Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The both MCQ are from finance . Please answer Each one with explanation . Up vote will be given for sure if answered both will

The both MCQ are from finance . Please answer Each one with explanation . Up vote will be given for sure if answered both will good and correct explanation .

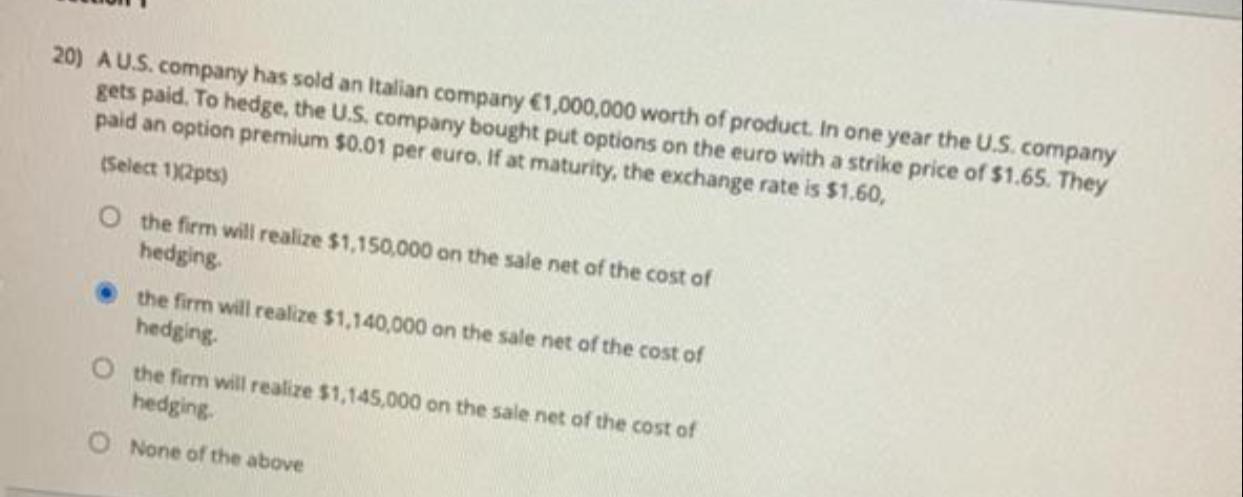

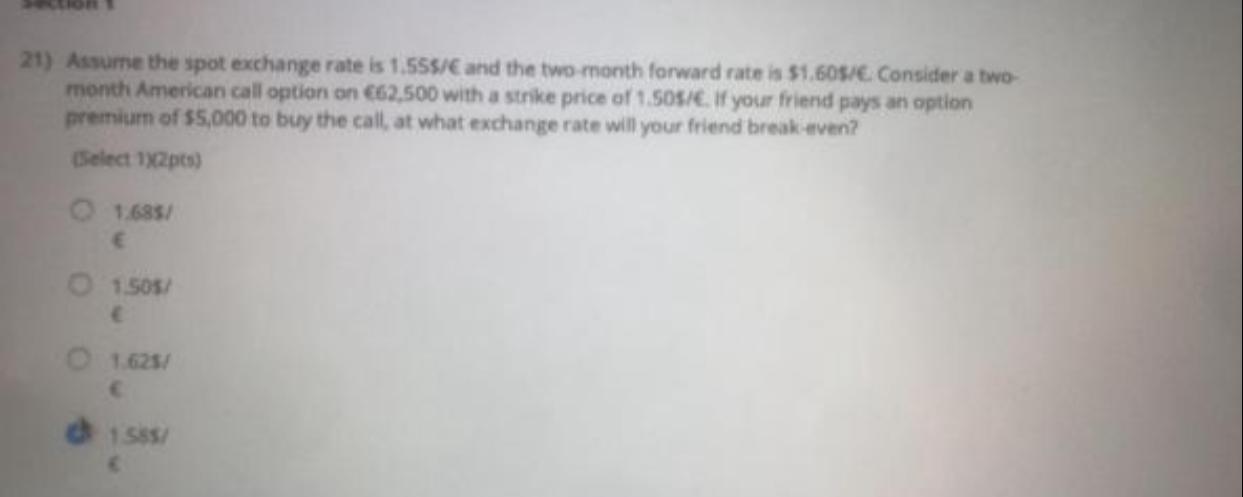

20) AU.S.company has sold an Italian company 1,000,000 worth of product. In one year the U.S.company gets paid. To hedge, the U.S. company bought put options on the euro with a strike price of $1.65. They paid an option premium $0.01 per euro. If at maturity, the exchange rate is $1.60, Select 1)(2pes) O the firm will realize $1,150,000 on the sale net of the cost of hedging . the firm will realize 51,140,000 on the sale net of the cost of hedging. o the firm will realize $1,145,000 on the sale net of the cost of hedging O None of the above 21) Assume the spot exchange rate is 1.5551 and the two month forward rate is $1.605/6. Consider a two month American call option on 62,500 with a strike price of 1 SOS/. If your friend pays an option premium of $5,000 to buy the call at what exchange rate will your friend break-even? Select 12pts) 1.6851 E 1.50$ 1.625/ d1555Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started