Question

The brilliant entrepreneur from class is considering a different one-year project. The project requires an initial investment of $6,000 & the project's expected cash flows

The brilliant entrepreneur from class is considering a different one-year project. The project requires an initial investment of $6,000 & the project's expected cash flows in one year are $11,000. The cost of capital is 10%. The entrepreneur will invest $1,500 of her own money and raise the remaining funds by issuing equity.

Assume that she will issue a total of 1,000 shares, sell some to the "outside" investors and retain the rest of the shares. E.g., if she sells 600 shares, then she will retain 400. This means that the entrepreneur sells 600/1,000= 60% of the firm, retains 400/1,000 = 40% of the firm, and that she will receive 40% of the next year's cash flows.

The entrepreneur's goal is to maximize her expected profits. She does not wish to "cash out", but instead wants to retain as many of the 1,000 issued shares as possible. The outside investors will buy the shares as long as they are able to obtain the 10% required rate of return.

If the entrepreneur invests $1,500 of her own funds, what is the minimum number of shares that she has to sell to the outside investors, for this project to be undertaken?

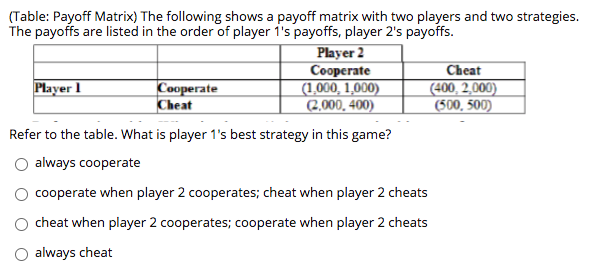

(Table: Payoff Matrix) The following shows a payoff matrix with two players and two strategies. The payoffs are listed in the order of player 1's payoffs, player 2's payoffs. Player 2 Cooperate (1,000 1,000) (2,000,400) Refer to the table. What is player 1's best strategy in this game? always cooperate cooperate when player 2 cooperates; cheat when player 2 cheats cheat when player 2 cooperates; cooperate when player 2 cheats always cheat Player 1 Cooperate Cheat Cheat (400, 2,000) (500, 500)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Id be glad to help you with the calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started