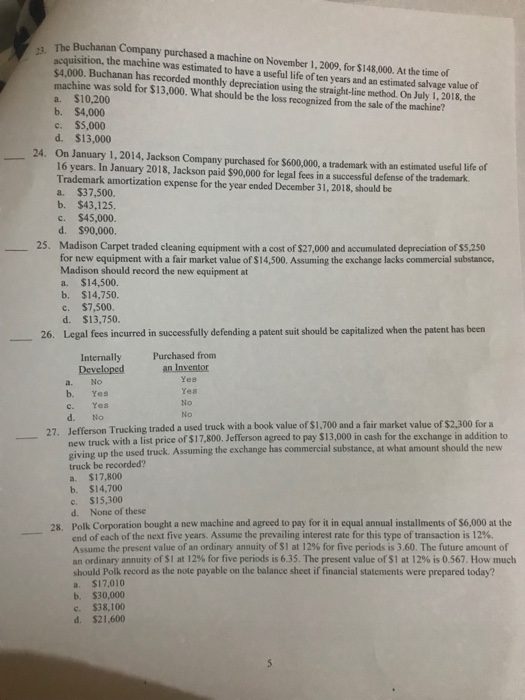

The Buchanan Company purchased a machine on November 1,2009, for $14,000. At the time of acquisition, the machine was estimated to have a useful life of ten years and an estimated salvage value of $4,000. Buchanan has r recorded monthly depreciation using the straight-line method. On July 1, 2018, the hine was sold for $13,000. What should be the loss recognized from the sale of the machine? a. $10.200 b. $4,000 C. $5,000 d. $13,000 On January 1,2014, Jackson Company purchased for $600,000, a trademark with an estimated useful life of 16 years. In January 2018, Jackson paid $90,000 for legal fees in a successful defense of the trademark Trademark amortization expense for the year ended December 31, 2018, should be a. $37,500. b. $43,125. c. $45,000 d. $90,000. 24. 25. Madison Carpet traded cleaning equipment with a cost of $27,000 and accumulated depreciation of $5,250 for new equipment with a fair market value of $14,500. Assuming the exchange lacks commercial substance, Madison should record the new equipnent at a. $14,500. b. $14,750. C. $7,500. d. $13,750. 26. Legal fees incurred in successfully defending a patent suit should be capitalized when the patent has been Internally Purchased from Developedan Inventor a. No b. Yes . Yes d. No Yes No Trucking traded a used truck with a book value of $1,700 and a fair market value of $2,300 for a new truck with a list price of $17,800. Jefferson agreed to pay $13,000 in cash for the exchange in addition to iving up the used truck. Assuming the exchange has commercial substance, at what amount should the new truck be recorded? a. $17,800 b. $14,700 c. $15,300 d. None of these Polk Corporation bought a new machine and agreed to pay for it in equal annual installments of $6,000 at the end of each of the next five years. Assume the prevailing interest rate for this type of transaction is 12%. Assume the present value of an ordinary annuity of SI at 12% for five periods is 3.60. The future amount of an ordinary annuity of $1 at 12% for five periods is 635. The present value of S1 at 12% is 0.567. How much should Polk record as the note payable on the balance sheet if financial statements were prepared today? a. $17,010 b. $30,000 c. $38,100 d. $21,600 27. Jefferson 28