Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Bloemfontein Citrus Corporation estimates its taxable income for next year at $3,200,000. The company is considering expanding its product line by introducing pineapple-orange juice

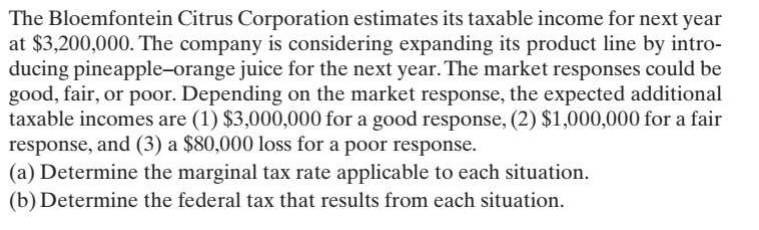

The Bloemfontein Citrus Corporation estimates its taxable income for next year at $3,200,000. The company is considering expanding its product line by introducing pineapple-orange juice for the next year. The market responses could be good, fair, or poor. Depending on the market response, the expected additional taxable incomes are (1) $3,000,000 for a good response, (2) $1,000,000 for a fair response, and (3) a $80,000 loss for a poor response. (a) Determine the marginal tax rate applicable to each situation. (b) Determine the federal tax that results from each situation

The Bloemfontein Citrus Corporation estimates its taxable income for next year at $3,200,000. The company is considering expanding its product line by introducing pineapple-orange juice for the next year. The market responses could be good, fair, or poor. Depending on the market response, the expected additional taxable incomes are (1) $3,000,000 for a good response, (2) $1,000,000 for a fair response, and (3) a $80,000 loss for a poor response. (a) Determine the marginal tax rate applicable to each situation. (b) Determine the federal tax that results from each situation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started