Alberta's Boot division is located in a country with a corporate tax of 10% and the Sole division of Alberta Company is located in a

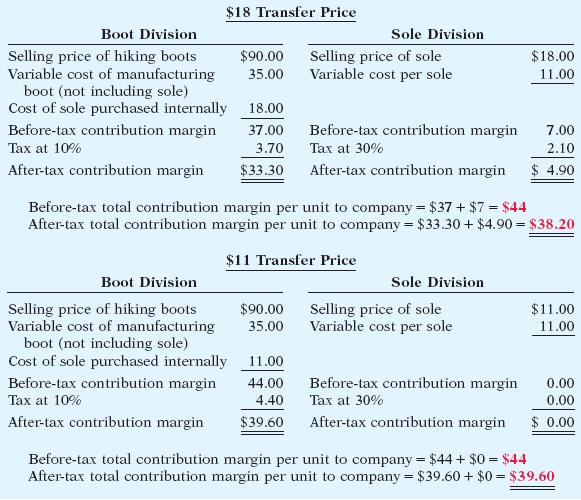

Alberta's Boot division is located in a country with a corporate tax of 10% and the Sole division of Alberta Company is located in a country with a tax rate of 30%. What conclusion can you make after analyzing the data in Figure 8b-1? There, the tax margins of a company are compared using a transfer price per unit of $18.00 versus a transfer price per unit of $11.00 (Weygandt, Kimmel, & Kieso, 2015, p. 337).

$18 Transfer Price Boot Division Sole Division Selling price of hiking boots Variable cost of manufacturing boot (not including sole) Cost of sole purchased internally $90.00 Selling price of sole Variable cost per sole $18.00 35.00 11.00 18.00 Before-tax contribution margin 37.00 Before-tax contribution margin 7.00 Tax at 10% 3.70 Tax at 30% 2.10 After-tax contribution margin $33.30 After-tax contribution margin $ 4.90 Before-tax total contribution margin per unit to company = $37 + $7 = $44 After-tax total contribution margin per unit to company = $33.30 + $4.90 = $38.20 $11 Transfer Price Boot Division Sole Division Selling price of hiking boots Variable cost of manufacturing boot (not including sole) Cost of sole purchased internally Before-tax contribution margin $90.00 Selling price of sole 35.00 $11.00 Variable cost per sole 11.00 11.00 44.00 Before-tax contribution margin 0.00 Tax at 10% 4.40 Tax at 30% 0.00 After-tax contribution margin $39.60 After-tax contribution margin $ 0.00 Before-tax total contribution margin per unit to company = $44 + $0 = $44 After-tax total contribution margin per unit to company = $39.60 + $0 = $39.60 %3D

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

After analyzing the data in Figure 8b1 we conclude this Before tax total ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started