Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Brisbane City Council is planning to develop a piece of land that it currently owns but is not utilising, which is valued at

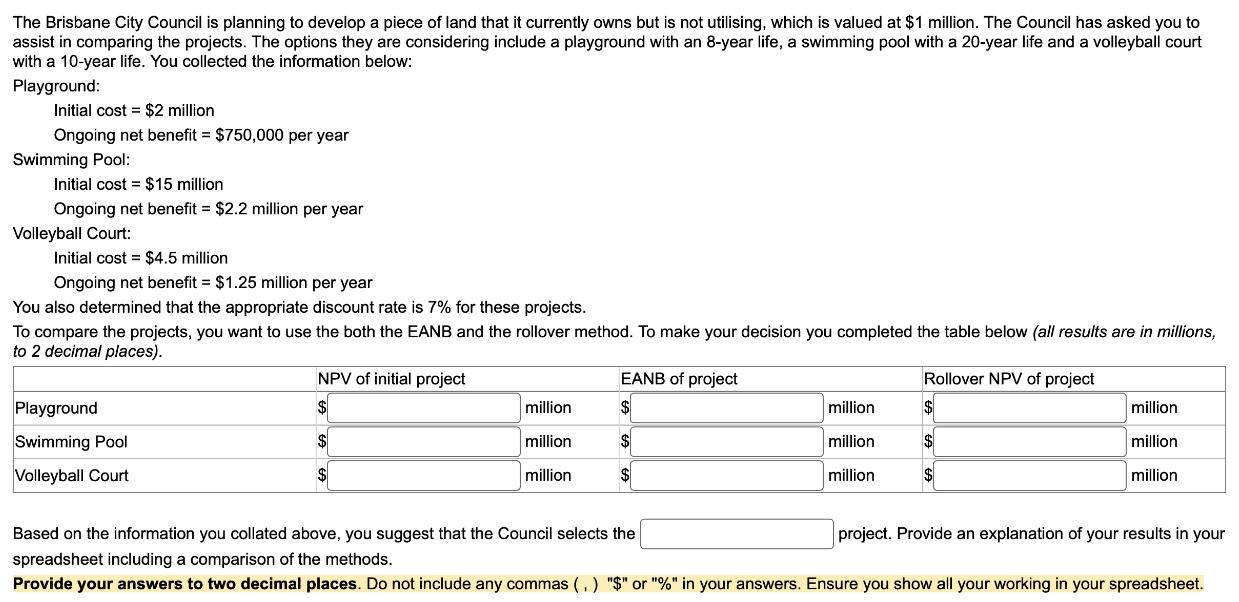

The Brisbane City Council is planning to develop a piece of land that it currently owns but is not utilising, which is valued at $1 million. The Council has asked you to assist in comparing the projects. The options they are considering include a playground with an 8-year life, a swimming pool with a 20-year life and a volleyball court with a 10-year life. You collected the information below: Playground: Initial cost = $2 million Ongoing net benefit = $750,000 per year Swimming Pool: Initial cost $15 million Ongoing net benefit = $2.2 million per year Volleyball Court: Initial cost $4.5 million Ongoing net benefit = $1.25 million per year You also determined that the appropriate discount rate is 7% for these projects. To compare the projects, you want to use the both the EANB and the rollover method. To make your decision you completed the table below (all results are in millions, to 2 decimal places). NPV of initial project Playground Swimming Pool Volleyball Court $ million million million EANB of project $ $ $ million million million Rollover NPV of project $ million million million Based on the information you collated above, you suggest that the Council selects the spreadsheet including a comparison of the methods. Provide your answers to two decimal places. Do not include any commas (,) "$" or "%" in your answers. Ensure you show all your working in your spreadsheet. project. Provide an explanation of your results in your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution To compare the projects using the Equivalent Annual Net Benefit EANB and Rollover Net Present Value NPV methods we need to calculate the rele...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started