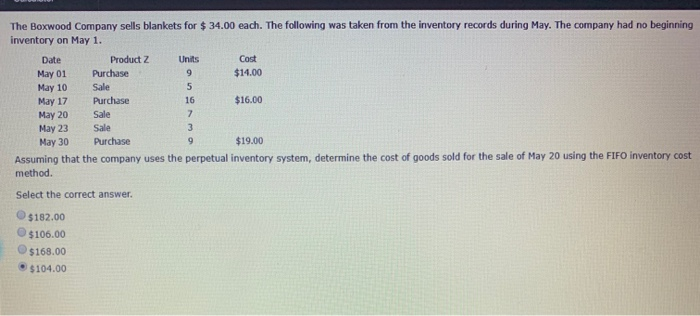

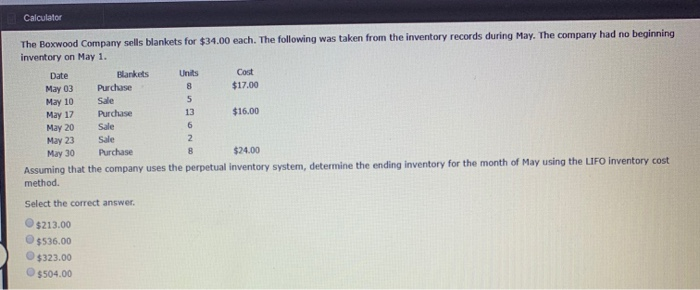

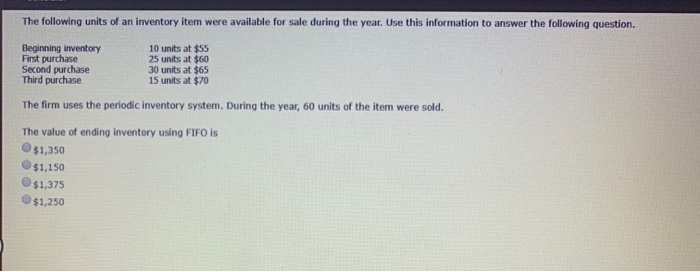

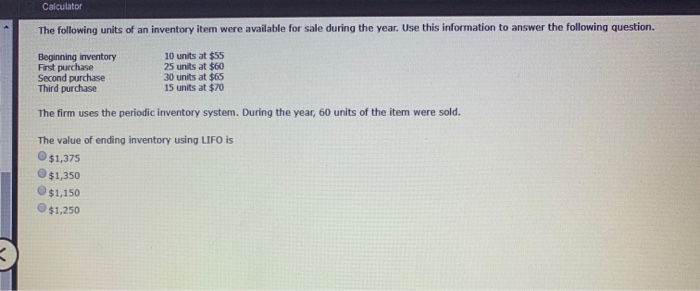

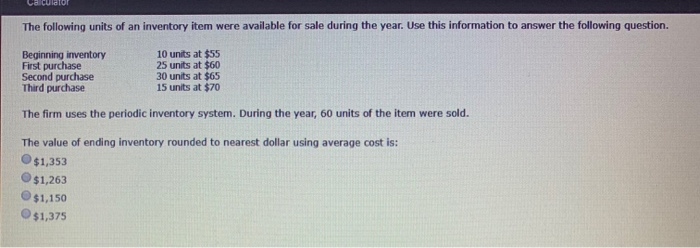

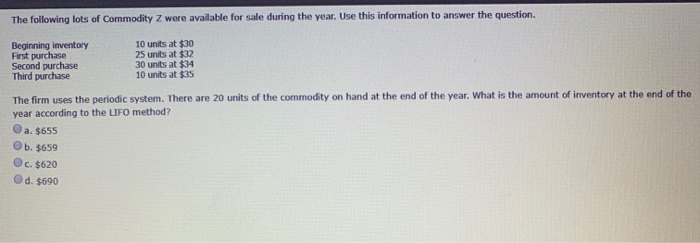

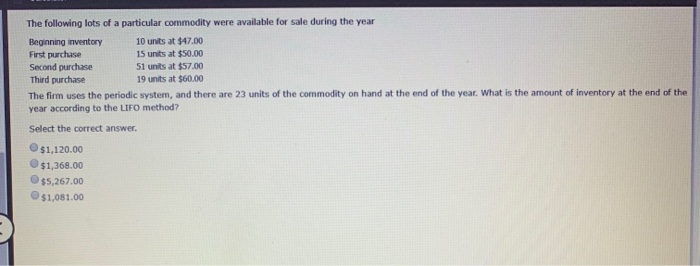

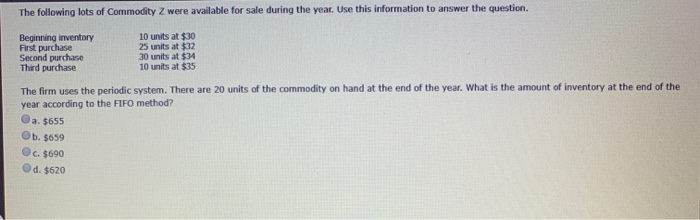

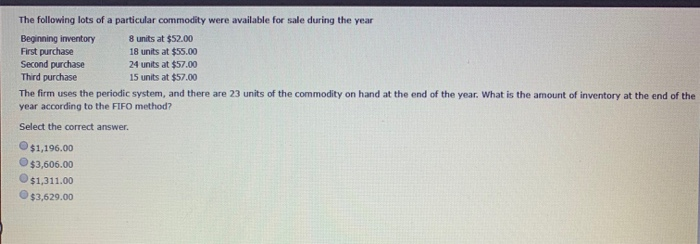

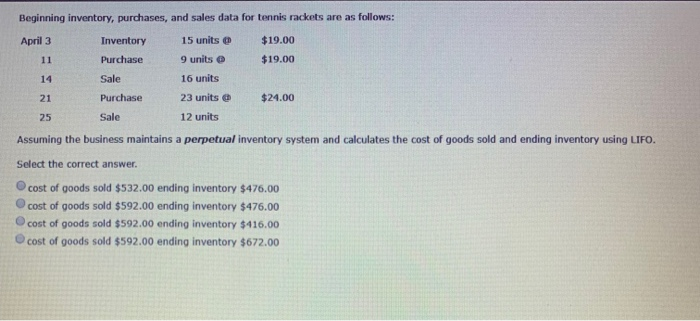

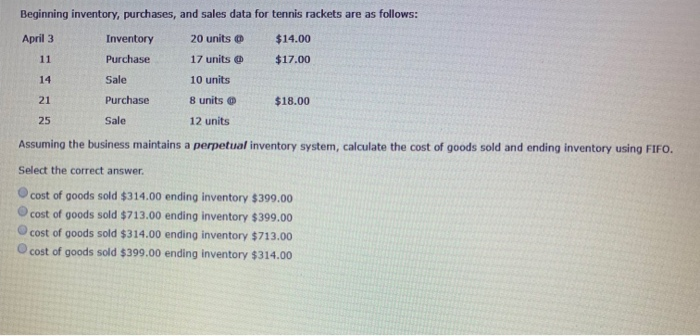

The Boxwood Company sells blankets for $34.00 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date May 01 Purchase May 10 Sale May 17 Purchase May 20 Sale May 23 Sale May 30 Purchase Product Z Cost $14.00 Units 16 $16.00 19.00 Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the FIFO inventory cost method. Select the correct answer $182.00 $106.00 $168.00 $104.00 Calculator The Boxwood Company sells blankets for $34.00 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Cost $17.00 BlanketsUnits Date May 03 Purchase May 10 Sale May 17 Purchase May 20 Sale May 23 Sale May 30 Purchase 13 $16.00 $24.00 Assuming that the company uses the perpetual inventory system, determine the ending inventory for the month of May using the LFO inventory cost method. Select the correct answer $213.00 $536.00 $323.00 $504.00 Calculator The following units of an inventory item were available for sale during the year. Use this information to answer the following question. Beginning inventory First purchase Second purchase Third purchase 10 units at $55 25 units at $60 30 units at $65 15 units at $70 The firm uses the periodic inventory system. During the year, 60 units of the item were sold. The value of ending inventory using LIFO is $1,375 O$1,350 $1,150 $1,250 The following lots of Commodity Z were available for sale during the year. Use this information to answer the question. Beginning inventory First purchase Second purchase Third purchase 10 units at $30 25 units at $32 30 units at $34 10 units at $35 The firm uses the periodic system. There are 20 units of the commodity on hand at the end of the year. What is the amount of inventory at the end of the year according to the LIFO method? . $655 O b. $659 . $620 Od. S690 The following lots of Commodity Z were available for sale during the year. Use this information to answer the question. Beginning inventory First purchase Second purchase Third purchase 10 units at $30 25 units at $32 30 units at $34 10 units at $35 The firm uses the periodic system. There are 20 units of the commodity on hand at the end of the year. What is the amount of inventory at the end of the year according to the FIFO method? oa. S655 Ob. $659 . $690 od, $620 The following lots of a particular commodity were available for sale during the year Beginning inventory First purchase Second purchase Third purchase 8 units at $52.00 18 units at $55.00 24 units at $57.00 15 units at $57.00 The firm uses the periodic system, and there are 23 units of the commodity on hand at the end of the year. What is the amount of inventory at the end of the year according to the FIFO method? Select the correct answer. O$1,196.00 $3,606.00 O$1,311.00 $3,629.00 Beginning inventory, purchases, and sales data for tennis rackets are as follows: 15 units $19.00 9 units 16 units 23 units e $24.00 12 units April 3 Inventory Purchase Sale Purchase Sale $19.00 14 21 25 Assuming the business maintains a perpetual inventory system and calculates the cost of goods sold and ending inventory using LIFO. Select the correct answer cost of goods sold $532.00 ending inventory $476.00 cost of goods sold $592.00 ending inventory $476.00 O cost of goods sold $592.00 ending inventory $416.00 Ocost of goods sold $592.00 ending inventory $672.00 Beginning inventory, purchases, and sales data for tennis rackets are as follows: Inventory 20 units Purchase Sale Purchase Sale April 3 $14.00 17 units 10 units 8 units 12 units $17.00 14 21 25 $18.00 Assuming the business maintains a perpetual inventory system, calculate the cost of goods sold and ending inventory using FIFO. Select the correct answer. cost of goods sold $314.00 ending inventory $399.00 cost of goods sold $713.00 ending inventory $399.00 cost of goods sold $314.00 ending inventory $713.00 Ocost of goods sold $399.00 ending inventory $314.00