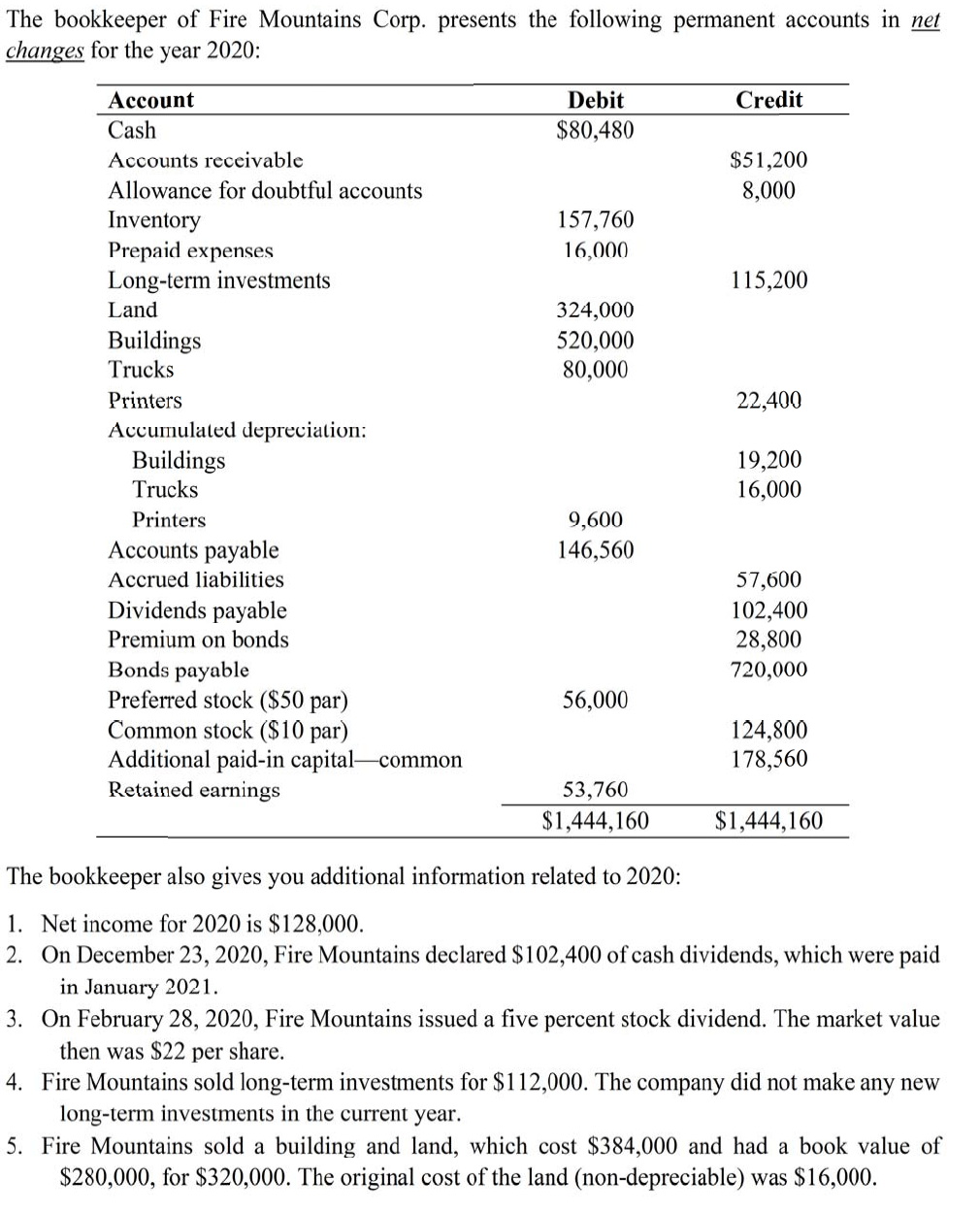

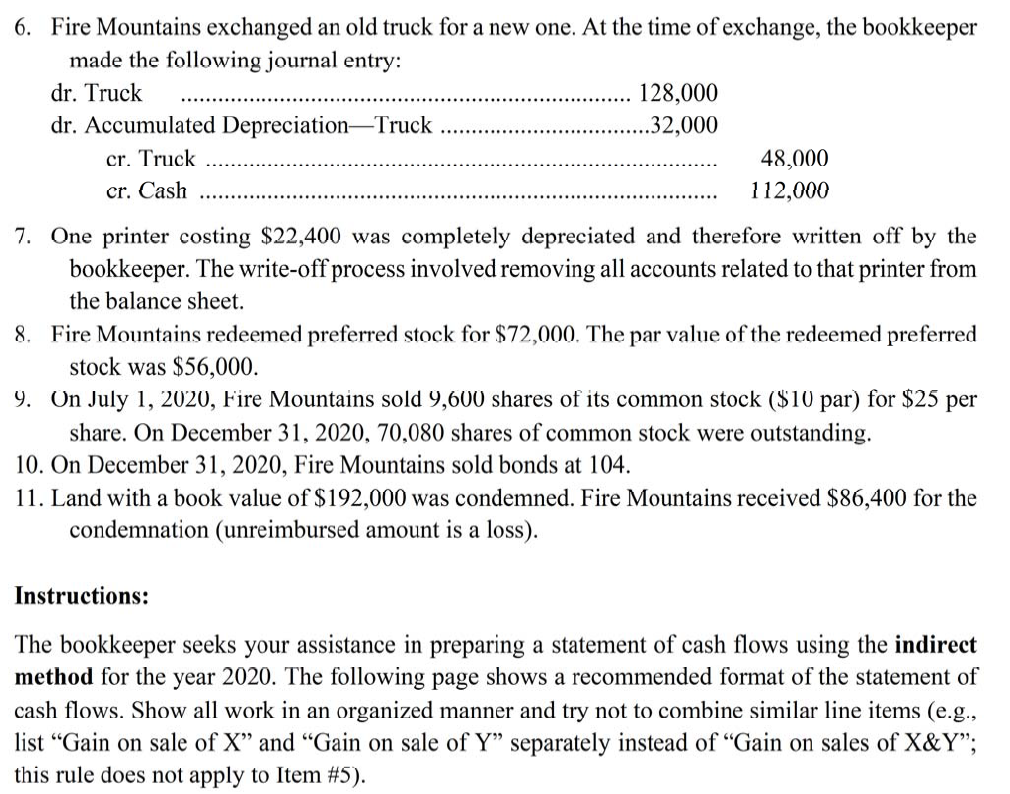

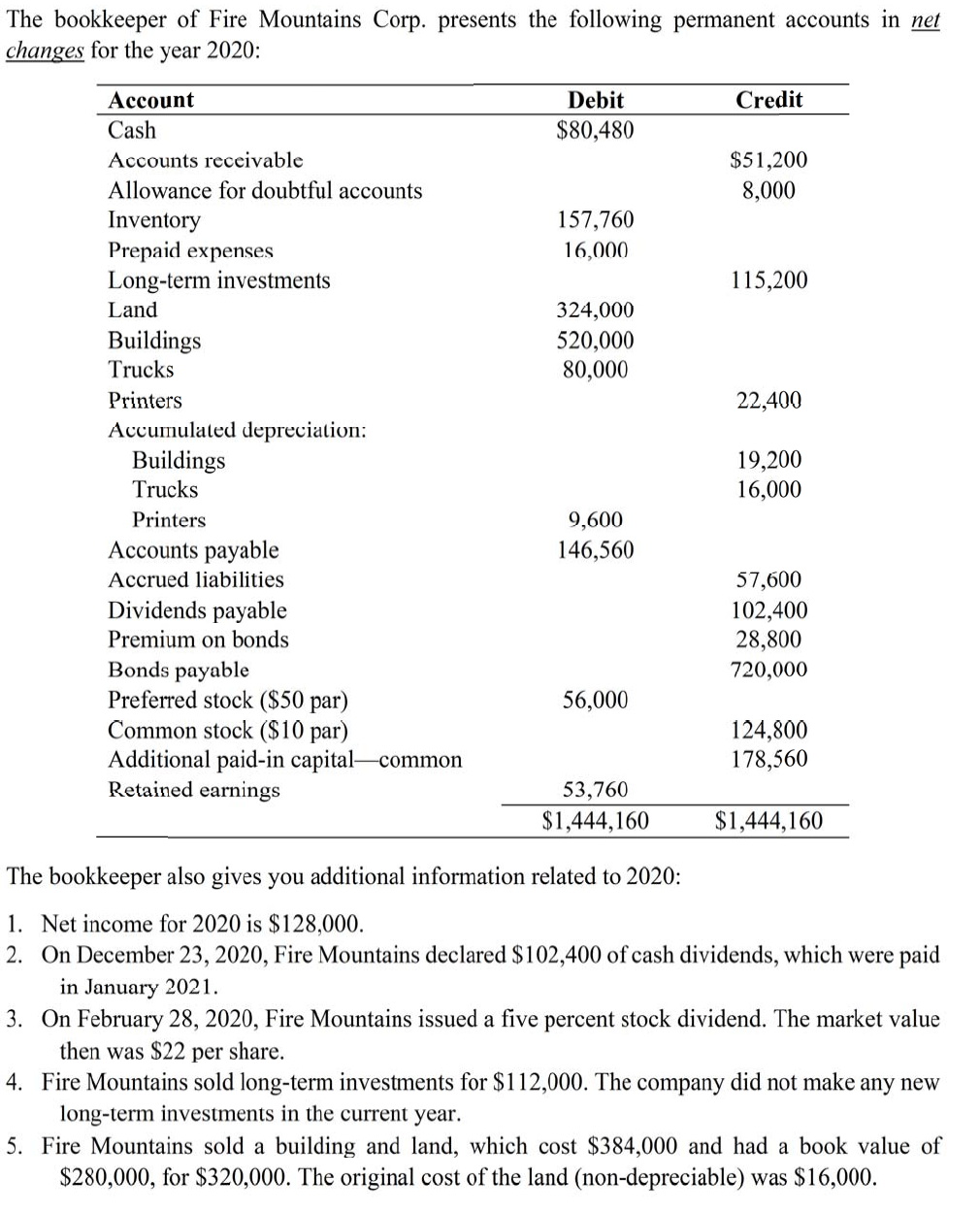

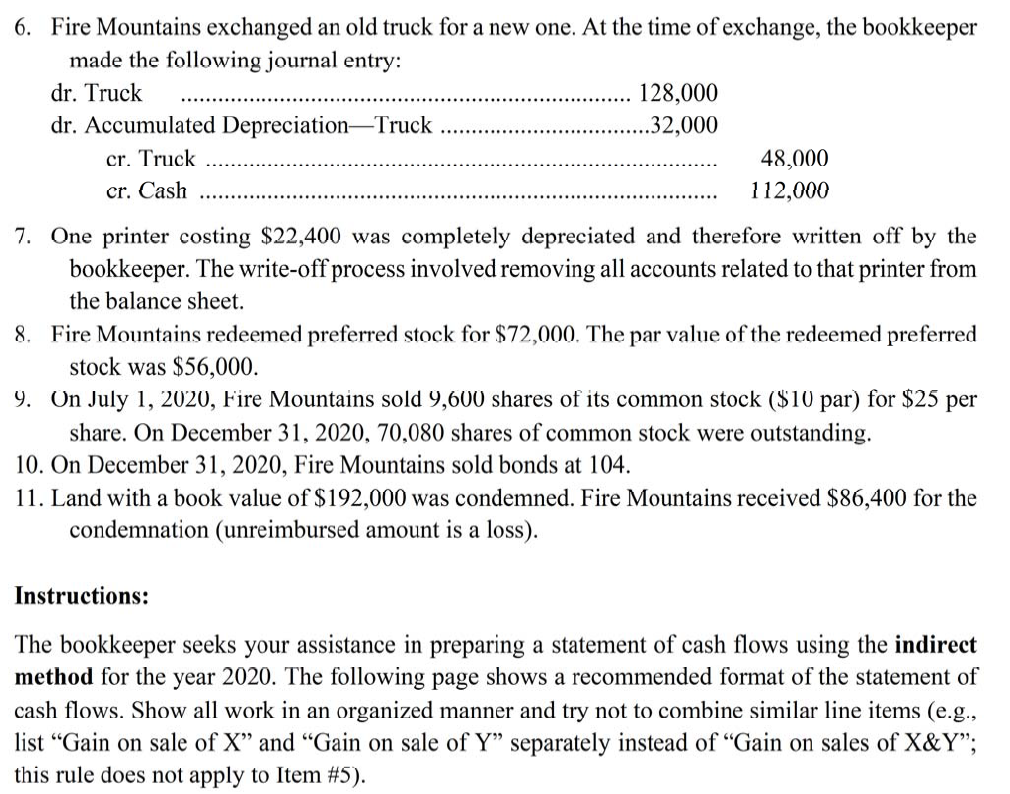

The bookkeeper of Fire Mountains Corp. presents the following permanent accounts in net changes for the year 2020: Credit Debit $80,480 $51,200 8,000 157,760 16,000 115,200 324,000 520,000 80,000 22,400 Account Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Long-term investments Land Buildings Trucks Printers Accumulated depreciation: Buildings Trucks Printers Accounts payable Accrued liabilities Dividends payable Premium on bonds Bonds payable Preferred stock ($50 par) Common stock ($10 par) Additional paid-in capitalcommon Retained earnings 19,200 16,000 9,600 146,560 57,600 102,400 28,800 720,000 56,000 124,800 178,560 53,760 $1,444,160 $1,444,160 The bookkeeper also gives you additional information related to 2020: 1. Net income for 2020 is $128,000. 2. On December 23, 2020, Fire Mountains declared $102,400 of cash dividends, which were paid in January 2021. 3. On February 28, 2020, Fire Mountains issued a five percent stock dividend. The market value then was $22 per share. 4. Fire Mountains sold long-term investments for $112,000. The company did not make any new long-term investments in the current year. 5. Fire Mountains sold a building and land, which cost $384,000 and had a book value of $280,000, for $320,000. The original cost of the land (non-depreciable) was $16,000. 6. Fire Mountains exchanged an old truck for a new one. At the time of exchange, the bookkeeper made the following journal entry: dr. Truck 128,000 dr. Accumulated DepreciationTruck 32,000 48,000 112,000 cr. Truck cr. Cash 7. One printer costing $22,400 was completely depreciated and therefore written off by the bookkeeper. The write-off process involved removing all accounts related to that printer from the balance sheet. 8. Fire Mountains redeemed preferred stock for $72,000. The par value of the redeemed preferred stock was $56,000. 9. On July 1, 2020, Fire Mountains sold 9,600 shares of its common stock ($10 par) for $25 per share. On December 31, 2020, 70,080 shares of common stock were outstanding. 10. On December 31, 2020, Fire Mountains sold bonds at 104. 11. Land with a book value of $192,000 was condemned. Fire Mountains received $86,400 for the condemnation (unreimbursed amount is a loss). Instructions: The bookkeeper seeks your assistance in preparing a statement of cash flows using the indirect method for the year 2020. The following page shows a recommended format of the statement of cash flows. Show all work in an organized manner and try not to combine similar line items (e.g., list Gain on sale of X and Gain on sale of Y separately instead of Gain on sales of X&Y; this rule does not apply to Item #5). The bookkeeper of Fire Mountains Corp. presents the following permanent accounts in net changes for the year 2020: Credit Debit $80,480 $51,200 8,000 157,760 16,000 115,200 324,000 520,000 80,000 22,400 Account Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Long-term investments Land Buildings Trucks Printers Accumulated depreciation: Buildings Trucks Printers Accounts payable Accrued liabilities Dividends payable Premium on bonds Bonds payable Preferred stock ($50 par) Common stock ($10 par) Additional paid-in capitalcommon Retained earnings 19,200 16,000 9,600 146,560 57,600 102,400 28,800 720,000 56,000 124,800 178,560 53,760 $1,444,160 $1,444,160 The bookkeeper also gives you additional information related to 2020: 1. Net income for 2020 is $128,000. 2. On December 23, 2020, Fire Mountains declared $102,400 of cash dividends, which were paid in January 2021. 3. On February 28, 2020, Fire Mountains issued a five percent stock dividend. The market value then was $22 per share. 4. Fire Mountains sold long-term investments for $112,000. The company did not make any new long-term investments in the current year. 5. Fire Mountains sold a building and land, which cost $384,000 and had a book value of $280,000, for $320,000. The original cost of the land (non-depreciable) was $16,000. 6. Fire Mountains exchanged an old truck for a new one. At the time of exchange, the bookkeeper made the following journal entry: dr. Truck 128,000 dr. Accumulated DepreciationTruck 32,000 48,000 112,000 cr. Truck cr. Cash 7. One printer costing $22,400 was completely depreciated and therefore written off by the bookkeeper. The write-off process involved removing all accounts related to that printer from the balance sheet. 8. Fire Mountains redeemed preferred stock for $72,000. The par value of the redeemed preferred stock was $56,000. 9. On July 1, 2020, Fire Mountains sold 9,600 shares of its common stock ($10 par) for $25 per share. On December 31, 2020, 70,080 shares of common stock were outstanding. 10. On December 31, 2020, Fire Mountains sold bonds at 104. 11. Land with a book value of $192,000 was condemned. Fire Mountains received $86,400 for the condemnation (unreimbursed amount is a loss). Instructions: The bookkeeper seeks your assistance in preparing a statement of cash flows using the indirect method for the year 2020. The following page shows a recommended format of the statement of cash flows. Show all work in an organized manner and try not to combine similar line items (e.g., list Gain on sale of X and Gain on sale of Y separately instead of Gain on sales of X&Y; this rule does not apply to Item #5)