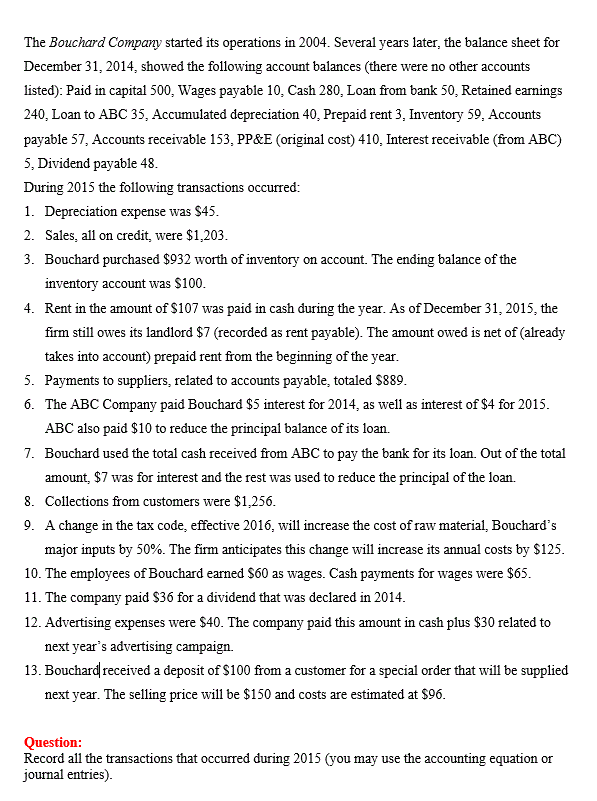

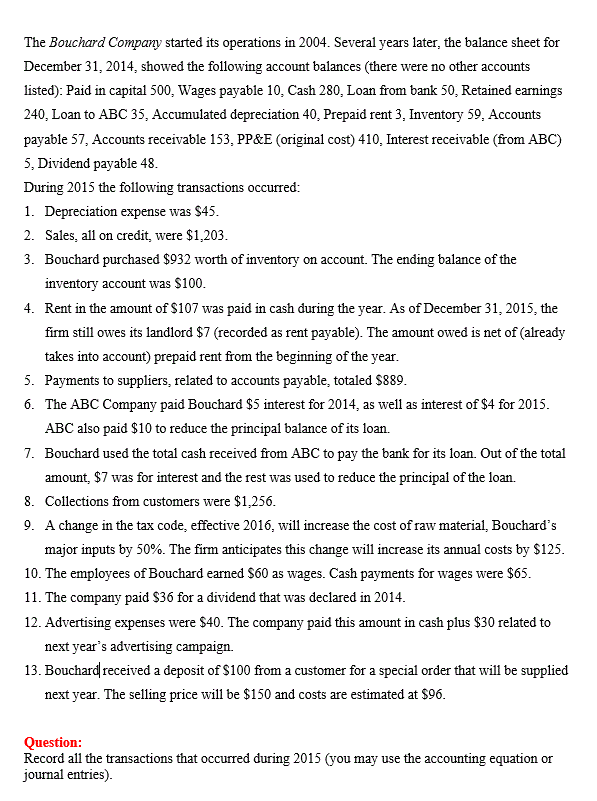

The Bouchard Company started its operations in 2004. Several years later, the balance sheet for December 31, 2014, showed the following account balances (there were no other accounts listed): Paid in capital 500, Wages payable 10. Cash 280, Loan from bank 50, Retained earnings 240, Loan to ABC 35, Accumulated depreciation 40. Prepaid rent 3. Inventory 59, Accounts payable 57, Accounts receivable 153. PP&E (original cost) 410. Interest receivable (from ABC) 5. Dividend payable 48. During 2015 the following transactions occurred: 1. Depreciation expense was $45. 2. Sales, all on credit, were $1,203. 3. Bouchard purchased $932 worth of inventory on account. The ending balance of the inventory account was $100. 4. Rent in the amount of $107 was paid in cash during the year. As of December 31, 2015, the firm still owes its landlord $7 (recorded as rent payable). The amount owed is net of (already takes into account) prepaid rent from the beginning of the year. 5. Payments to suppliers, related to accounts payable, totaled $889. 6. The ABC Company paid Bouchard $5 interest for 2014, as well as interest of $4 for 2015. ABC also paid $10 to reduce the principal balance of its loan. 7. Bouchard used the total cash received from ABC to pay the bank for its loan. Out of the total amount, $7 was for interest and the rest was used to reduce the principal of the loan. 8. Collections from customers were $1,256. 9. A change in the tax code, effective 2016, will increase the cost of raw material, Bouchard's major inputs by 50%. The firm anticipates this change will increase its annual costs by $125. 10. The employees of Bouchard earned $60 as wages. Cash payments for wages were $65. 11. The company paid $36 for a dividend that was declared in 2014. 12. Advertising expenses were $40. The company paid this amount in cash plus $30 related to next year's advertising campaign. 13. Bouchard received a deposit of $100 from a customer for a special order that will be supplied next year. The selling price will be $150 and costs are estimated at $96. Question: Record all the transactions that occurred during 2015 (you may use the accounting equation or journal entries)