Answered step by step

Verified Expert Solution

Question

1 Approved Answer

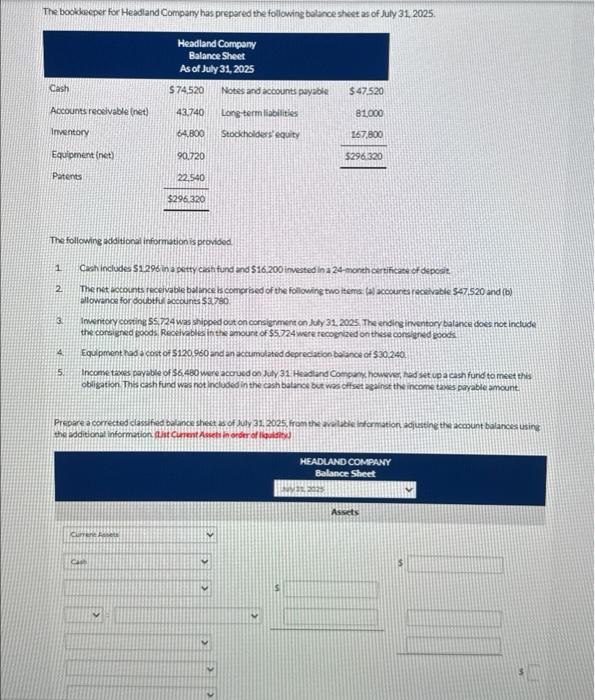

The bookkeeper for Headland Company has prepared the following balance sheet as of July 31, 2025. Cash Accounts receivable (net) Inventory Equipment (net) Patents 1

The bookkeeper for Headland Company has prepared the following balance sheet as of July 31, 2025. Cash Accounts receivable (net) Inventory Equipment (net) Patents 1 2 3 4 5. Headland Company Balance Sheet As of July 31, 2025 $74,520 43.740 The following additional information is provided. 64,800 Current Assets 90.720 22.540 $296.320 Notes and accounts payable Long-term liabilities Stockholders' equity $47.520 Cash includes $1.296 in a petty cash fund and $16,200 invested in a 24-month certificate of deposit. The net accounts receivable balance is comprised of the following two items: (a) accounts receivable $47.520 and (b) allowance for doubtful accounts $3,780. > 81,000 Inventory costing $5.724 was shipped out on consignment on July 31, 2025. The ending inventory balance does not include the consigned goods. Receivables in the amount of $5,724 were recognized on these consigned goods. Equipment had a cost of $120,960 and an accumulated depreciation balance of $30,240. Income taxes payable of $6.480 were accrued on July 31. Headland Company, however, had set up a cash fund to meet this obligation. This cash fund was not included in the cash balance but was offset against the income taxes payable amount. 6 167,800 Prepare a corrected classified balance sheet as of July 31, 2025, from the available information, adjusting the account balances using the additional information. (List Current Assets in order of liquidity) $296.320 July 31 2025 HEADLAND COMPANY Balance Sheet Assets IA $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started