Answered step by step

Verified Expert Solution

Question

1 Approved Answer

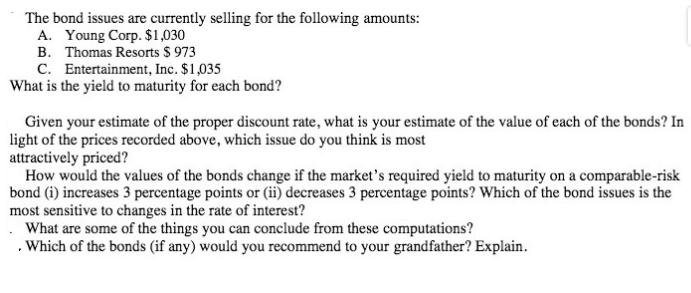

The bond issues are currently selling for the following amounts: A. Young Corp. $1,030 B. Thomas Resorts $ 973 C. Entertainment, Inc. $1,035 What

The bond issues are currently selling for the following amounts: A. Young Corp. $1,030 B. Thomas Resorts $ 973 C. Entertainment, Inc. $1,035 What is the yield to maturity for each bond? Given your estimate of the proper discount rate, what is your estimate of the value of each of the bonds? In light of the prices recorded above, which issue do you think is most attractively priced? How would the values of the bonds change if the market's required yield to maturity on a comparable-risk bond (i) increases 3 percentage points or (ii) decreases 3 percentage points? Which of the bond issues is the most sensitive to changes in the rate of interest? . What are some of the things you can conclude from these computations? . Which of the bonds (if any) would you recommend to your grandfather? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the yield to maturity YTM for each bond we still need additional information such as th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started