Answered step by step

Verified Expert Solution

Question

1 Approved Answer

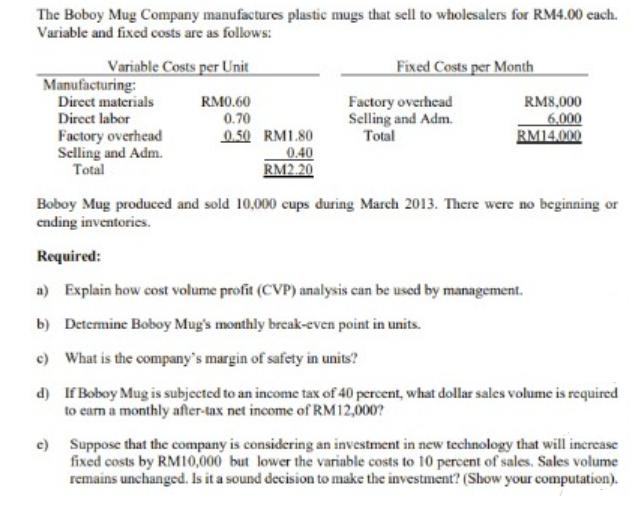

The Boboy Mug Company manufactures plastic mugs that sell to wholesalers for RM4.00 each. Variable and fixed costs are as follows: Variable Costs per

The Boboy Mug Company manufactures plastic mugs that sell to wholesalers for RM4.00 each. Variable and fixed costs are as follows: Variable Costs per Unit Fixed Costs per Month Manufacturing: Direct materials RM0.60 Factory overhead Direct labor 0.70 Selling and Adm. RM8,000 6,000 Factory overhead 0.50 RM1.80 Total RM14000 Selling and Adm. Total 0.40 RM2.20 Boboy Mug produced and sold 10,000 cups during March 2013. There were no beginning or ending inventories. Required: a) Explain how cost volume profit (CVP) analysis can be used by management. b) Determine Boboy Mug's monthly break-even point in units. c) What is the company's margin of safety in units? d) If Boboy Mug is subjected to an income tax of 40 percent, what dollar sales volume is required to earn a monthly after-tax net income of RM12,000? e) Suppose that the company is considering an investment in new technology that will increase fixed costs by RM10,000 but lower the variable costs to 10 percent of sales. Sales volume remains unchanged. Is it a sound decision to make the investment? (Show your computation).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started