Answered step by step

Verified Expert Solution

Question

1 Approved Answer

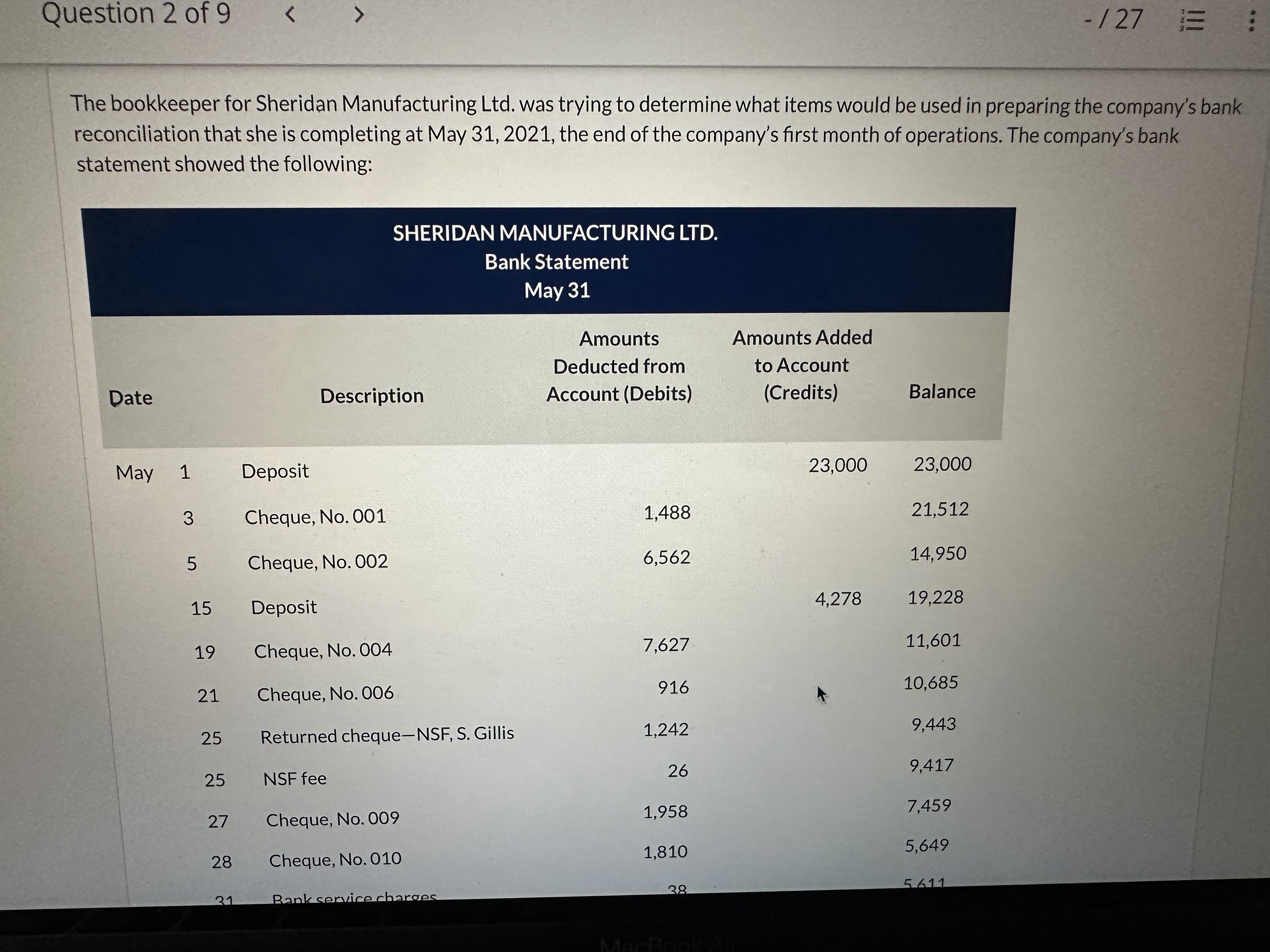

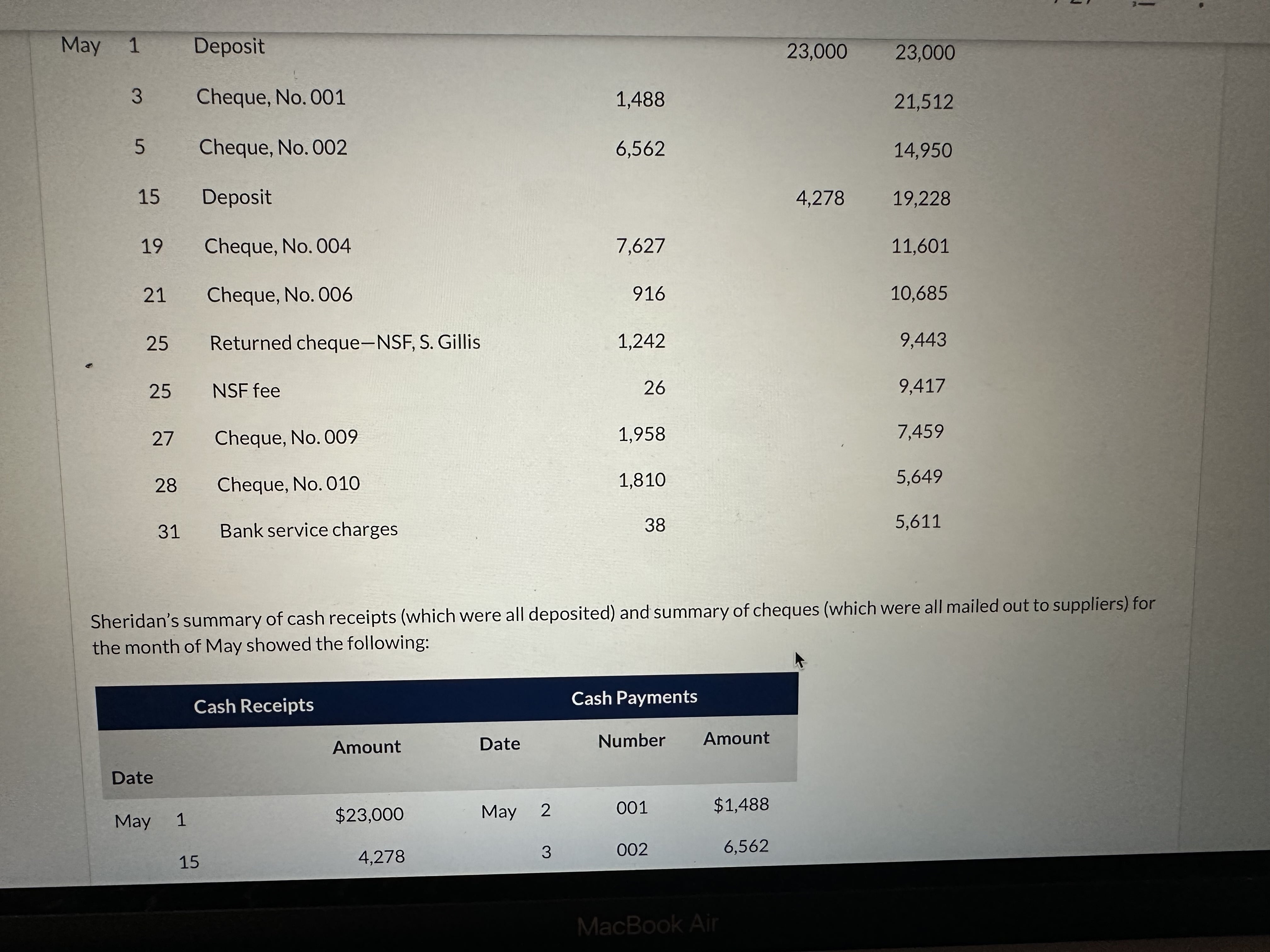

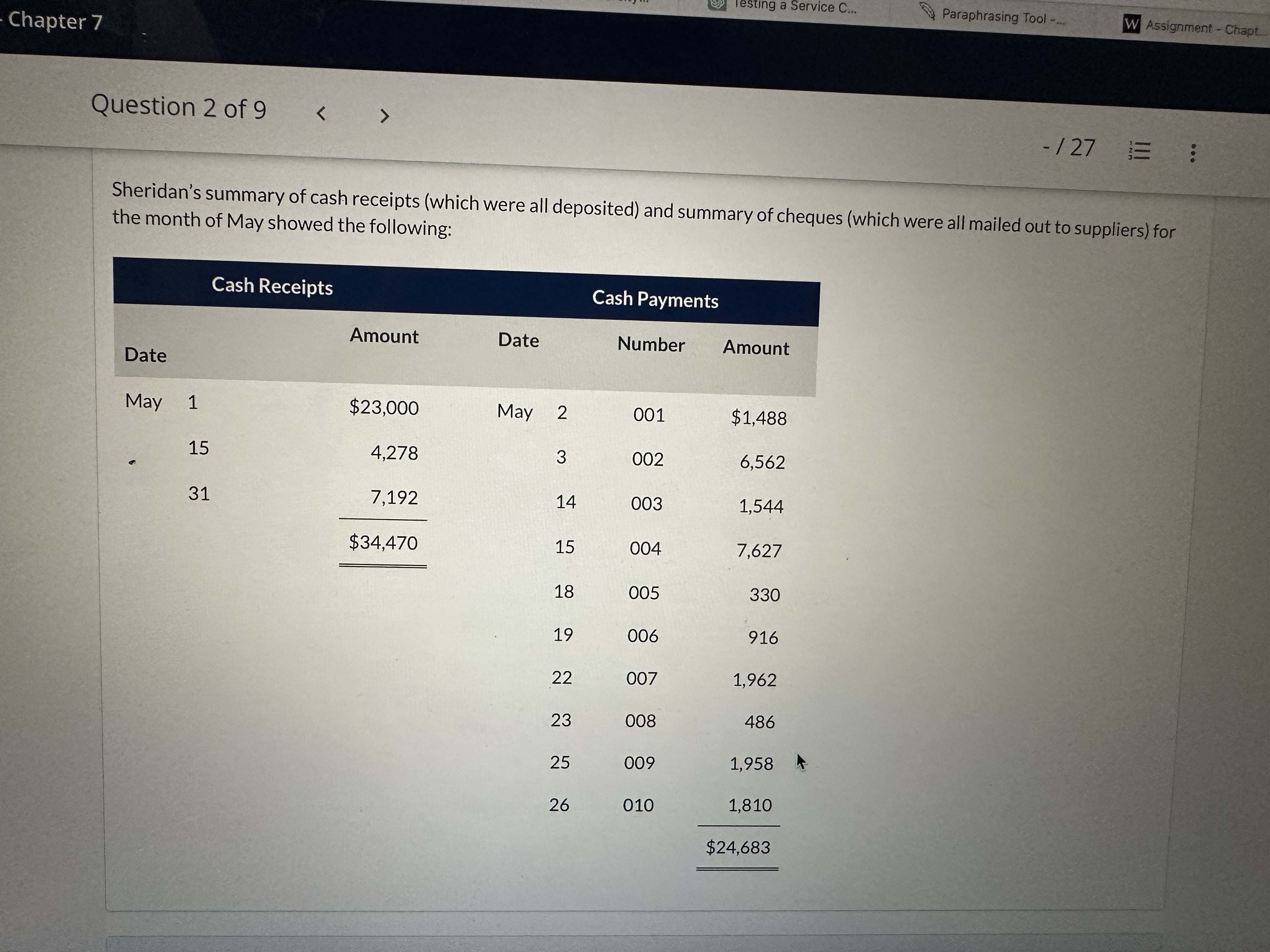

The bookkeeper for Sheridan Manufacturing Ltd. was trying to determine what items would be used in preparing the company's bank reconciliation that she is completing

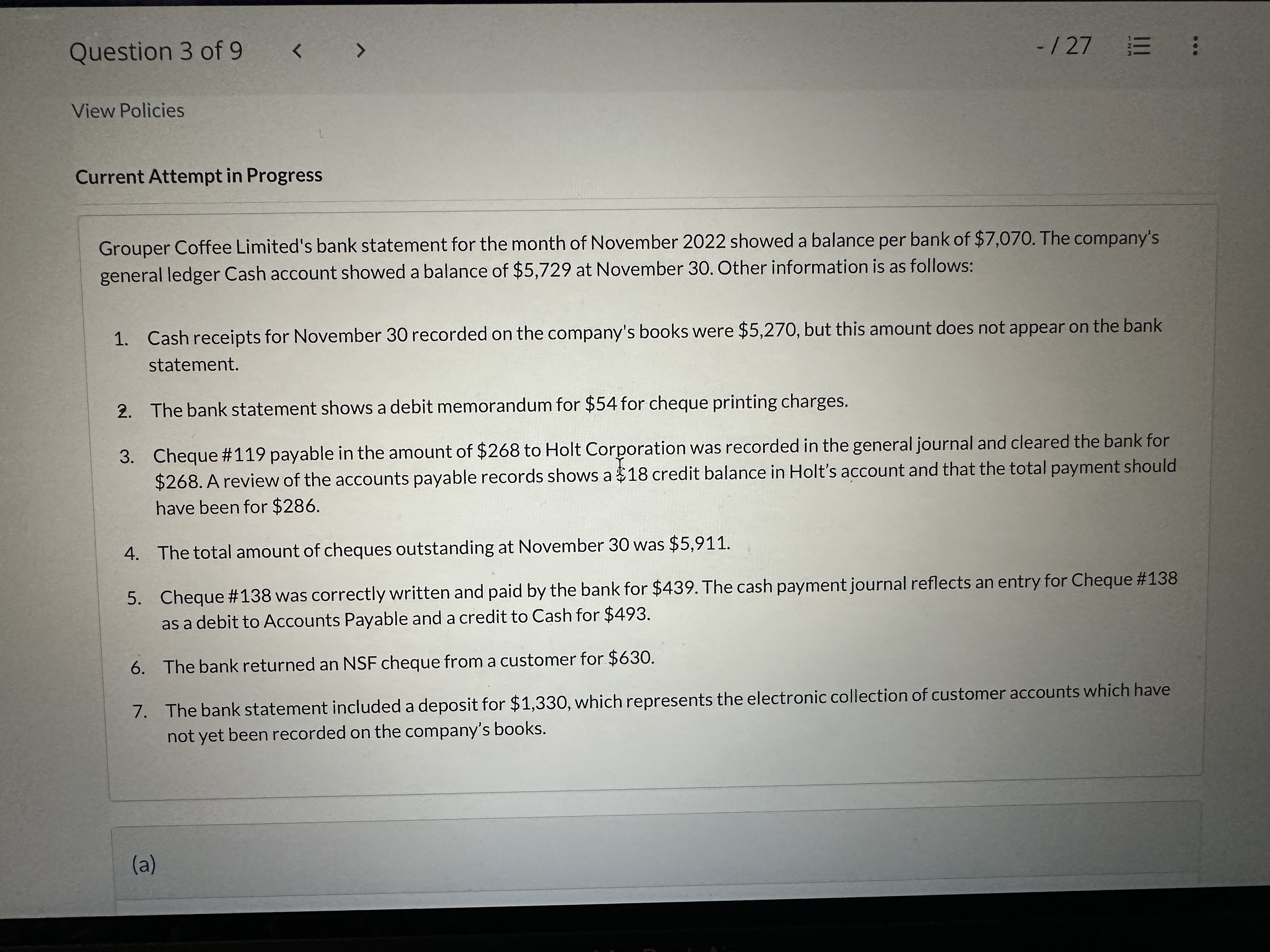

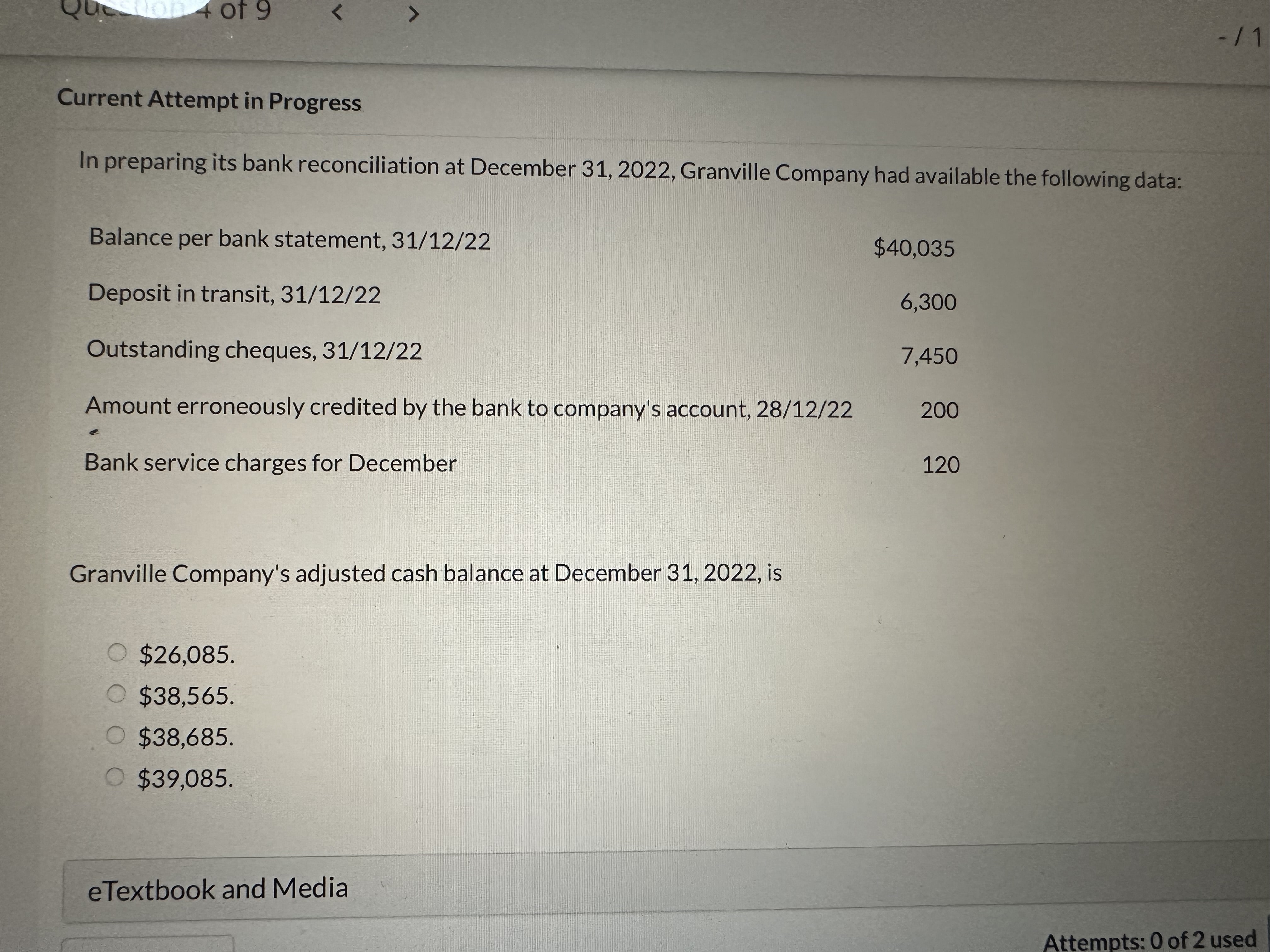

The bookkeeper for Sheridan Manufacturing Ltd. was trying to determine what items would be used in preparing the company's bank reconciliation that she is completing at May 31,2021, the end of the company's first month of operations. The company's bank statement showed the following: Sheridan's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the month of May showed the following: Sheridan's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the month of May showed the following: Grouper Coffee Limited's bank statement for the month of November 2022 showed a balance per bank of $7,070. The company's general ledger Cash account showed a balance of $5,729 at November 30 . Other information is as follows: 1. Cash receipts for November 30 recorded on the company's books were $5,270, but this amount does not appear on the bank statement. 2. The bank statement shows a debit memorandum for $54 for cheque printing charges. 3. Cheque \#119 payable in the amount of $268 to Holt Corporation was recorded in the general journal and cleared the bank for $268. A review of the accounts payable records shows a $18 credit balance in Holt's account and that the total payment should have been for $286. 4. The total amount of cheques outstanding at November 30 was $5,911. 5. Cheque \#138 was correctly written and paid by the bank for $439. The cash payment journal reflects an entry for Cheque \#138 as a debit to Accounts Payable and a credit to Cash for $493. 6. The bank returned an NSF cheque from a customer for $630. 7. The bank statement included a deposit for $1,330, which represents the electronic collection of customer accounts which have not yet been recorded on the company's books. Prepare a bank reconciliation for Grouper Coffee Limited at November 30, 2022. (List items that increase halance firct.) Question 3 of 9 127 $ In preparing its bank reconciliation at December 31,2022, Granville Company had available the following data: Granville Company's adjusted cash balance at December 31,2022 , is $26,085. $38,565. $38,685. $39,085. The bookkeeper for Sheridan Manufacturing Ltd. was trying to determine what items would be used in preparing the company's bank reconciliation that she is completing at May 31,2021, the end of the company's first month of operations. The company's bank statement showed the following: Sheridan's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the month of May showed the following: Sheridan's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the month of May showed the following: Grouper Coffee Limited's bank statement for the month of November 2022 showed a balance per bank of $7,070. The company's general ledger Cash account showed a balance of $5,729 at November 30 . Other information is as follows: 1. Cash receipts for November 30 recorded on the company's books were $5,270, but this amount does not appear on the bank statement. 2. The bank statement shows a debit memorandum for $54 for cheque printing charges. 3. Cheque \#119 payable in the amount of $268 to Holt Corporation was recorded in the general journal and cleared the bank for $268. A review of the accounts payable records shows a $18 credit balance in Holt's account and that the total payment should have been for $286. 4. The total amount of cheques outstanding at November 30 was $5,911. 5. Cheque \#138 was correctly written and paid by the bank for $439. The cash payment journal reflects an entry for Cheque \#138 as a debit to Accounts Payable and a credit to Cash for $493. 6. The bank returned an NSF cheque from a customer for $630. 7. The bank statement included a deposit for $1,330, which represents the electronic collection of customer accounts which have not yet been recorded on the company's books. Prepare a bank reconciliation for Grouper Coffee Limited at November 30, 2022. (List items that increase halance firct.) Question 3 of 9 127 $ In preparing its bank reconciliation at December 31,2022, Granville Company had available the following data: Granville Company's adjusted cash balance at December 31,2022 , is $26,085. $38,565. $38,685. $39,085

The bookkeeper for Sheridan Manufacturing Ltd. was trying to determine what items would be used in preparing the company's bank reconciliation that she is completing at May 31,2021, the end of the company's first month of operations. The company's bank statement showed the following: Sheridan's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the month of May showed the following: Sheridan's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the month of May showed the following: Grouper Coffee Limited's bank statement for the month of November 2022 showed a balance per bank of $7,070. The company's general ledger Cash account showed a balance of $5,729 at November 30 . Other information is as follows: 1. Cash receipts for November 30 recorded on the company's books were $5,270, but this amount does not appear on the bank statement. 2. The bank statement shows a debit memorandum for $54 for cheque printing charges. 3. Cheque \#119 payable in the amount of $268 to Holt Corporation was recorded in the general journal and cleared the bank for $268. A review of the accounts payable records shows a $18 credit balance in Holt's account and that the total payment should have been for $286. 4. The total amount of cheques outstanding at November 30 was $5,911. 5. Cheque \#138 was correctly written and paid by the bank for $439. The cash payment journal reflects an entry for Cheque \#138 as a debit to Accounts Payable and a credit to Cash for $493. 6. The bank returned an NSF cheque from a customer for $630. 7. The bank statement included a deposit for $1,330, which represents the electronic collection of customer accounts which have not yet been recorded on the company's books. Prepare a bank reconciliation for Grouper Coffee Limited at November 30, 2022. (List items that increase halance firct.) Question 3 of 9 127 $ In preparing its bank reconciliation at December 31,2022, Granville Company had available the following data: Granville Company's adjusted cash balance at December 31,2022 , is $26,085. $38,565. $38,685. $39,085. The bookkeeper for Sheridan Manufacturing Ltd. was trying to determine what items would be used in preparing the company's bank reconciliation that she is completing at May 31,2021, the end of the company's first month of operations. The company's bank statement showed the following: Sheridan's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the month of May showed the following: Sheridan's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the month of May showed the following: Grouper Coffee Limited's bank statement for the month of November 2022 showed a balance per bank of $7,070. The company's general ledger Cash account showed a balance of $5,729 at November 30 . Other information is as follows: 1. Cash receipts for November 30 recorded on the company's books were $5,270, but this amount does not appear on the bank statement. 2. The bank statement shows a debit memorandum for $54 for cheque printing charges. 3. Cheque \#119 payable in the amount of $268 to Holt Corporation was recorded in the general journal and cleared the bank for $268. A review of the accounts payable records shows a $18 credit balance in Holt's account and that the total payment should have been for $286. 4. The total amount of cheques outstanding at November 30 was $5,911. 5. Cheque \#138 was correctly written and paid by the bank for $439. The cash payment journal reflects an entry for Cheque \#138 as a debit to Accounts Payable and a credit to Cash for $493. 6. The bank returned an NSF cheque from a customer for $630. 7. The bank statement included a deposit for $1,330, which represents the electronic collection of customer accounts which have not yet been recorded on the company's books. Prepare a bank reconciliation for Grouper Coffee Limited at November 30, 2022. (List items that increase halance firct.) Question 3 of 9 127 $ In preparing its bank reconciliation at December 31,2022, Granville Company had available the following data: Granville Company's adjusted cash balance at December 31,2022 , is $26,085. $38,565. $38,685. $39,085 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started