Answered step by step

Verified Expert Solution

Question

1 Approved Answer

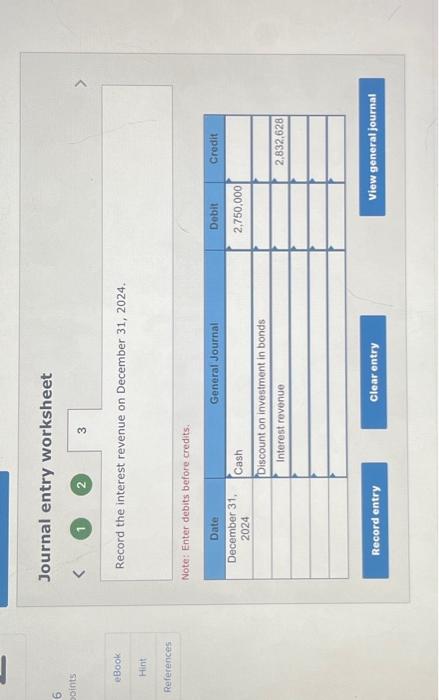

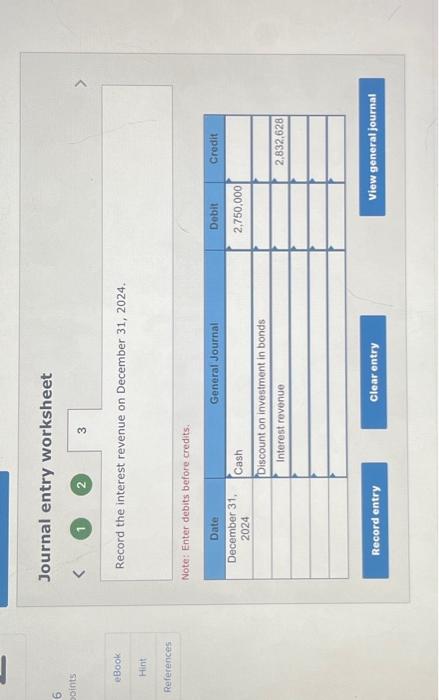

The Bradford company issued 11% bonds dated January 1 with a face amount of 50 million on January 1, 2024 to Saxton-Bose corporation - The

The Bradford company issued 11% bonds dated January 1 with a face amount of 50 million on January 1, 2024 to Saxton-Bose corporation

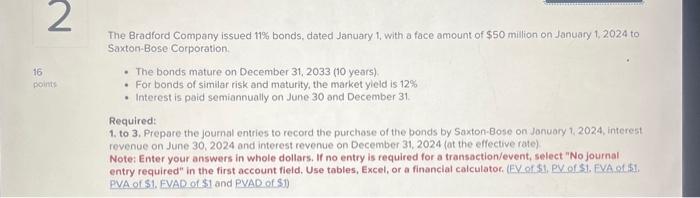

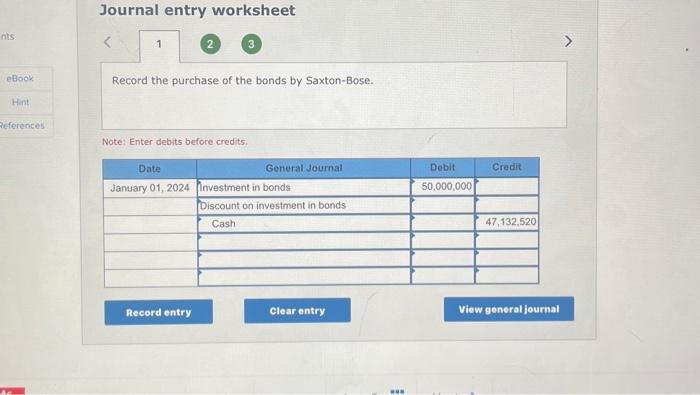

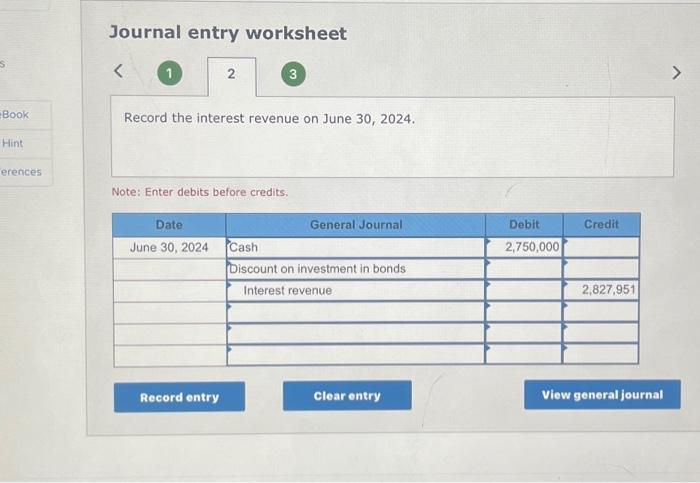

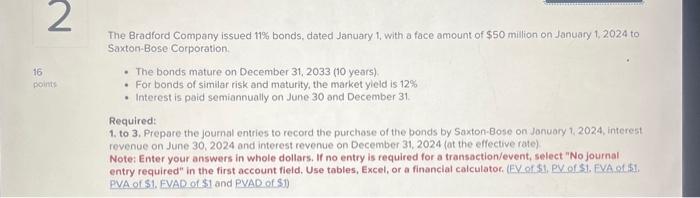

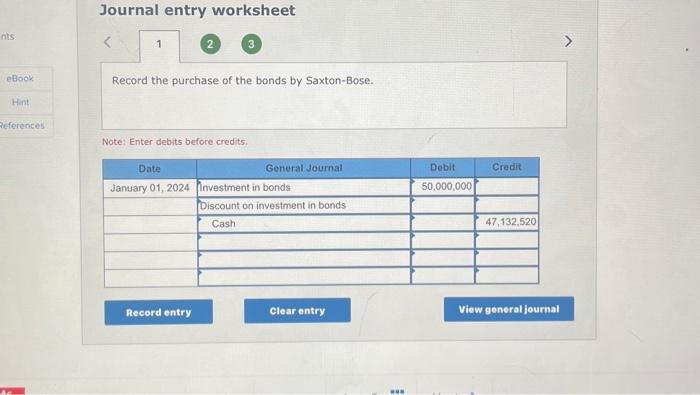

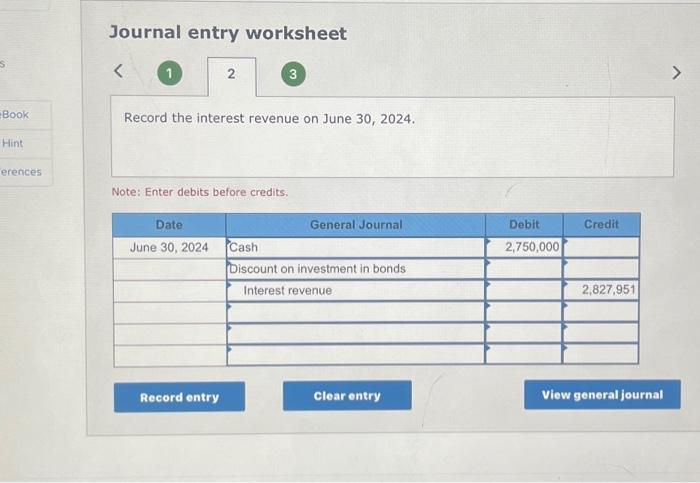

Journal entry worksheet Record the interest revenue on June 30, 2024. Note: Enter debits before credits. Journal entry worksheet 1) 2 Note: Enter debits before credits. Journal entry worksheet 3 Record the purchase of the bonds by Saxton-Bose. Note: Enter debits before credits. The Bradford Company issued \11 bonds, dated January 1 , with a face amount of \\( \\$ 50 \\) milion on January 1,2024 to Saxton-Bose Corporation. - The bonds mature on December 31,2033 (10 years) - For bonds of similar risk and maturity, the market yield is \12 - Interest is paid semiannually on June 30 and December 31. Required: 1. to 3. Prepare the joumal entries to record the purchase of the bonds by Saxton-Bose on Jonuary 1,2024, interest revenue on June 30, 2024 and interest revenue on December 31, 2024 (at the effective rate) Note: Enter your answers in whole dollars. If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field. Use tables, Excel, or a financial calculator. (FV of S1, PV of S1. FVA of S1 - The bonds mature on December 31, 2033 (10 years)

- for bonds of similar risk and maturity, the market yield is 12%

- interest is paid semi annually on June 30 and December 31

1 to 3. Prepare the journal entries to record the purchase of the bonds by Saxton boss on January 1, 2024, interest revenue on June 30, 2024 and interest revenue on December 31, 2024 at the effective rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started