Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The board is interested in learning about the various options for using borrowing. Outline the difference between, and the relative benefits of, loans and bonds,

The board is interested in learning about the various options for using borrowing. Outline the difference between, and the relative benefits of, loans and bonds, fixed-rate and variablerate debt, and domestic-issued bonds and Eurobonds.

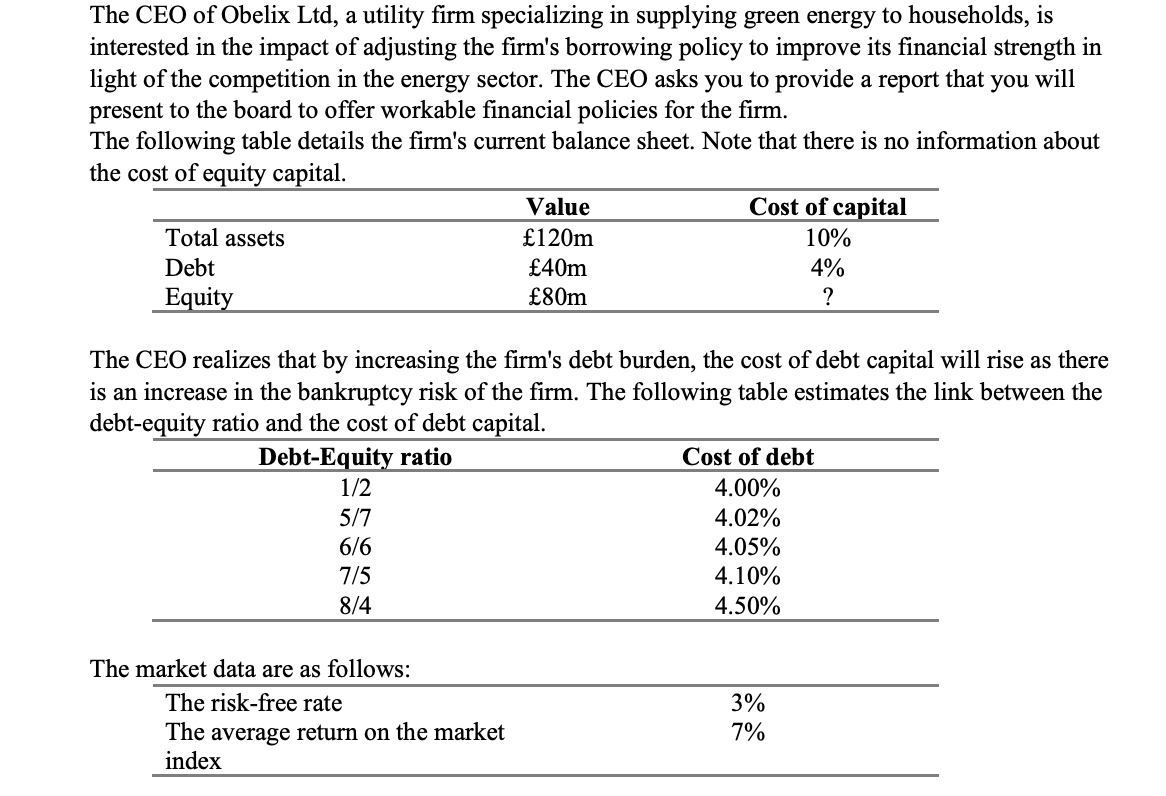

The CEO of Obelix Ltd, a utility firm specializing in supplying green energy to households, is interested in the impact of adjusting the firm's borrowing policy to improve its financial strength in light of the competition in the energy sector. The CEO asks you to provide a report that you will present to the board to offer workable financial policies for the firm. The following table details the firm's current balance sheet. Note that there is no information about the cost of equity capital. Value Cost of capital Total assets 120m 10% Debt 40m 4% Equity 80m ? The CEO realizes that by increasing the firm's debt burden, the cost of debt capital will rise as there is an increase in the bankruptcy risk of the firm. The following table estimates the link between the debt-equity ratio and the cost of debt capital. Debt-Equity ratio Cost of debt 1/2 4.00% 5/7 4.02% 6/6 4.05% 7/5 4.10% 8/4 4.50% The market data are as follows: The risk-free rate The average return on the market index 3% 7% The CEO of Obelix Ltd, a utility firm specializing in supplying green energy to households, is interested in the impact of adjusting the firm's borrowing policy to improve its financial strength in light of the competition in the energy sector. The CEO asks you to provide a report that you will present to the board to offer workable financial policies for the firm. The following table details the firm's current balance sheet. Note that there is no information about the cost of equity capital. Value Cost of capital Total assets 120m 10% Debt 40m 4% Equity 80m ? The CEO realizes that by increasing the firm's debt burden, the cost of debt capital will rise as there is an increase in the bankruptcy risk of the firm. The following table estimates the link between the debt-equity ratio and the cost of debt capital. Debt-Equity ratio Cost of debt 1/2 4.00% 5/7 4.02% 6/6 4.05% 7/5 4.10% 8/4 4.50% The market data are as follows: The risk-free rate The average return on the market index 3% 7%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started