Answered step by step

Verified Expert Solution

Question

1 Approved Answer

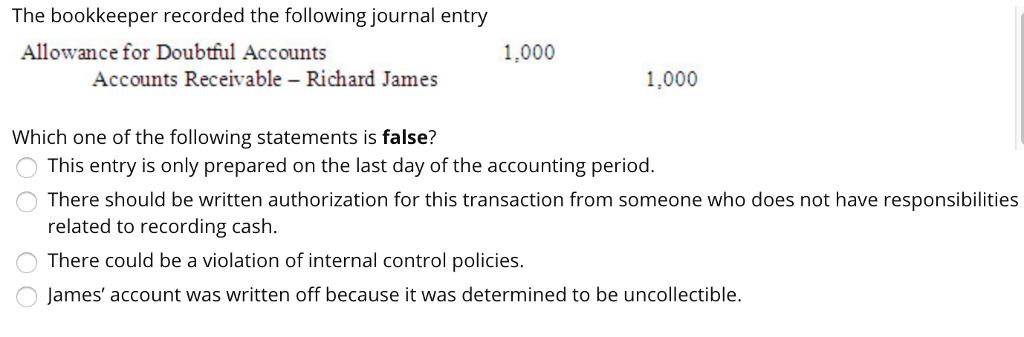

The bookkeeper recorded the following journal entry Allowance for Doubtful Accounts Accounts Receivable - Richard James 1,000 1,000 Which one of the following statements

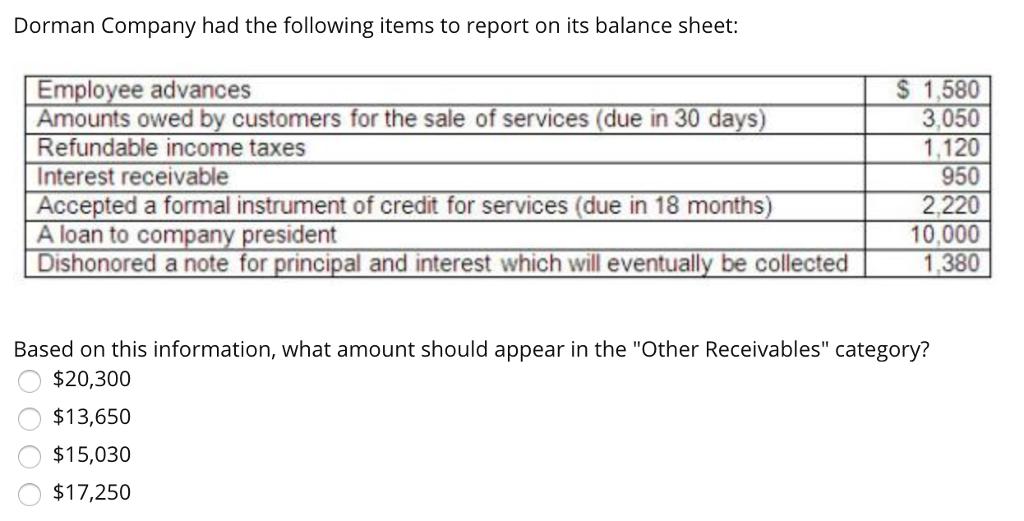

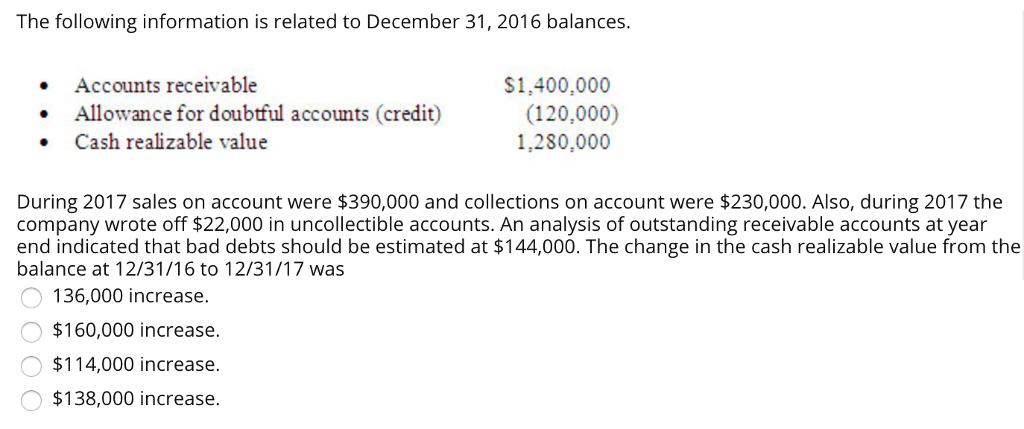

The bookkeeper recorded the following journal entry Allowance for Doubtful Accounts Accounts Receivable - Richard James 1,000 1,000 Which one of the following statements is false? This entry is only prepared on the last day of the accounting period. There should be written authorization for this transaction from someone who does not have responsibilities related to recording cash. There could be a violation of internal control policies. James' account was written off because it was determined to be uncollectible. Dorman Company had the following items to report on its balance sheet: Employee advances Amounts owed by customers for the sale of services (due in 30 days) Refundable income taxes Interest receivable Accepted a formal instrument of credit for services (due in 18 months) A loan to company president Dishonored a note for principal and interest which will eventually be collected $ 1,580 3,050 1,120 950 2,220 10,000 1,380 Based on this information, what amount should appear in the "Other Receivables" category? $20,300 $13,650 $15,030 $17,250 The following information is related to December 31, 2016 balances. Accounts receivable Allowance for doubtful accounts (credit) Cash realizable value $1,400,000 (120,000) 1,280,000 During 2017 sales on account were $390,000 and collections on account were $230,000. Also, during 2017 the company wrote off $22,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $144,000. The change in the cash realizable value from the balance at 12/31/16 to 12/31/17 was 136,000 increase. $160,000 increase. $114,000 increase. $138,000 increase.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Allowance for doubtful accounts Allowance for doubtful accounts is a type of contraasset account I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started