Answered step by step

Verified Expert Solution

Question

1 Approved Answer

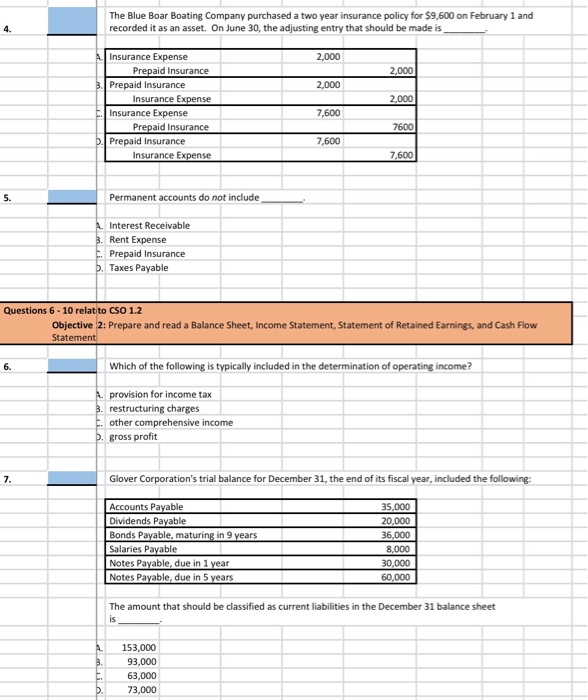

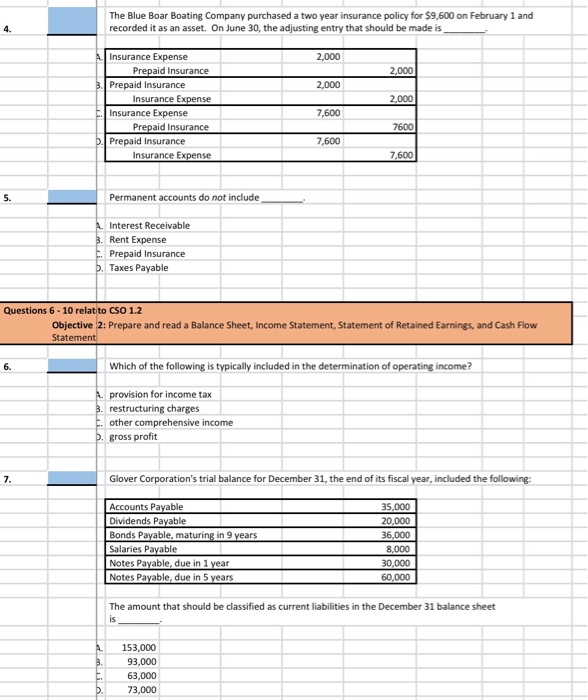

The Blue Boar Boating Company purchased a two year insurance policy for $9,600 on February 1 and recorded it as an asset. On June 30,

The Blue Boar Boating Company purchased a two year insurance policy for $9,600 on February 1 and recorded it as an asset. On June 30, the adjusting entry that should be made is 2,000 2,000 2,000 2,000 1. Insurance Expense Prepaid Insurance 3. Prepaid Insurance Insurance Expense Insurance Expense Prepaid insurance b. Prepaid Insurance Insurance Expense 7,600 7600 7,600 7,600 5.- Permanent accounts do not include A. Interest Receivable 3. Rent Expense 1. Prepaid Insurance b. Taxes Payable Questions 6 - 10 relat to CSO 1.2 Objective 2: Prepare and read a Balance Sheet, Income Statement, Statement of Retained Earnings, and Cash Flow Statement Which of the following is typically included in the determination of operating income? A provision for income tax 3. restructuring charges . other comprehensive income D. gross profit Glover Corporation's trial balance for December 31, the end of its fiscal year, included the following: Accounts Payable Dividends Payable Bonds Payable, maturing in 9 years Salaries Payable Notes Payable, due in 1 year Notes Payable, due in 5 years 35,000 20,000 36,000 8,000 30,000 60,000 The amount that should be classified as current liabilities in the December 31 balance sheet 153,000 93,000 63,000 73,000

The Blue Boar Boating Company purchased a two year insurance policy for $9,600 on February 1 and recorded it as an asset. On June 30, the adjusting entry that should be made is 2,000 2,000 2,000 2,000 1. Insurance Expense Prepaid Insurance 3. Prepaid Insurance Insurance Expense Insurance Expense Prepaid insurance b. Prepaid Insurance Insurance Expense 7,600 7600 7,600 7,600 5.- Permanent accounts do not include A. Interest Receivable 3. Rent Expense 1. Prepaid Insurance b. Taxes Payable Questions 6 - 10 relat to CSO 1.2 Objective 2: Prepare and read a Balance Sheet, Income Statement, Statement of Retained Earnings, and Cash Flow Statement Which of the following is typically included in the determination of operating income? A provision for income tax 3. restructuring charges . other comprehensive income D. gross profit Glover Corporation's trial balance for December 31, the end of its fiscal year, included the following: Accounts Payable Dividends Payable Bonds Payable, maturing in 9 years Salaries Payable Notes Payable, due in 1 year Notes Payable, due in 5 years 35,000 20,000 36,000 8,000 30,000 60,000 The amount that should be classified as current liabilities in the December 31 balance sheet 153,000 93,000 63,000 73,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started