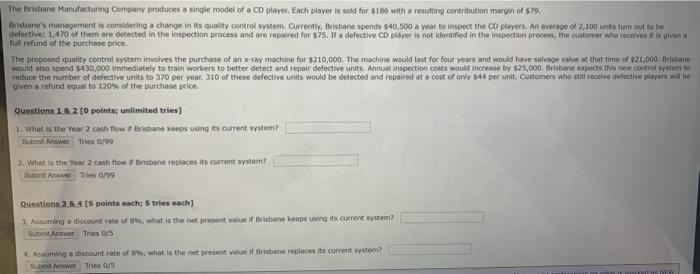

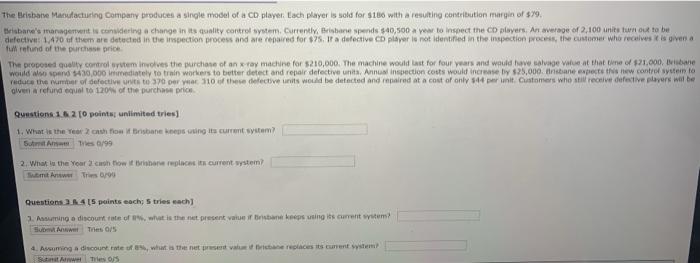

The Brebane Manufacturing Company produces a single model of a CD player. Each player is sold for 186 with a resulting contribution margin of $79. Brisbane's management is considering a change in its quality control system. Currently, Brisbane spends $40,500 a year to inspect the CD players. An average of 2.100 units turn out to be defective: 1.470 of them are detected in the inspection process and are repaired for $75. If a defective CD player is not identified in the inspection process, the customer who receives it is full refund of the purchase price The proposed quality control system involves the purchase of an x-ray machine for $210,000. The machine would last for four years and would have salvage Vahe at that time of 121.000 Brisbane would also spend $430,000 immediately to train workers to better detect and repair defective units. Annual inspection costs would increase by $25,000. Brisbane expects the new control system to reduce the number of defective units to 370 per year: 310 of these defective units would be detected and repaired at a cost of only $44 per unit. Customers who still receive defective players will be Diven a refund equal to 120% of the purchase price Questions 12 to points; unlimited tries) 1. What is the Year 2 cash flow if Brisbane keeps using its current wstem? Schmid AnswerTres 0/90 2. What is the Year 2 cash flow i Brisbane replaces its current system But Aww Tries 0,99 Questions. 24 points each tries each) 2. Anning a discount rate of 8%, what is the present value if Brisbane koepe using is current system? SA Tries 0/5 4. Assuming a discount rate of what is the net present value of Brisbane replaces its current system? Su Are Ties 0/5 The Brisbane Macudacturing Company produces a single model of a CD player. Each player is sold for $100 with a resulting contribution margin of $79. Brisbane's management is considering a change in its quality control system. Currently, Brane spends 540,500 a year to inspect the CD players. An average of 2.100 units turn out to be defective: 1.470 of them are detected in the inspection process and are repaired for $75. If a defective CD player is not identified in the inspection process, the customer who receives is given a full refund of the purchase price The proposed quality control stem involves the purchase of an x-ray machine for $210,000. The machine would last for four years and would have salge value at that time of $21.000, visbane would also spend 430,000 inmediately to train workers to better detect and repair defective units Annual inspection costs would increase by $25,000. Ansbane expects this mw control system to reduce the number of defective units to 370 per via 10 of these defective units would be detected and repaired at a cost of only 544 per unit. Customers who stilective defective players will be given a refund equal to 120% of the purchase price Questions 1.6 2 0 points unlimited tries) 1. What is the Year cathton Brisbane keeps using its current system SA Tres 0/99 2. What the your contowane replace its current system Sumt Antwer The 690 Questions AS prints each tries each 1. Auming a discount rate of what is the present value is kepting its current wstem? Subww Ties 0/5 4. Assuming a discount rate of what is the new value is replaces its current system Swel Tiles ois