Answered step by step

Verified Expert Solution

Question

1 Approved Answer

.. The bonds pay interest semi-annually on June 30 and December 31 and mature on December 31,2026. 2. purchased Linn Inc. for $330,000 which is

..

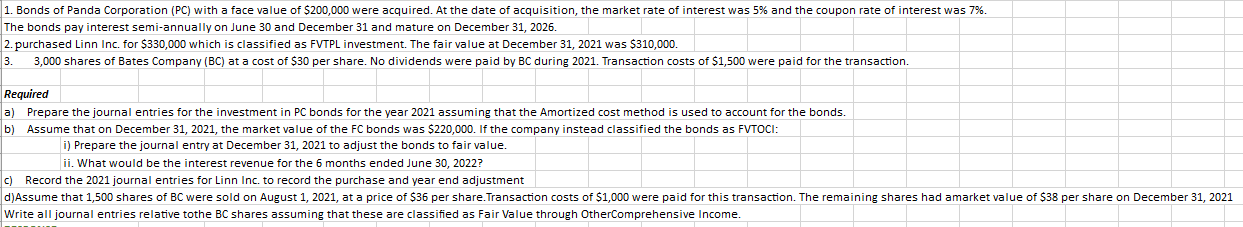

The bonds pay interest semi-annually on June 30 and December 31 and mature on December 31,2026. 2. purchased Linn Inc. for $330,000 which is classified as FVTPL investment. The fair value at December 31,2021 was $310,000. Required a) Prepare the journal entries for the investment in PC bonds for the year 2021 assuming that the Amortized cost method is used to account for the bonds. b) Assume that on December 31,2021 , the market value of the FC bonds was $220,000. If the company instead classified the bonds as FVTOCl: i) Prepare the journal entry at December 31,2021 to adjust the bonds to fair value. ii. What would be the interest revenue for the 6 months ended June 30,2022 ? c) Record the 2021 journal entries for Linn Inc. to record the purchase and year end adjustment Write all journal entries relative tothe BC shares assuming that these are classified as Fair Value through OtherComprehensive IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started