Answered step by step

Verified Expert Solution

Question

1 Approved Answer

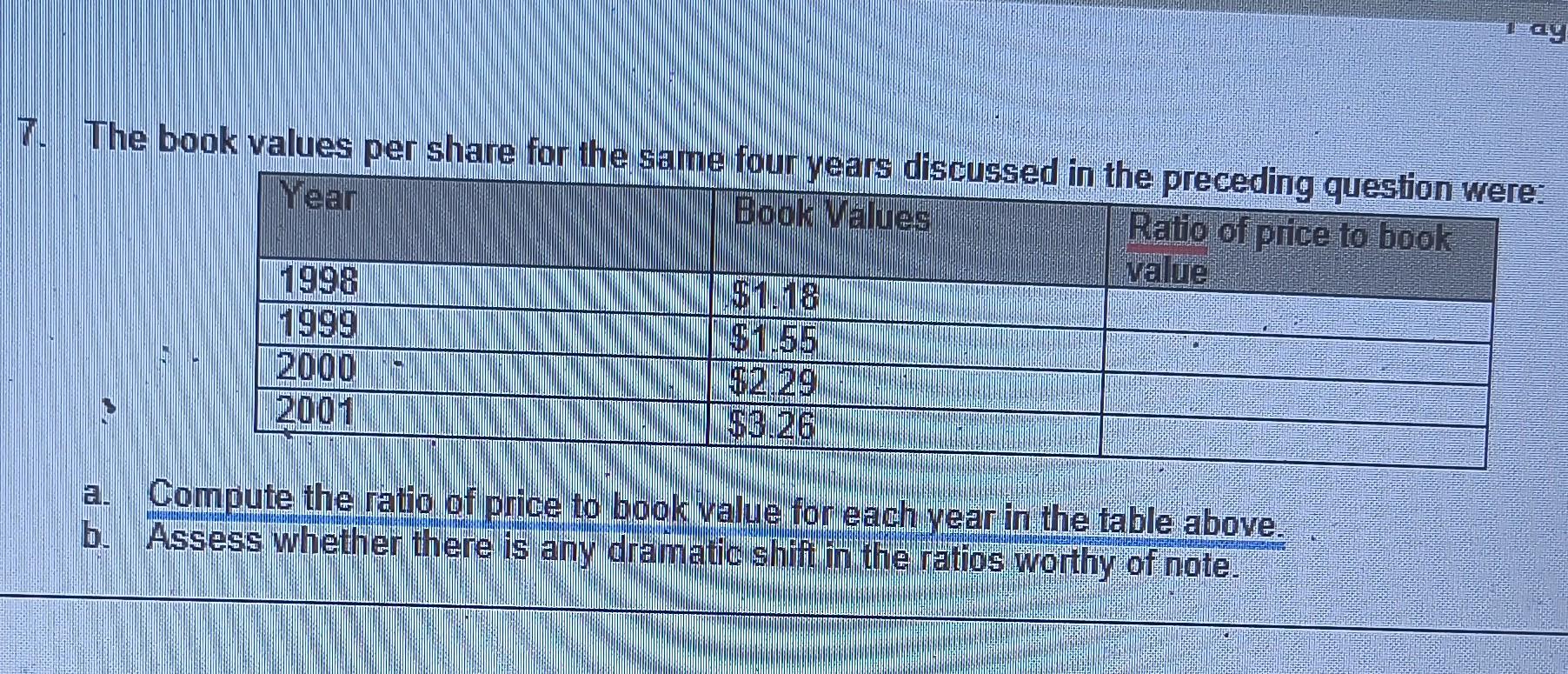

The book values per share for the same four years discussed in the a. Compute the ratio of price to book value for each year

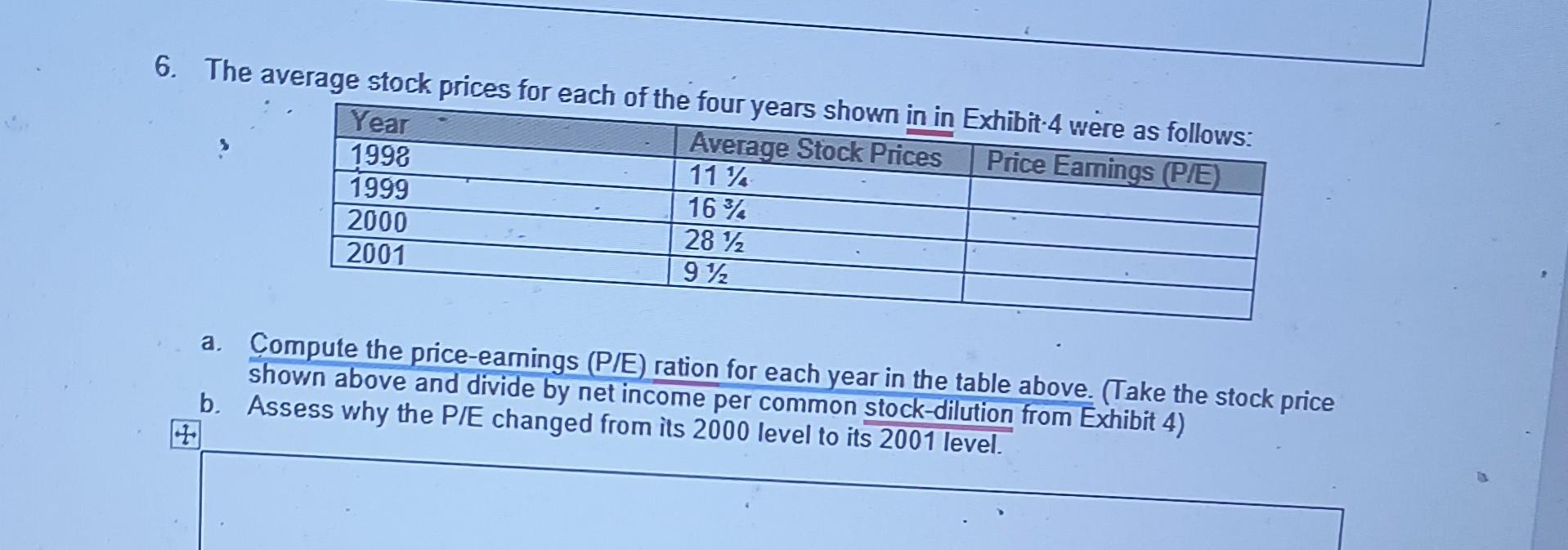

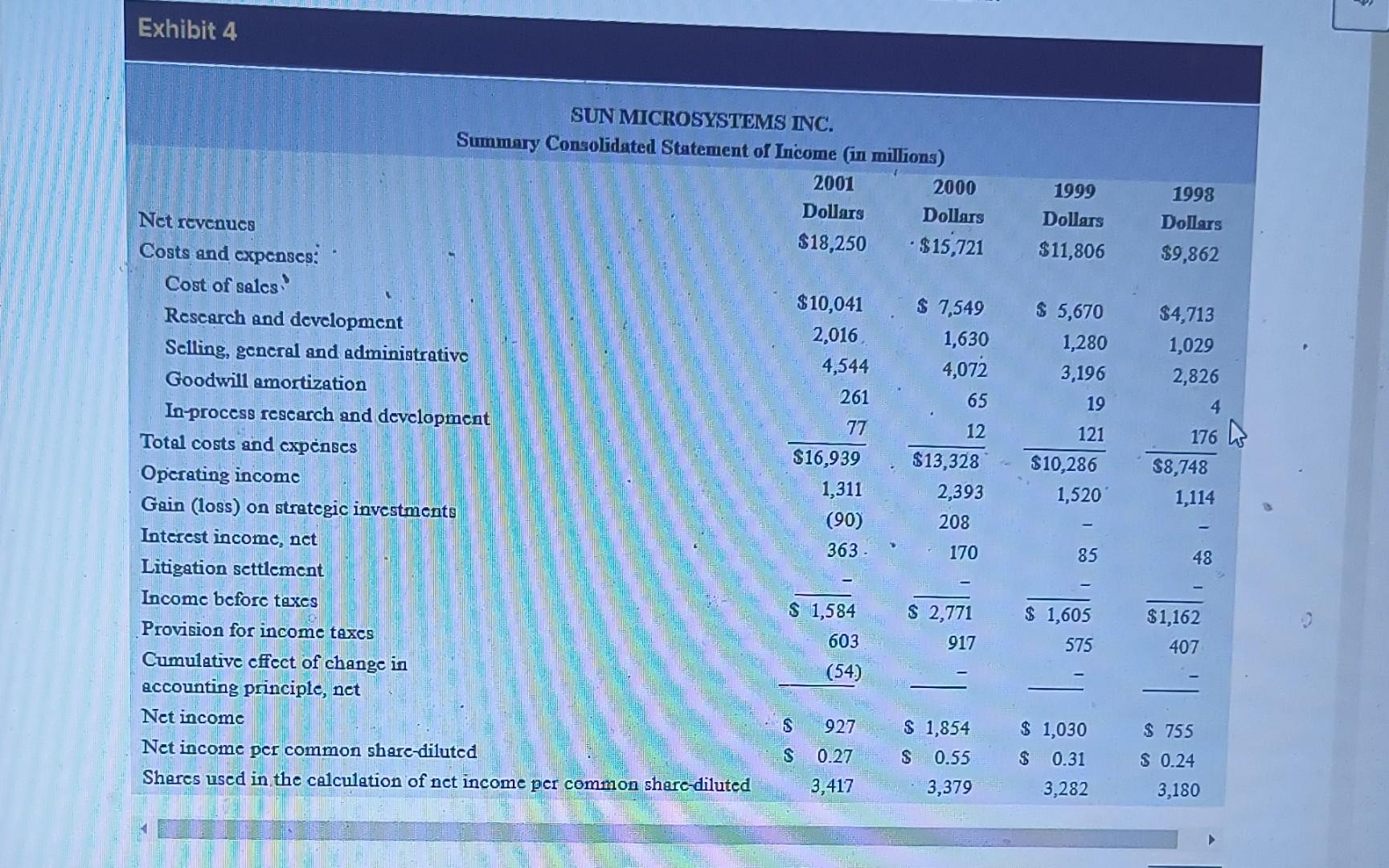

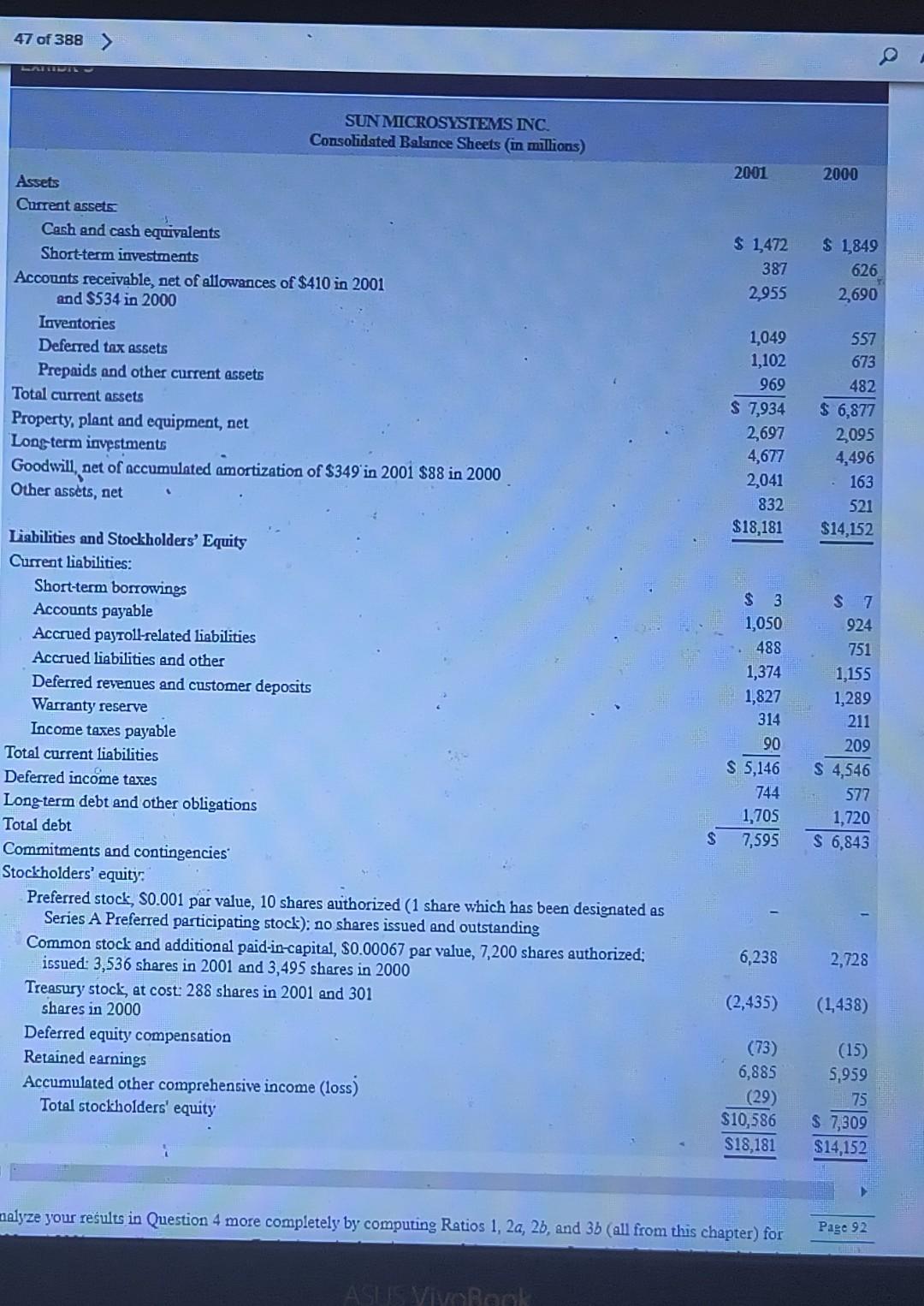

The book values per share for the same four years discussed in the a. Compute the ratio of price to book value for each year in the table above. b. Assess whether there is any dramatic shifi in the ratios worthy of note. 6. The average stock prices for each of the fnirr voarm a ...... a. Compute the price-earnings (P/E) ration for each year in the table above. (Take the stock price shown above and divide by net income per common stock-dilution from Exhibit 4) b. Assess why the P/E changed from its 2000 level to its 2001 level. Exhibit 4 SUN MICROSYSTEMS INC. Summary Consolidated Statement of Inicome (in millions) Net revenues Costs and expenses: Cost of sales: Rescarch and development Selling, gencral and administrative Goodwill amortization In-process research and devclopment Total costs and expenses Operating income Gain (loss) on strategic investments Interest income, net Litigation settlement Income before texes Provision for income taxes Cumulative effect of change in accounting principle, net Net income Net income per common share-diluted Shares used in the calculation of net income per common share-diluted 4 47 of 388 Alyze your results in Question 4 more completely by computing Ratios \\( 1,2 a, 2 b \\), and \\( 3 b \\) (all from this chapter) for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started