Answered step by step

Verified Expert Solution

Question

1 Approved Answer

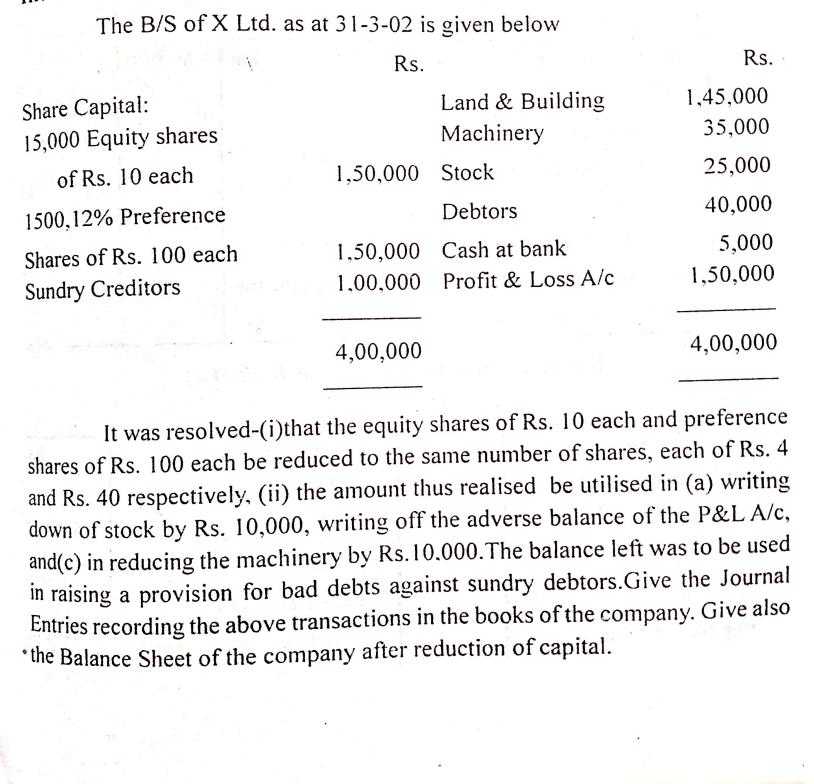

The B/S of X Ltd. as at 31-3-02 is given below Rs. Share Capital: 15,000 Equity shares of Rs. 10 each 1500,12% Preference Shares

The B/S of X Ltd. as at 31-3-02 is given below Rs. Share Capital: 15,000 Equity shares of Rs. 10 each 1500,12% Preference Shares of Rs. 100 each Sundry Creditors Land & Building Machinery 1,50,000 Stock Debtors 1,50,000 Cash at bank 1,00,000 Profit & Loss A/c 4,00,000 Rs. 1,45,000 35,000 25,000 40,000 5,000 1,50,000 4,00,000 It was resolved-(i)that the equity shares of Rs. 10 each and preference shares of Rs. 100 each be reduced to the same number of shares, each of Rs. 4 and Rs. 40 respectively, (ii) the amount thus realised be utilised in (a) writing down of stock by Rs. 10,000, writing off the adverse balance of the P&L A/c, and(c) in reducing the machinery by Rs.10.000. The balance left was to be used in raising a provision for bad debts against sundry debtors. Give the Journal Entries recording the above transactions in the books of the company. Give also *the Balance Sheet of the company after reduction of capital.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started