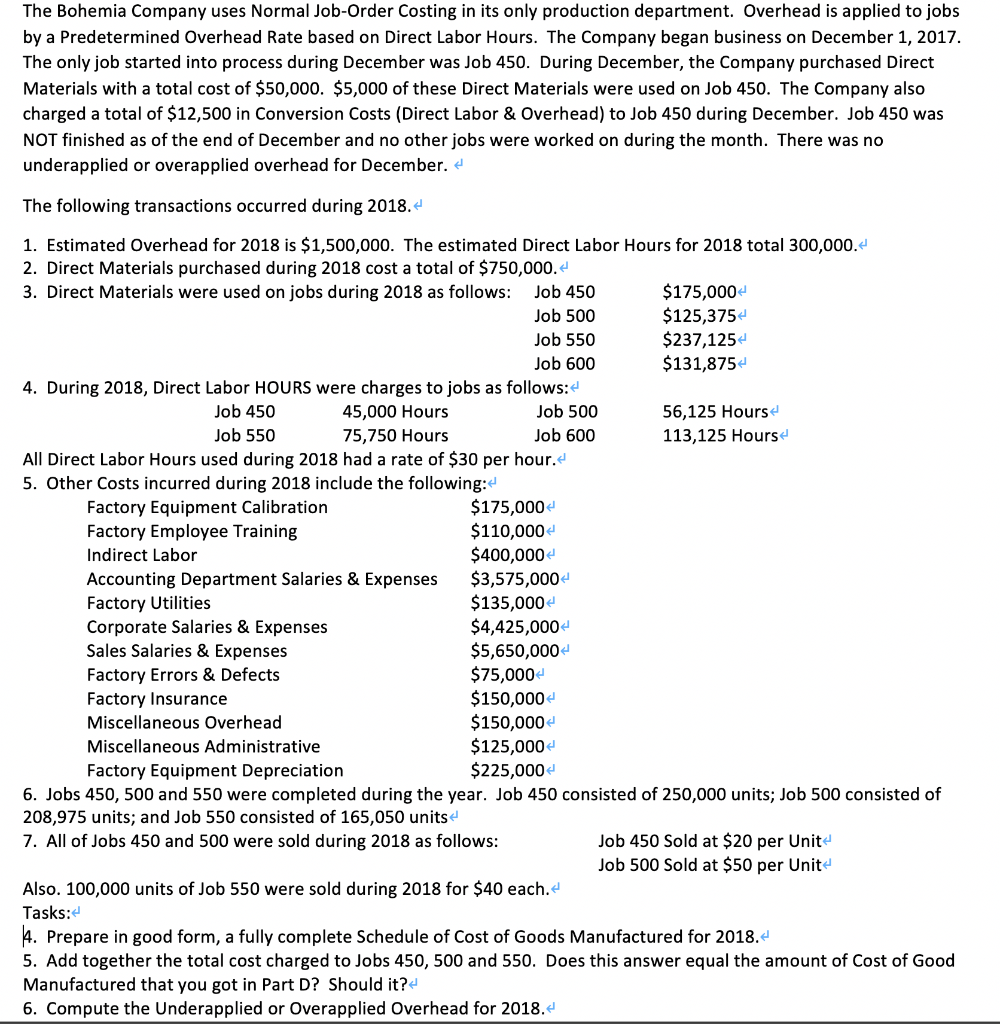

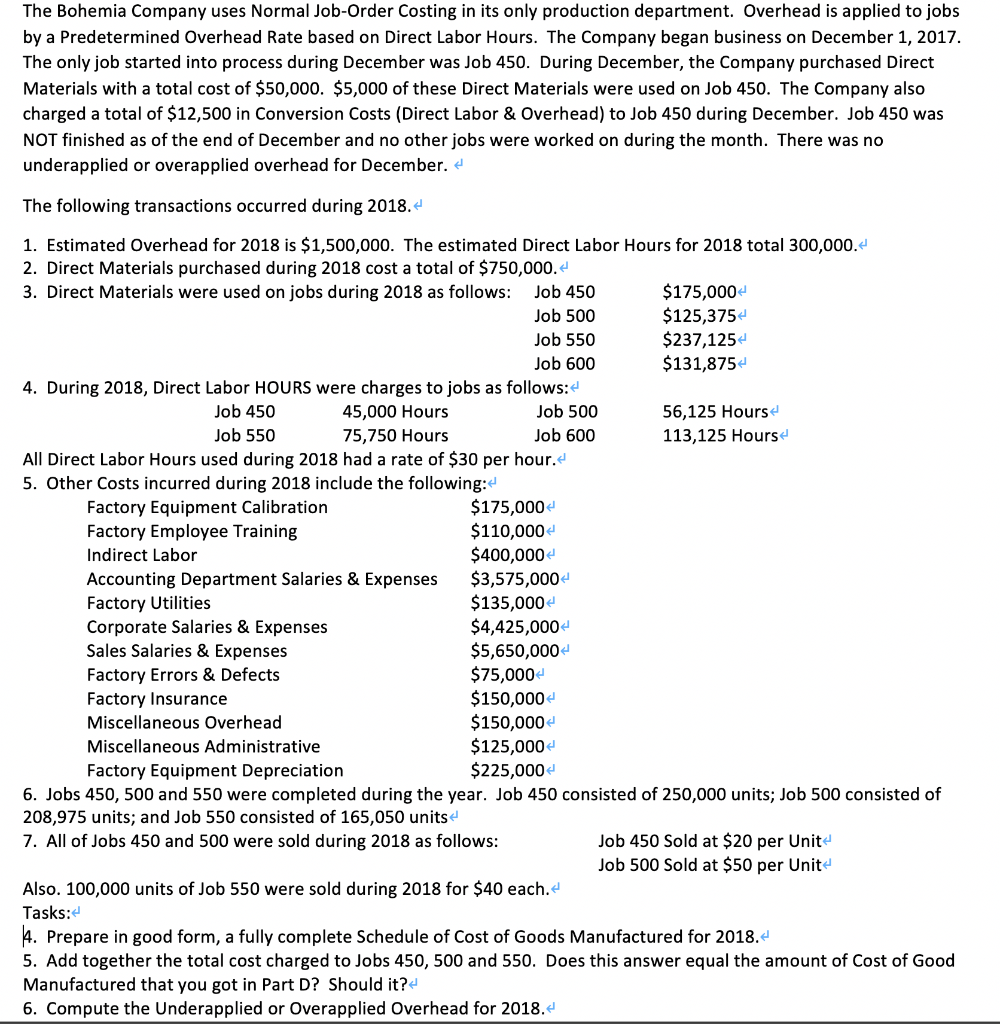

The Bohemia Company uses Normal Job-Order Costing in its only production department. Overhead is applied to jobs by a Predetermined Overhead Rate based on Direct Labor Hours. The Company began business on December 1, 2017. The only job started into process during December was Job 450. During December, the Company purchased Direct Materials with a total cost of $50,000. $5,000 of these Direct Materials were used on Job 450. The Company also charged a total of $12,500 in Conversion Costs (Direct Labor & Overhead) to Job 450 during December. Job 450 was NOT finished as of the end of December and no other jobs were worked on during the month. There was no underapplied or overapplied overhead for December. The following transactions occurred during 2018. 1. Estimated Overhead for 2018 is $1,500,000. The estimated Direct Labor Hours for 2018 total 300,000. 2. Direct Materials purchased during 2018 cost a total of $750,000. 3. Direct Materials were used on jobs during 2018 as follows: Job 450 Job 500 Job 550 Job 600 $175,000 $125,375 $237,125 $131,875 4. During 2018, Direct Labor HOURS were charges to jobs as follows: Job 450 Job 550 45,000 Hours 75,750 Hours Job 500 Job 600 56,125 Hours 113,125 Hours All Direct Labor Hours used during 2018 had a rate of $30 per hour. 5. Other Costs incurred during 2018 include the following:- $175,000 $110,000e $400,000e Factory Equipment Calibration Factory Employee Training Indirect Labor Accounting Department Salaries & Expenses $3,575,000 Factory Utilities Corporate Salaries & Expenses Sales Salaries & Expenses Factory Errors & Defects Factory Insurance Miscellaneous Overhead Miscellaneous Administrative Factory Equipment Depreciation $135,000 $4,425,000 $5,650,000 $75,000 $150,000 $150,000 $125,000 $225,000 6. Jobs 450, 500 and 550 were completed during the year. Job 450 consisted of 250,000 units; Job 500 consisted of 208,975 units; and Job 550 consisted of 165,050 units 7. All of Jobs 450 and 500 were sold during 2018 as follows: Job 450 Sold at $20 per Unit Job 500 Sold at $50 per Unit Also. 100,000 units of Job 550 were sold during 2018 for $40 each.f Tasks: Prepare in good form, a fully complete Schedule of Cost of Goods Manufactured for 2018. 5. Add together the total cost charged to Jobs 450, 500 and 550. Does this answer equal the amount of Cost of Good Manufactured that you got in Part D? Should it?e 6. Compute the Underapplied or Overapplied Overhead for 2018