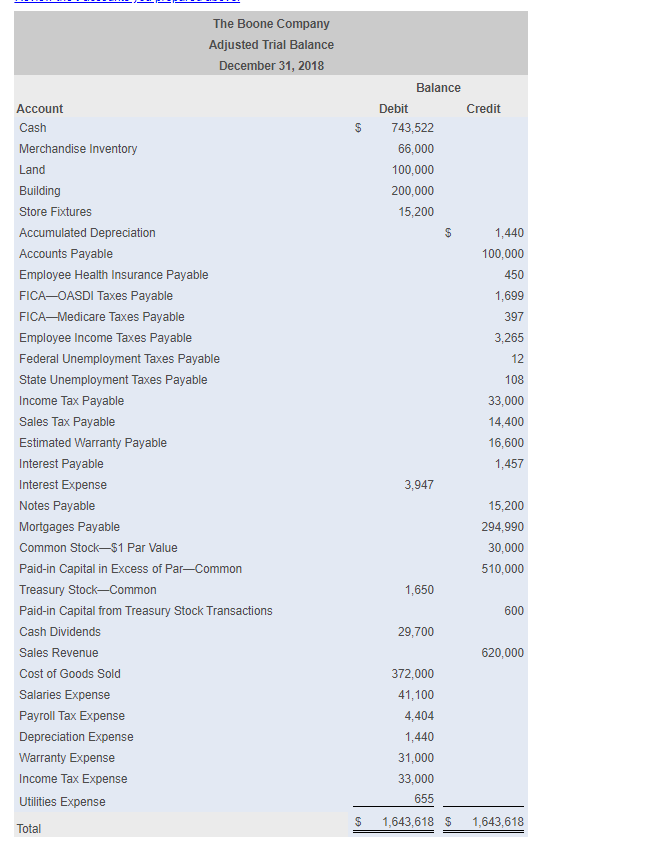

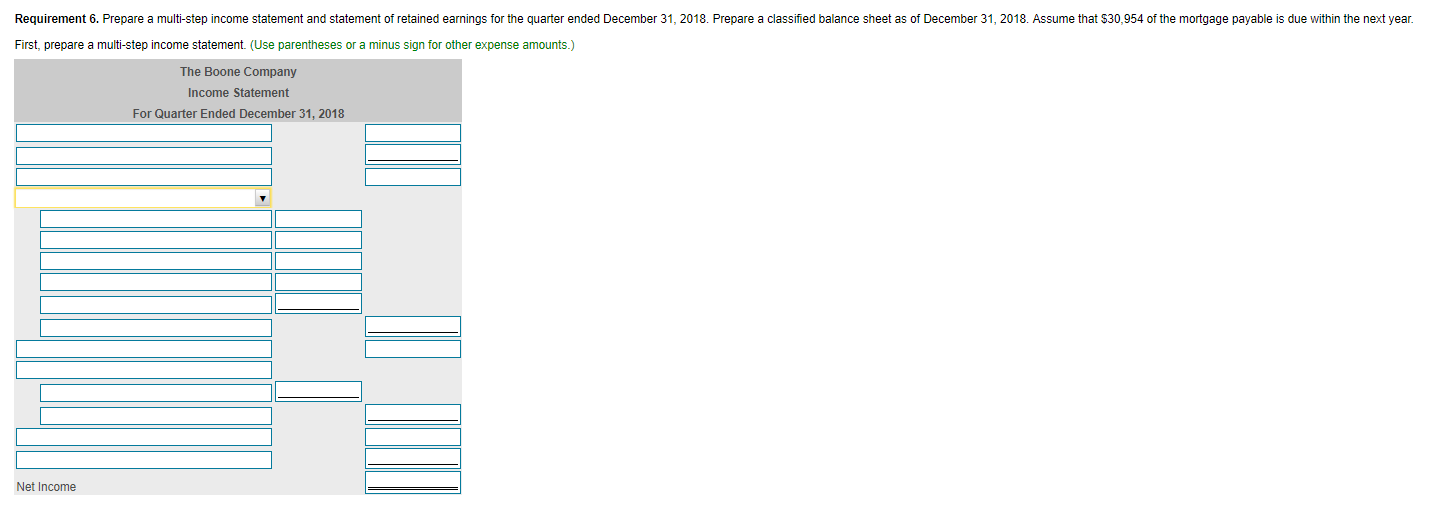

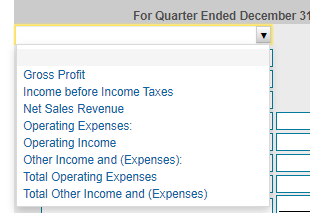

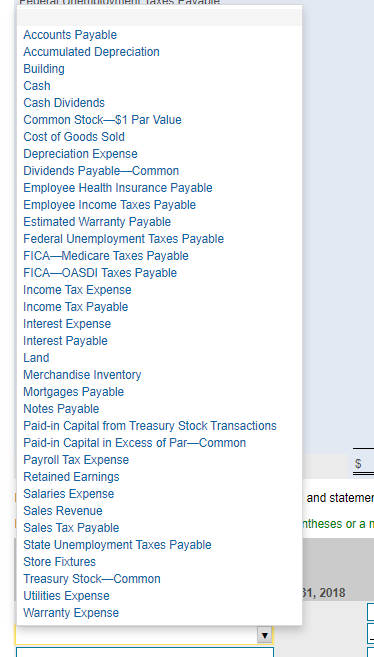

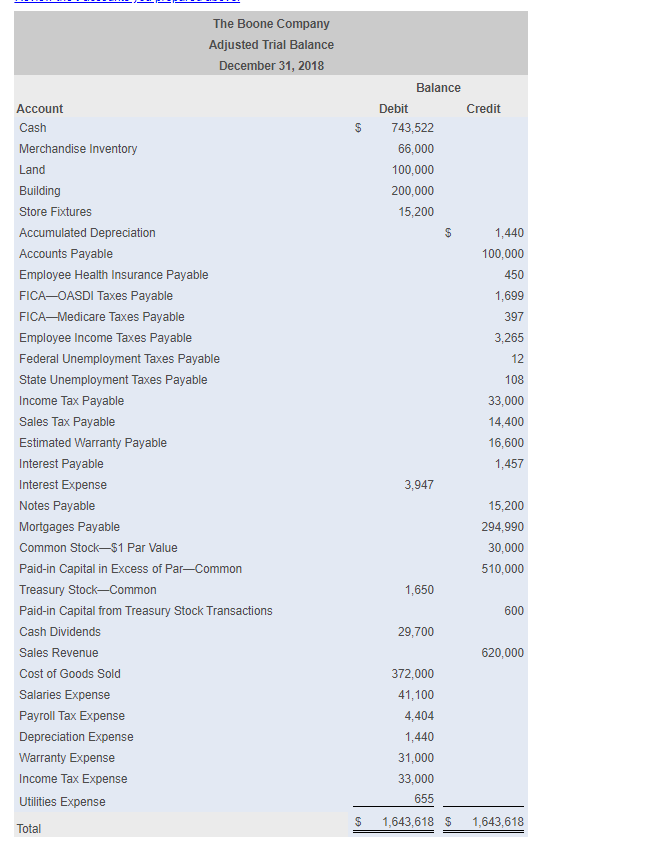

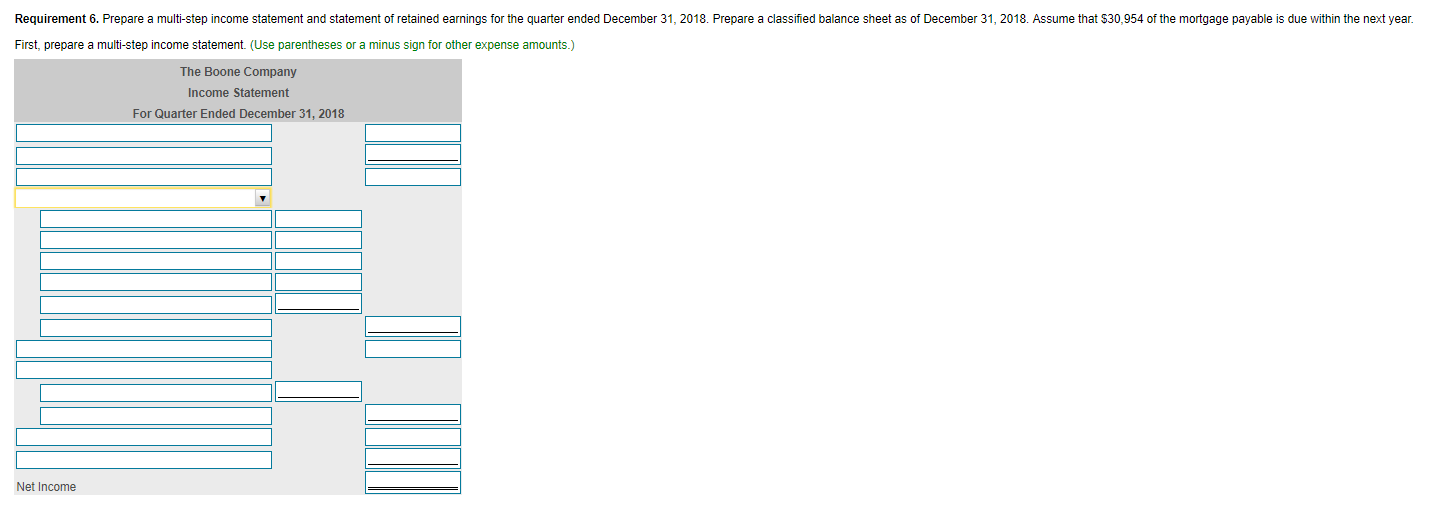

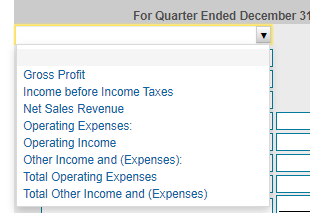

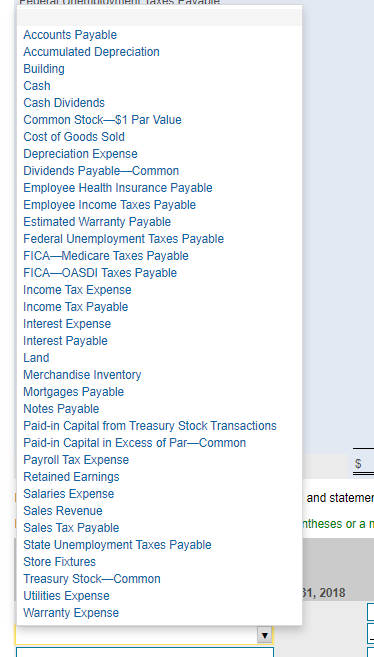

The Boone Company Adjusted Trial Balance December 31, 2018 Credit $ Balance Debit 743,522 66,000 100,000 200,000 15,200 $ Account Cash Merchandise Inventory Land Building Store Fixtures Accumulated Depreciation Accounts Payable Employee Health Insurance Payable FICAOASDI Taxes Payable FICAMedicare Taxes Payable Employee Income Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Income Tax Payable Sales Tax Payable Estimated Warranty Payable Interest Payable Interest Expense Notes Payable Mortgages Payable Common Stock51 Par Value Paid-in Capital in Excess of ParCommon Treasury Stock-Common Paid-in Capital from Treasury Stock Transactions Cash Dividends Sales Revenue Cost of Goods Sold Salaries Expense Payroll Tax Expense Depreciation Expense Warranty Expense Income Tax Expense Utilities Expense 1,440 100,000 450 1,699 397 3,265 12 108 33,000 14,400 16,600 1,457 3,947 15,200 294,990 30,000 510,000 1,650 600 29,700 620,000 372,000 41,100 4,404 1,440 31,000 33,000 655 $ 1,643,618 $ 1,643,618 Total Requirement 6. Prepare a multi-step income statement and statement of retained earnings for the quarter ended December 31, 2018. Prepare a classified balance sheet as of December 31, 2018. Assume that $30,954 of the mortgage payable is due within the next year. First, prepare a multi-step income statement. (Use parentheses or a minus sign for other expense amounts.) The Boone Company Income Statement For Quarter Ended December 31, 2018 V Net Income For Quarter Ended December 31 Gross Profit Income before Income Taxes Net Sales Revenue Operating Expenses: Operating Income Other Income and (Expenses): Total Operating Expenses Total Other Income and (Expenses) Accounts Payable Accumulated Depreciation Building Cash Cash Dividends Common Stock-$1 Par Value Cost of Goods Sold Depreciation Expense Dividends Payable-Common Employee Health Insurance Payable Employee Income Taxes Payable Estimated Warranty Payable Federal Unemployment Taxes Payable FICAMedicare Taxes Payable FICAOASDI Taxes Payable Income Tax Expense Income Tax Payable Interest Expense Interest Payable Land Merchandise Inventory Mortgages Payable Notes Payable Paid-in Capital from Treasury Stock Transactions Paid-in Capital in Excess of ParCommon Payroll Tax Expense Retained Earnings Salaries Expense Sales Revenue Sales Tax Payable State Unemployment Taxes Payable Store Fixtures Treasury Stock-Common Utilities Expense Warranty Expense and statemer ntheses or a 31, 2018 LLUL