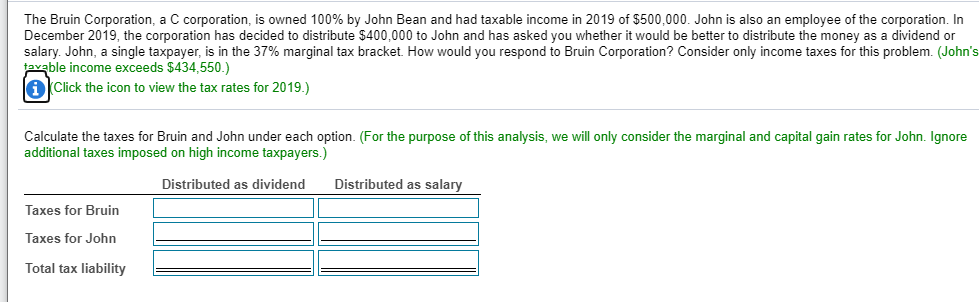

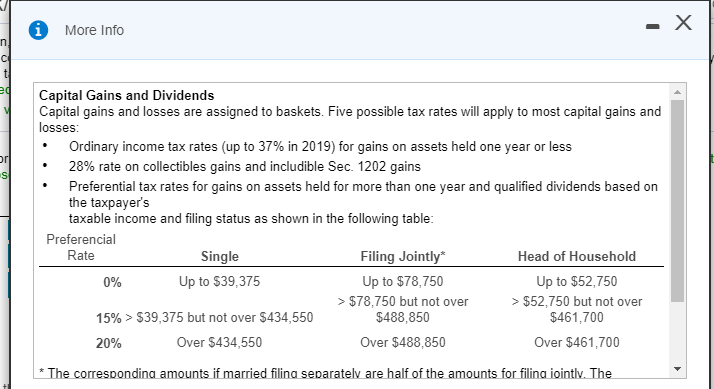

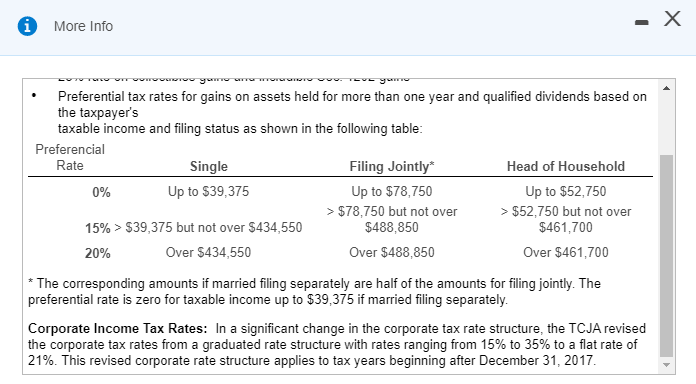

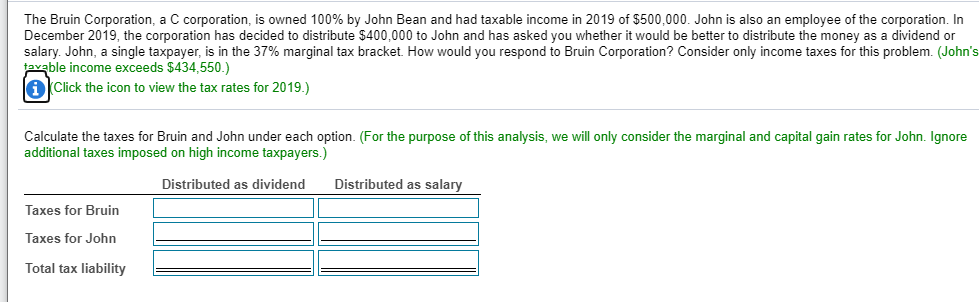

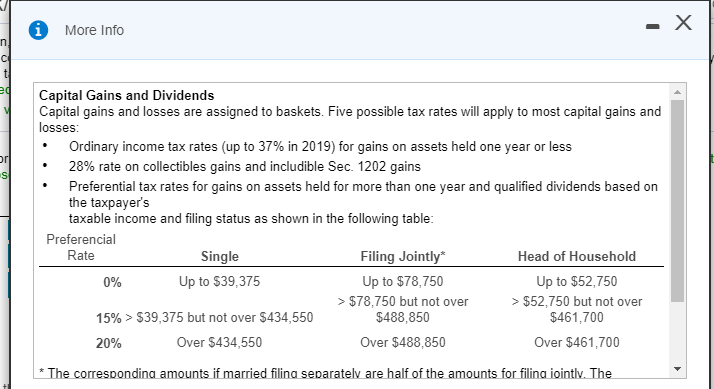

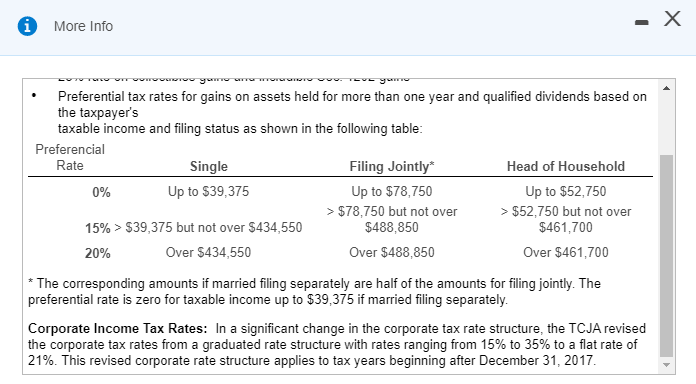

The Bruin Corporation, a C corporation, is owned 100% by John Bean and had taxable income in 2019 of $500,000. John is also an employee of the corporation. In December 2019, the corporation has decided to distribute $400,000 to John and has asked you whether it would be better to distribute the money as a dividend or salary. John, a single taxpayer, is in the 37% marginal tax bracket. How would you respond to Bruin Corporation? Consider only income taxes for this problem. (John's taxable income exceeds $434,550.) la Click the icon to view the tax rates for 2019.) Calculate the taxes for Bruin and John under each option. (For the purpose of this analysis, we will only consider the marginal and capital gain rates for John. Ignore additional taxes imposed on high income taxpayers.) Distributed as dividend Distributed as salary Taxes for Bruin Taxes for John Total tax liability * More Info Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2019) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Rate Single Filing Jointly* Head of Household 0% Up to $39,375 Up to $78,750 Up to $52,750 > $78,750 but not over > $52,750 but not over 15% > $39,375 but not over $434,550 $488,850 $461,700 20% Over 5434,550 Over $488,850 Over $461,700 * The corresponding amounts if married filina separately are half of the amounts for filina jointly. The x * More Info - Termowe w TV vou. TEVE Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Rate Single Filing Jointly* Head of Household 0% Up to $39,375 Up to $78,750 Up to $52,750 > $78,750 but not over > $52,750 but not over 15% > $39,375 but not over $434,550 $488,850 $461,700 20% Over $434,550 Over $488,850 Over $461,700 * The corresponding amounts if married filing separately are half of the amounts for filing jointly. The preferential rate is zero for taxable income up to $39,375 if married filing separately. Corporate Income Tax Rates: In a significant change in the corporate tax rate structure, the TCJA revised the corporate tax rates from a graduated rate structure with rates ranging from 15% to 35% to a flat rate of 21%. This revised corporate rate structure applies to tax years beginning after December 31, 2017 The Bruin Corporation, a C corporation, is owned 100% by John Bean and had taxable income in 2019 of $500,000. John is also an employee of the corporation. In December 2019, the corporation has decided to distribute $400,000 to John and has asked you whether it would be better to distribute the money as a dividend or salary. John, a single taxpayer, is in the 37% marginal tax bracket. How would you respond to Bruin Corporation? Consider only income taxes for this problem. (John's taxable income exceeds $434,550.) la Click the icon to view the tax rates for 2019.) Calculate the taxes for Bruin and John under each option. (For the purpose of this analysis, we will only consider the marginal and capital gain rates for John. Ignore additional taxes imposed on high income taxpayers.) Distributed as dividend Distributed as salary Taxes for Bruin Taxes for John Total tax liability * More Info Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2019) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Rate Single Filing Jointly* Head of Household 0% Up to $39,375 Up to $78,750 Up to $52,750 > $78,750 but not over > $52,750 but not over 15% > $39,375 but not over $434,550 $488,850 $461,700 20% Over 5434,550 Over $488,850 Over $461,700 * The corresponding amounts if married filina separately are half of the amounts for filina jointly. The x * More Info - Termowe w TV vou. TEVE Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Rate Single Filing Jointly* Head of Household 0% Up to $39,375 Up to $78,750 Up to $52,750 > $78,750 but not over > $52,750 but not over 15% > $39,375 but not over $434,550 $488,850 $461,700 20% Over $434,550 Over $488,850 Over $461,700 * The corresponding amounts if married filing separately are half of the amounts for filing jointly. The preferential rate is zero for taxable income up to $39,375 if married filing separately. Corporate Income Tax Rates: In a significant change in the corporate tax rate structure, the TCJA revised the corporate tax rates from a graduated rate structure with rates ranging from 15% to 35% to a flat rate of 21%. This revised corporate rate structure applies to tax years beginning after December 31, 2017