Answered step by step

Verified Expert Solution

Question

1 Approved Answer

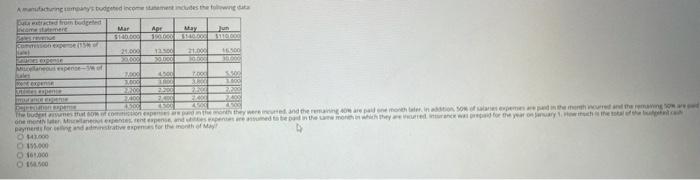

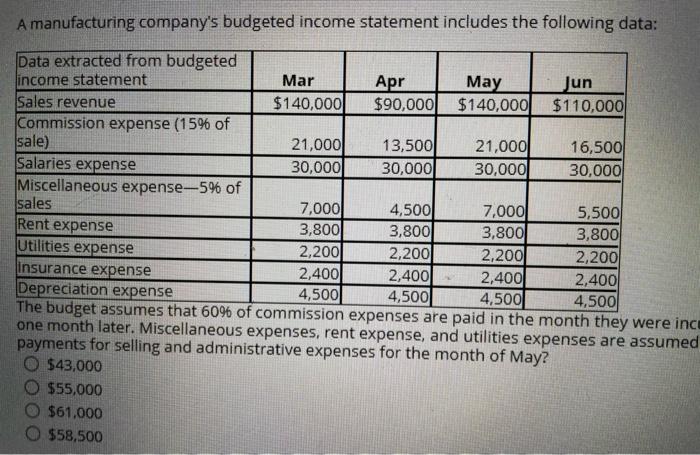

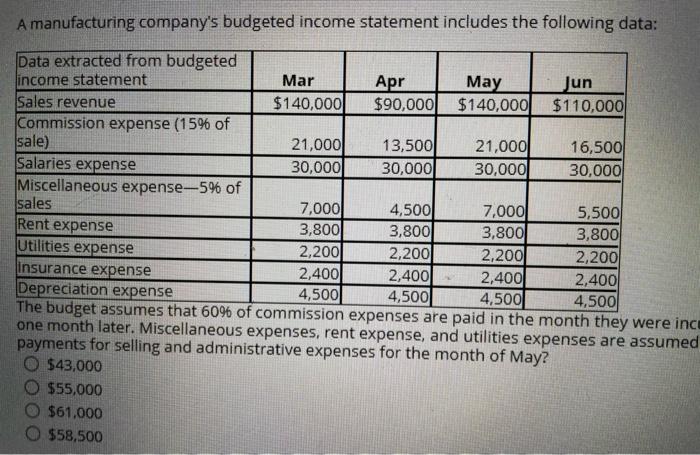

The budget assumes that 60% of commission expenses are pald in the month they were incurred, and the remaining 40% are paid one month later.

The budget assumes that 60% of commission expenses are pald in the month they were incurred, and the remaining 40% are paid one month later. in addition 50% of salaries expenses are paid in the month Incurred and the remaining 50% are paid one month later. Miscellanegus expenses, rent expense, and utilities expenses are assumed to be paid in the same monthin which they are Incurred. Insurance was prepaid for the year on January 1. How much is the total of the budgeted cash payments for selling and administrative expenses for the month of May? O S43.000 S55.000 O $61,000 O 558.500

The budget assumes that 60% of commission expenses are pald in the month they were incurred, and the remaining 40% are paid one month later. in addition 50% of salaries expenses are paid in the month Incurred and the remaining 50% are paid one month later. Miscellanegus expenses, rent expense, and utilities expenses are assumed to be paid in the same monthin which they are Incurred. Insurance was prepaid for the year on January 1. How much is the total of the budgeted cash payments for selling and administrative expenses for the month of May? O S43.000 S55.000 O $61,000 O 558.500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started