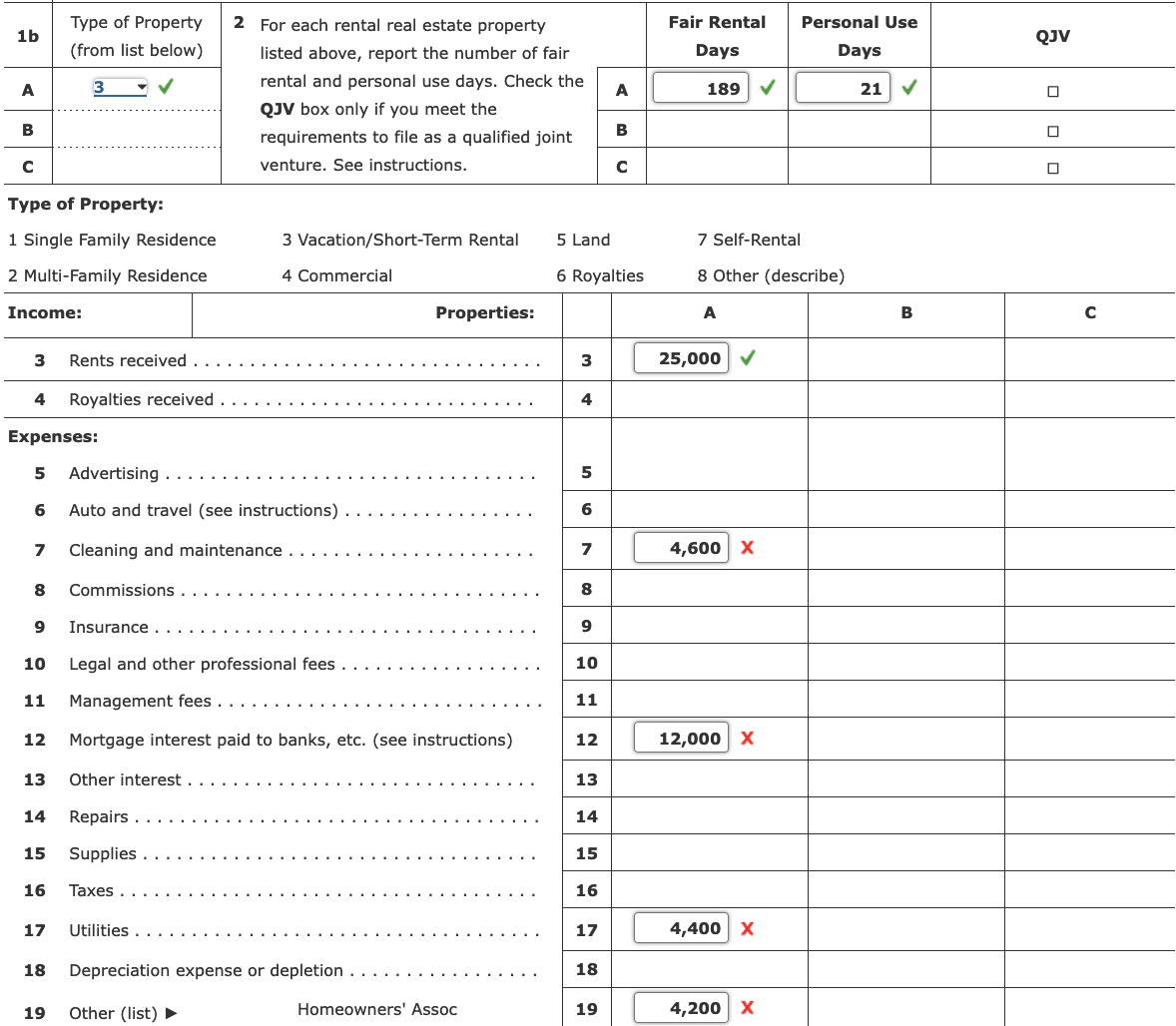

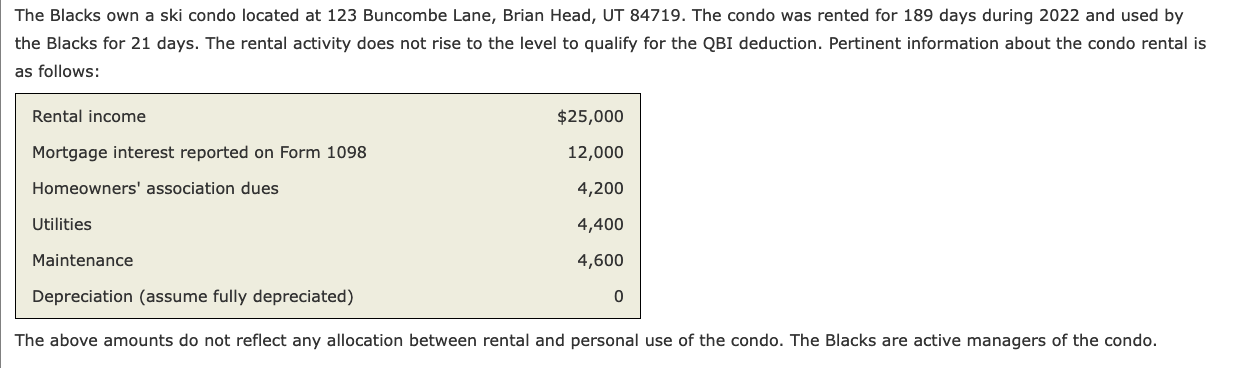

The Blacks own a ski condo located at 123 Buncombe Lane, Brian Head, UT 84719 . The condo was rented for 189 days during 2022 and used by the Blacks for 21 days. The rental activity does not rise to the level to qualify for the QBI deduction. Pertinent information about the condo rental is as follows: \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline 1b & \begin{tabular}{l} Type of Property \\ (from list below) \end{tabular} & \multirow{4}{*}{\multicolumn{2}{|c|}{\begin{tabular}{l} For each rental real estate property \\ listed above, report the number of fair \\ rental and personal use days. Check the \\ QJV box only if you meet the \\ requirements to file as a qualified joint \\ venture. See instructions. \end{tabular}}} & & \multicolumn{2}{|c|}{\begin{tabular}{c} Fair Rental \\ Days \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} Personal Use \\ Days \end{tabular}} & \multirow{2}{*}{QJV} \\ \hline A & \multirow[t]{3}{*}{3} & & & A & \multicolumn{2}{|c|}{189} & 21 & & \\ \hline B & & & & B & & & & & \\ \hline c & & & & c & & & & & \\ \hline \multicolumn{10}{|c|}{ Type of Property: } \\ \hline \multicolumn{2}{|c|}{1 Single Family Residence } & 3 Vacation/Short-Term Rental & 5 Lan & & \multicolumn{2}{|c|}{7 Self-Rent } & & & \\ \hline \multicolumn{2}{|c|}{2 Multi-Family Residence } & 4 Commercial & 5 Roy & alties & \multicolumn{3}{|c|}{8 Other (describe) } & & \\ \hline \multicolumn{2}{|c|}{ Income: } & Properties: & & & \multicolumn{2}{|l|}{A} & & B & c \\ \hline 3 & \multicolumn{2}{|l|}{ Rents received } & 3 & & 25,000 & & & & \\ \hline 4 & \multicolumn{2}{|c|}{ Royalties received } & 4 & & & & & & \\ \hline \multicolumn{3}{|c|}{ Expenses: } & & & & & & & \\ \hline 5 & \multicolumn{2}{|l|}{ Advertising } & 5 & & & & & & \\ \hline 6 & \multicolumn{2}{|c|}{ Auto and travel (see instructions) . } & 6 & & & & & & \\ \hline 7 & \multicolumn{2}{|c|}{ Cleaning and maintenance } & 7 & & 4,600 & x & & & \\ \hline 8 & \multicolumn{2}{|l|}{ Commissions . } & 8 & & & & & & \\ \hline 9 & \multicolumn{2}{|l|}{ Insurance . . } & 9 & & & & & & \\ \hline 10 & \multicolumn{2}{|c|}{ Legal and other professional fees } & 10 & & & & & & \\ \hline 11 & \multicolumn{2}{|l|}{ Management fees } & 11 & & & & & & \\ \hline 12 & \multicolumn{2}{|c|}{ Mortgage interest paid to banks, etc. (see instructions) } & 12 & & 12,000 & x & & & \\ \hline 13 & \multicolumn{2}{|l|}{ Other interest } & 13 & & & & & & \\ \hline 14 & \multicolumn{2}{|l|}{ Repairs ...... } & 14 & & & & & & \\ \hline 15 & \multicolumn{2}{|l|}{ Supplies . . } & 15 & & & & & & \\ \hline 16 & \multicolumn{2}{|l|}{ Taxes } & 16 & & & & & & \\ \hline 17 & \multicolumn{2}{|l|}{ Utilities } & 17 & & 4,400 & x & & & \\ \hline 18 & \multicolumn{2}{|c|}{ Depreciation expense or depletion } & 18 & & & & & & \\ \hline 19 & Other (list) & Homeowners' Assoc & 19 & & 4,200 & x & & & \\ \hline \end{tabular} 10:09 LTE 93 Expert Q\&A Done