Question: The Brady & Matthew Camera Company has just come out with their newest professional quality digital camera, the ToughPix1. The company is selling this

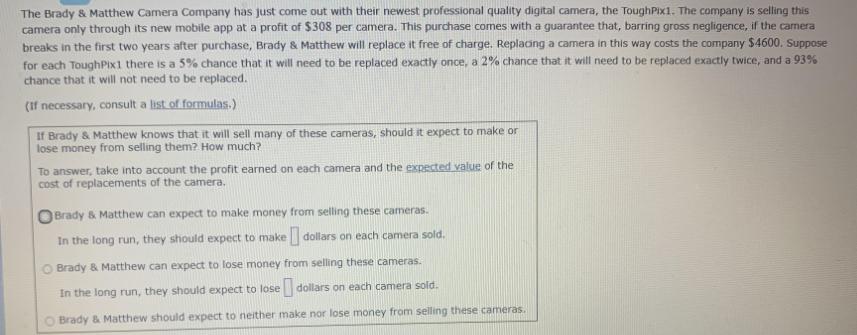

The Brady & Matthew Camera Company has just come out with their newest professional quality digital camera, the ToughPix1. The company is selling this camera only through its new mobile app at a profit of $308 per camera. This purchase comes with a guarantee that, barring gross negligence, if the camera breaks in the first two years after purchase, Brady & Matthew will replace it free of charge. Replacing a camera in this way costs the company $4600. suppose for each ToughPix1 there is a 5% chance that it will need to be replaced exactly once, a 2% chance that it will need to be replaced exactly twice, and a 93% chance that it will not need to be replaced. (If necessary, consult a list of formulas.) If Brady & Matthew knows that it will sell many of these cameras, should it expect to make or lose money from selling them? How much? To answer, take into account the profit earned on each camera and the expected value of the cost of replacements of the camera. Brady & Matthew can expect to make money from selling these cameras. dollars on each camera sold. In the long run, they should expect to make Brady & Matthew can expect to lose money from selling these cameras. In the long run, they should expect to lose dollars on each camera sold. Brady & Matthew should expect to neither make nor lose money from selling these cameras.

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts