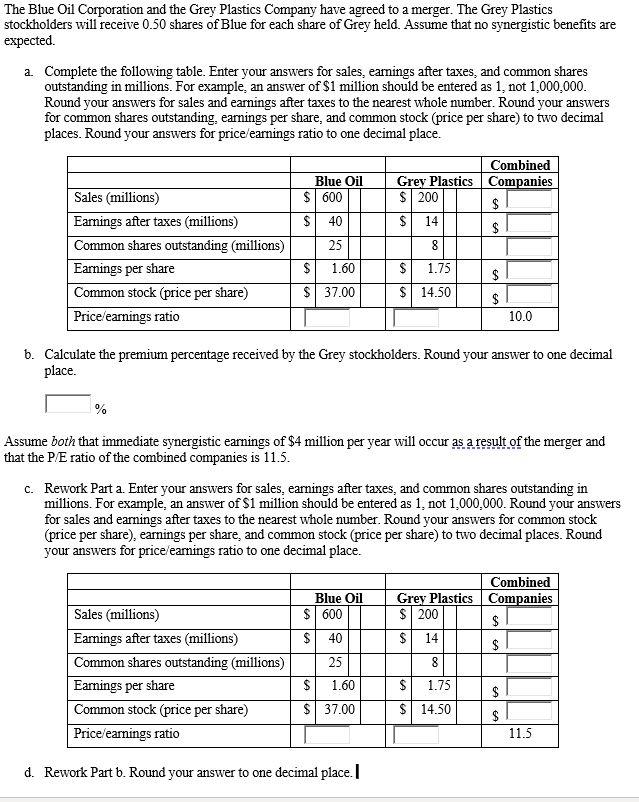

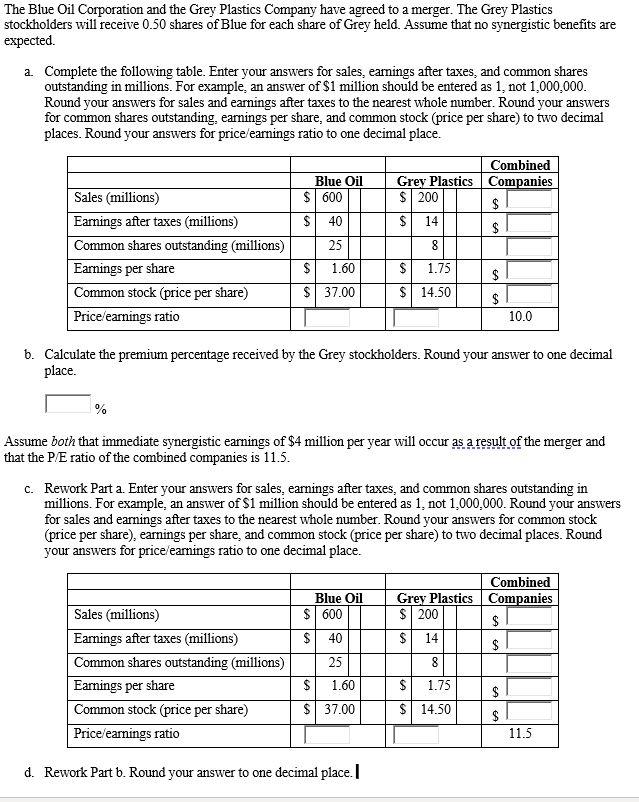

The Blue Oil Corporation and the Grey Plastics Company have agreed to a merger. The Grey Plastics stockholders will receive 0.50 shares of Blue for each share of Grey held. Assume that no synergistic benefits are expected. a. Complete the following table. Enter your answers for sales, earnings after taxes, and common shares outstanding in millions. For example, an answer of $1 million should be entered as 1 , not 1,000,000. Round your answers for sales and earnings after taxes to the nearest whole number. Round your answers for common shares outstanding, earnings per share, and common stock (price per share) to two decimal places. Round your answers for price/earnings ratio to one decimal place. b. Calculate the premium percentage received by the Grey stockholders. Round your answer to one decimal place. % Assume both that immediate synergistic earnings of $4 million per year will occur as a result of the merger and that the P/E ratio of the combined companies is 11.5 . c. Rework Part a. Enter your answers for sales, earnings after taxes, and common shares outstanding in millions. For example, an answer of $1 million should be entered as 1 , not 1,000,000. Round your answers for sales and earnings after taxes to the nearest whole number. Round your answers for common stock (price per share), earnings per share, and common stock (price per share) to two decimal places. Round your answers for price/earnings ratio to one decimal place. d. Rework Part b. Round your answer to one decimal place. I The Blue Oil Corporation and the Grey Plastics Company have agreed to a merger. The Grey Plastics stockholders will receive 0.50 shares of Blue for each share of Grey held. Assume that no synergistic benefits are expected. a. Complete the following table. Enter your answers for sales, earnings after taxes, and common shares outstanding in millions. For example, an answer of $1 million should be entered as 1 , not 1,000,000. Round your answers for sales and earnings after taxes to the nearest whole number. Round your answers for common shares outstanding, earnings per share, and common stock (price per share) to two decimal places. Round your answers for price/earnings ratio to one decimal place. b. Calculate the premium percentage received by the Grey stockholders. Round your answer to one decimal place. % Assume both that immediate synergistic earnings of $4 million per year will occur as a result of the merger and that the P/E ratio of the combined companies is 11.5 . c. Rework Part a. Enter your answers for sales, earnings after taxes, and common shares outstanding in millions. For example, an answer of $1 million should be entered as 1 , not 1,000,000. Round your answers for sales and earnings after taxes to the nearest whole number. Round your answers for common stock (price per share), earnings per share, and common stock (price per share) to two decimal places. Round your answers for price/earnings ratio to one decimal place. d. Rework Part b. Round your answer to one decimal place