Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The British pound is selling at a in the forward market. Suppose you make a E600,000 sale to a British customer who has 60 days

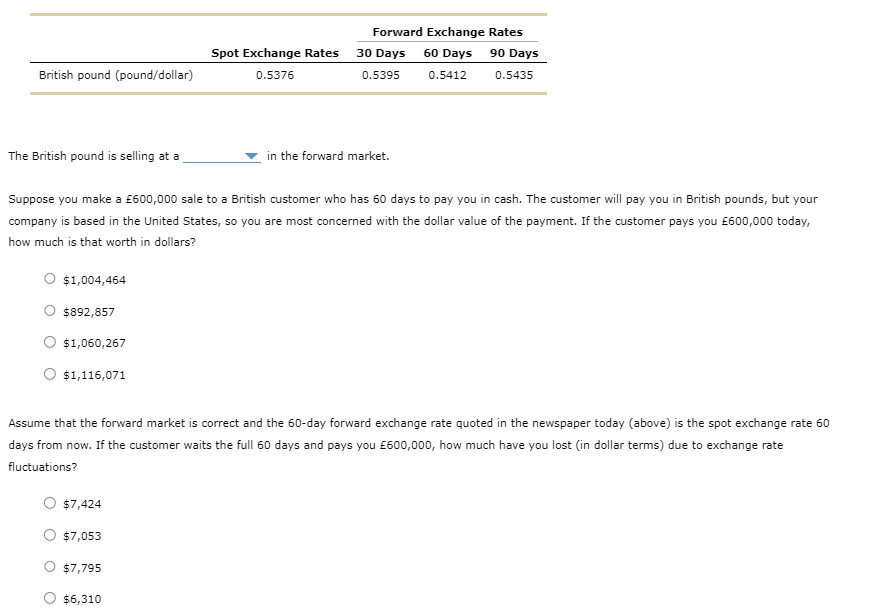

The British pound is selling at a in the forward market. Suppose you make a E600,000 sale to a British customer who has 60 days to pay you in cash. The customer will pay you in British pounds, but your company is based in the United States, so you are most concerned with the dollar value of the payment. If the customer pays you E600,000 today, how much is that worth in dollars? $1,004,464$892,857$1,060,267$1,116,071 Assume that the forward market is correct and the 60-day forward exchange rate quoted in the newspaper today (above) is the spot exchange rate 60 days from now. If the customer waits the full 60 days and pays you 600,000, how much have you lost (in dollar terms) due to exchange rate fluctuations? $7,424$7,053$7,795$6,310

The British pound is selling at a in the forward market. Suppose you make a E600,000 sale to a British customer who has 60 days to pay you in cash. The customer will pay you in British pounds, but your company is based in the United States, so you are most concerned with the dollar value of the payment. If the customer pays you E600,000 today, how much is that worth in dollars? $1,004,464$892,857$1,060,267$1,116,071 Assume that the forward market is correct and the 60-day forward exchange rate quoted in the newspaper today (above) is the spot exchange rate 60 days from now. If the customer waits the full 60 days and pays you 600,000, how much have you lost (in dollar terms) due to exchange rate fluctuations? $7,424$7,053$7,795$6,310 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started