Answered step by step

Verified Expert Solution

Question

1 Approved Answer

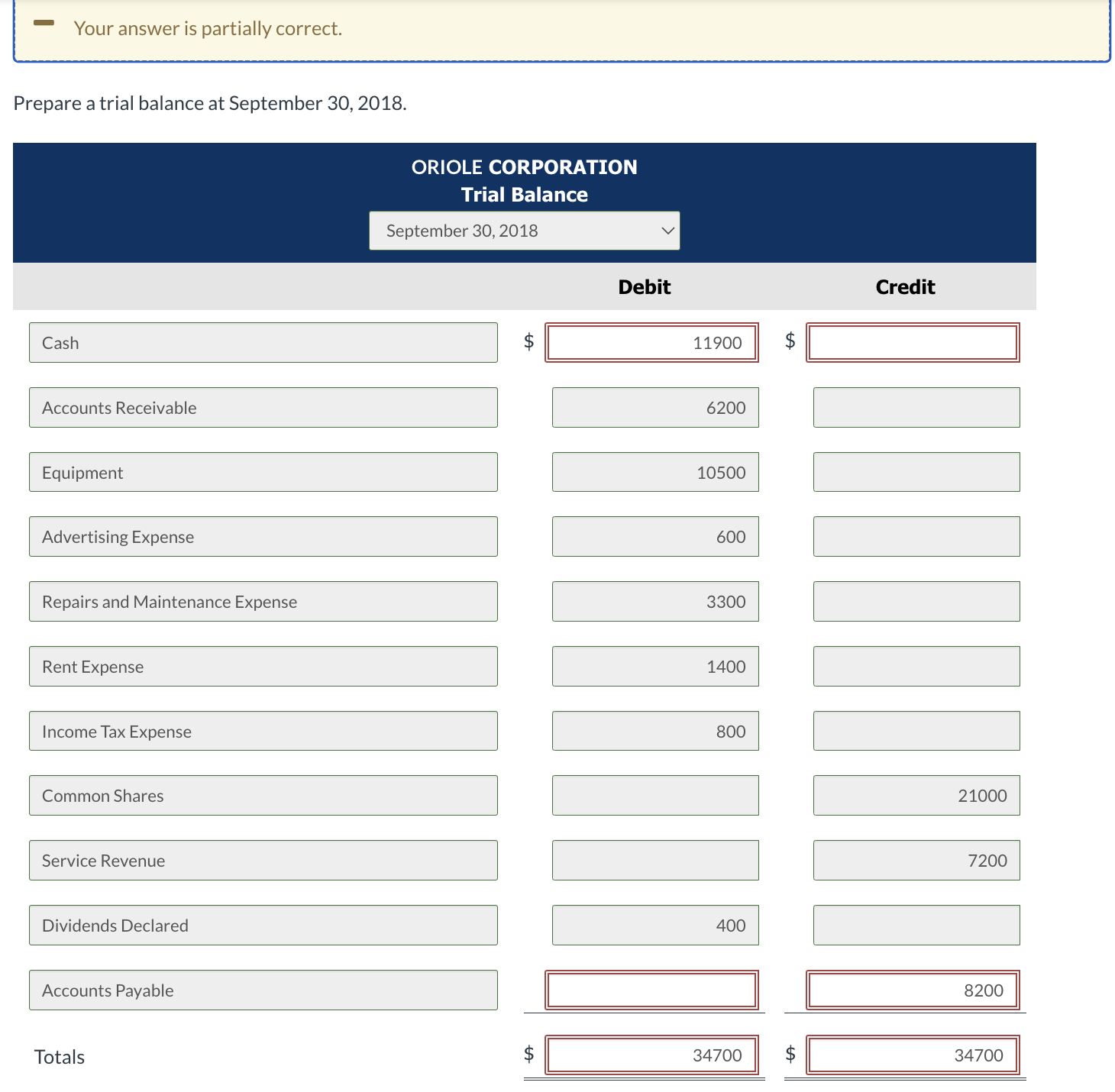

The boxes in red are wrong . If the box is empty and wrong, then it cannot be left empty and requires an answer (not

The boxes in red are wrong. If the box is empty and wrong, then it cannot be left empty and requires an answer (not 0).

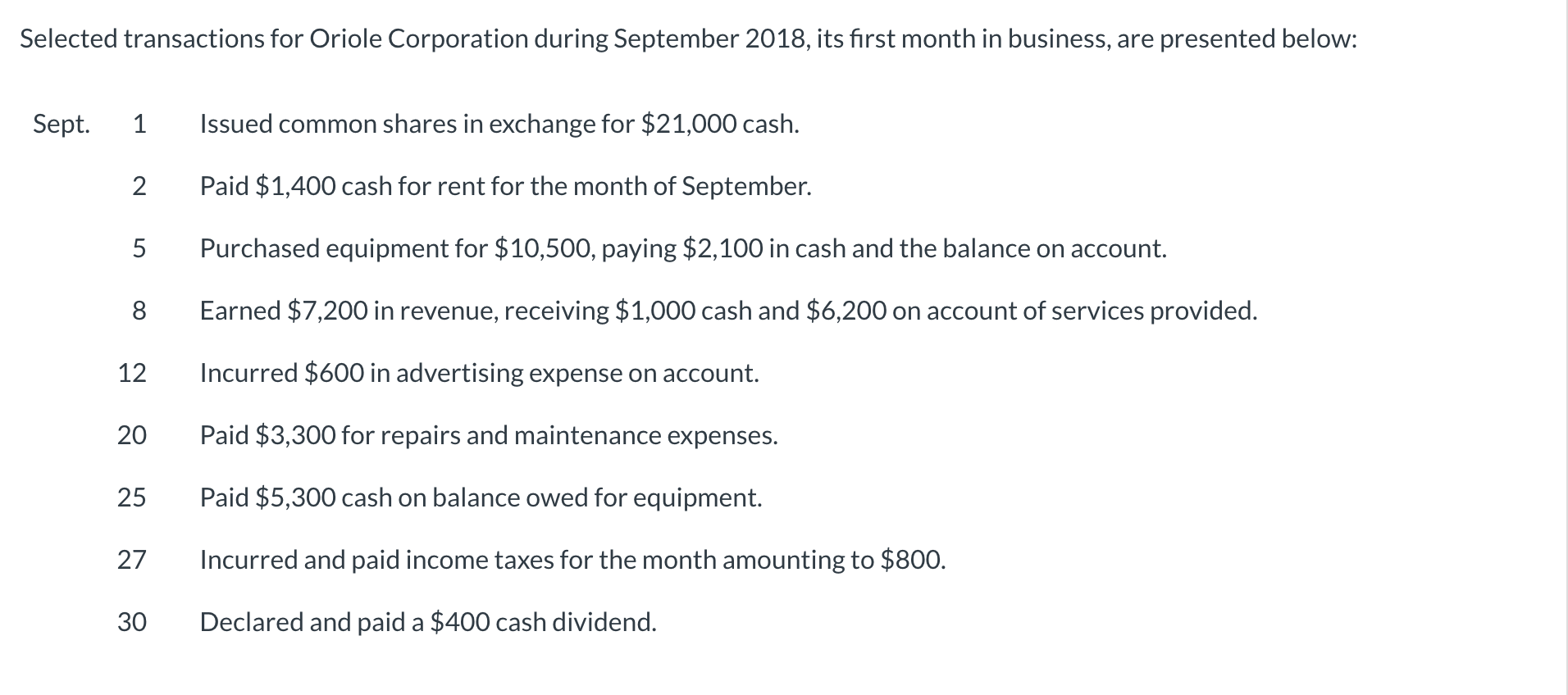

Selected transactions for Oriole Corporation during September 2018, its first month in business, are presented below: Sept. 1 Issued common shares in exchange for $21,000 cash. 2 Paid $1,400 cash for rent for the month of September. 5 Purchased equipment for $10,500, paying $2,100 in cash and the balance on account. 8 Earned $7,200 in revenue, receiving $1,000 cash and $6,200 on account of services provided. 12 Incurred $600 in advertising expense on account. 20 Paid $3,300 for repairs and maintenance expenses. 25 Paid $5,300 cash on balance owed for equipment. 27 Incurred and paid income taxes for the month amounting to $800. 30 Declared and paid a $400 cash dividend. Your answer is partially correct. Prepare a trial balance at September 30, 2018. ORIOLE CORPORATION Trial Balance September 30, 2018 Cash Common Shares Service Revenue Dividends Declared Accounts Payable Totals Credit $ 400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started