the blank in number six is wrong can someone give the correct answer to it

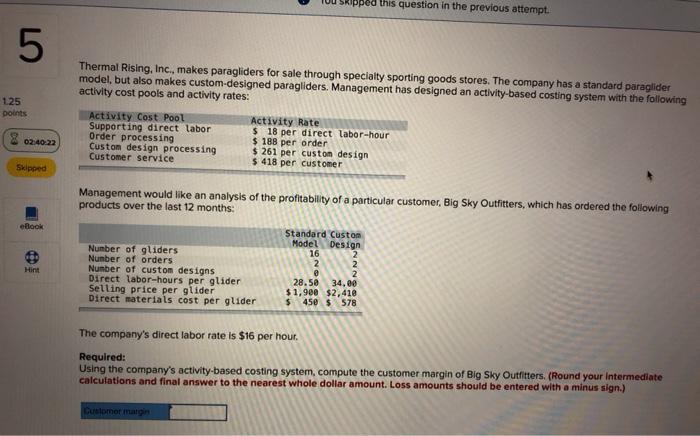

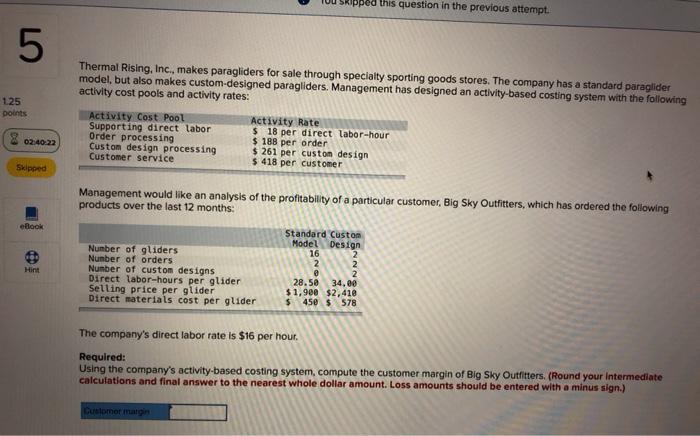

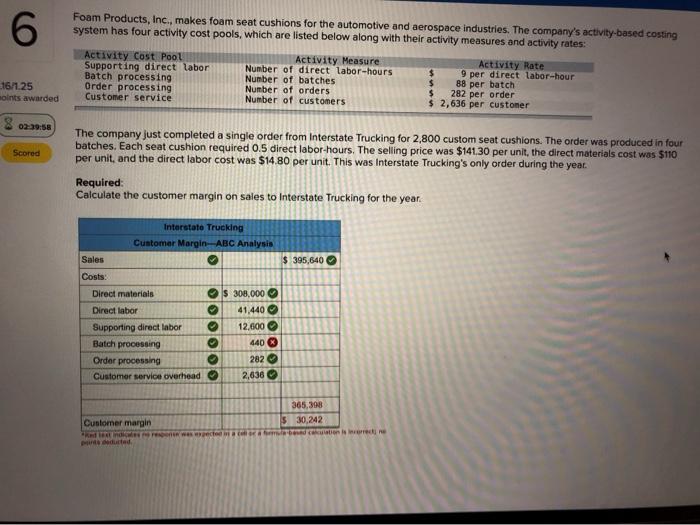

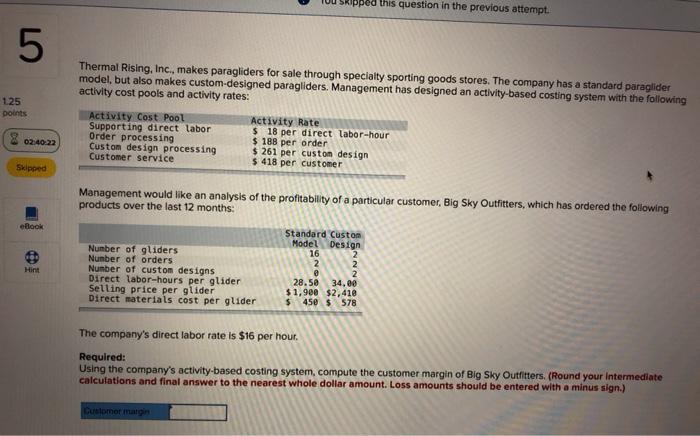

apped this question in the previous attempt. 5 Thermal Rising, Inc., makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: 125 points Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service 02:40:22 Activity Rate $ 18 per direct labor-hour $ 188 per order $ 261 per custom design $ 418 per customer Skipped Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: eBook Hint Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Selling price per glider Direct materials cost per glider Standard Custom Model Design 16 2 2 2 28.50 34,00 $1,900 $2,410 $ 450 $ 578 The company's direct labor rate is $16 per hour. Required: Using the company's activity-based costing system, compute the customer margin of Big Sky Outfitters. (Round your intermediate calculations and final answer to the nearest whole dollar amount. Loss amounts should be entered with a minus sign.) Customer mani 6 Foam Products, Inc., makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Activity Measure Activity Rate Supporting direct labor Number of direct labor-hours $ 9 per direct labor-hour Batch processing Number of batches $ 88 per batch Order processing Number of orders $ 282 per order Customer service Number of customers $ 2,636 per customer 16/1.25 noints awarded 02:39:58 Scored The company just completed a single order from Interstate Trucking for 2,800 custom seat cushions. The order was produced in four batches. Each seat cushion required 0.5 direct labor-hours. The selling price was $141.30 per unit, the direct materials cost was $110 per unit, and the direct labor cost was $14.80 per unit. This was Interstate Trucking's only order during the year. Required: Calculate the customer margin on sales to Interstate Trucking for the year. $ 395,640 Interstate Trucking Customer Margin-ABC Analysis Sales Costs: Direct materials $ 308,000 Direct labor 41,440 Supporting direct labor 12,600 Batch processing 440 Order processing 282 Customer service overhead 2,636 Customer margin Rendice 365,308 $ 30,242 mation rece