Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Board of Directors of Begum plc, a listed company, have constituted an acquisition committee to research and consult widely as a pre-cursor to considering

The Board of Directors of Begum plc, a listed company, have constituted an acquisition committee

to research and consult widely as a pre-cursor to considering making takeover bids for two

competitors. One is KL plc, also a listed company and the other PVT Ltd., is a private company.

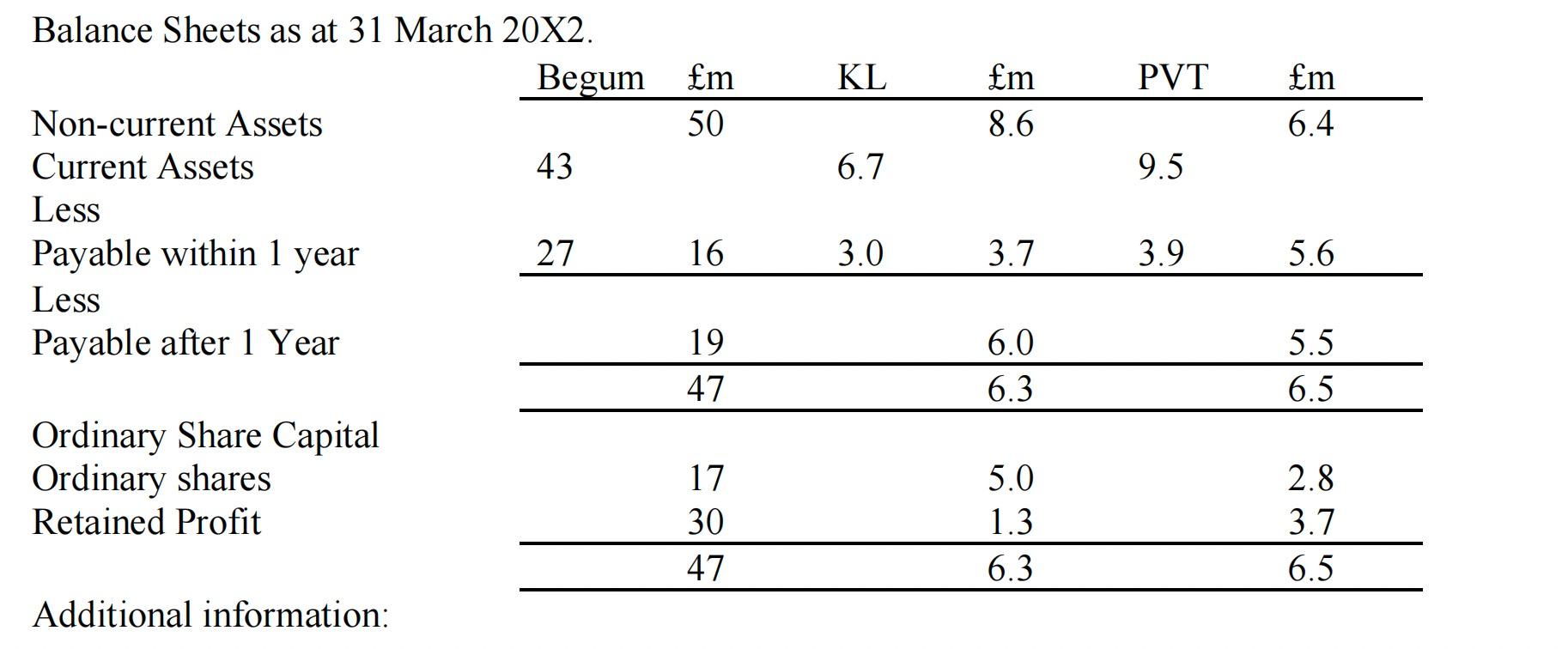

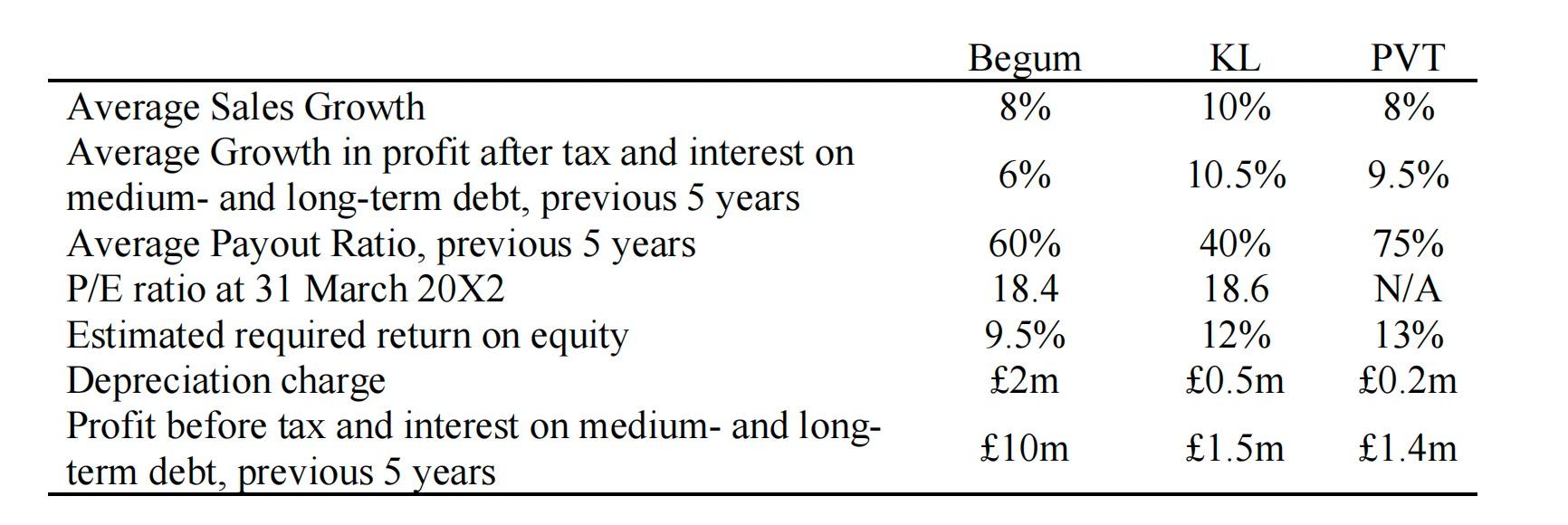

Summarised below are financial data for the three companies:

Additional information:

- The current assets of Begum plc include 5m cash.

- Ordinary share capitals of KL and PVT comprise 1 ordinary shares, while that of Begum comprises 50p shares.

- Begums liability, payable after 1 year, comprises 8% debentures trading at 80 per 100 of debentures.

- KLs liability, payable after 1 year, comprises 11% debentures trading at 110 per 100 of debentures.

- PVTs liability, payable after 1 year, is 7-year 10% bank loan.

The corporation tax rate is 17%.

REQUIRED:

- Prepare a report, including your calculations as an appendix, advising the Board of Begum plc on the possible cost of acquiring each of the companies, using

- The P/E ratio method,

- Dividend valuation method, i Asset valuation method.

- Employ the Enterprise Value to EBITDA multiple of both KL plc and Begum plc to calculate estimated equity values for PVT Ltd., and comment on your results.

- Discuss alternative terms that might be offered to the shareholders of KL plc and PVT Ltd.

Balance Sheets as at 31 March 20X2. Begum Non-current Assets Current Assets 43 Less 27 Payable within 1 year Less Payable after 1 Year Ordinary Share Capital Ordinary shares Retained Profit Additional information: m 50 16 19 47 17 30 47 KL 6.7 3.0 m 8.6 3.7 6.0 6.3 5.0 1.3 6.3 PVT 9.5 3.9 m 6.4 5.6 5.5 6.5 2.8 3.7 6.5 Average Sales Growth Average Growth in profit after tax and interest on medium- and long-term debt, previous 5 years Average Payout Ratio, previous 5 years P/E ratio at 31 March 20X2 Estimated required return on equity Depreciation charge Profit before tax and interest on medium- and long- term debt, previous 5 years Begum 8% 6% 60% 18.4 9.5% 2m 10m KL PVT 10% 8% 10.5% 9.5% 40% 75% 18.6 N/A 12% 13% 0.5m 0.2m 1.5m 1.4m Balance Sheets as at 31 March 20X2. Begum Non-current Assets Current Assets 43 Less 27 Payable within 1 year Less Payable after 1 Year Ordinary Share Capital Ordinary shares Retained Profit Additional information: m 50 16 19 47 17 30 47 KL 6.7 3.0 m 8.6 3.7 6.0 6.3 5.0 1.3 6.3 PVT 9.5 3.9 m 6.4 5.6 5.5 6.5 2.8 3.7 6.5 Average Sales Growth Average Growth in profit after tax and interest on medium- and long-term debt, previous 5 years Average Payout Ratio, previous 5 years P/E ratio at 31 March 20X2 Estimated required return on equity Depreciation charge Profit before tax and interest on medium- and long- term debt, previous 5 years Begum 8% 6% 60% 18.4 9.5% 2m 10m KL PVT 10% 8% 10.5% 9.5% 40% 75% 18.6 N/A 12% 13% 0.5m 0.2m 1.5m 1.4m

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started