Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The budget director of Gold Medal Athletic Co., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data

The budget director of Gold Medal Athletic Co., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for March:

- Estimated sales for March:

Batting helmet 1,200 units at $40 per unit Football helmet 6,500 units at $160 per unit - Estimated inventories at March 1:

Direct materials: Plastic 90 lb. Foam lining 80 lb. Finished products: Batting helmet 40 units at $25 per unit Football helmet 240 units at $77 per unit - Desired inventories at March 31:

Direct materials: Plastic 50 lb. Foam lining 65 lb. Finished products: Batting helmet 50 units at $25 per unit Football helmet 220 units at $78 per unit - Direct materials used in production:

In manufacture of batting helmet: Plastic 1.20 lb. per unit of product Foam lining 0.50 lb. per unit of product In manufacture of football helmet: Plastic 3.50 lb. per unit of product Foam lining 1.50 lb. per unit of product - Anticipated cost of purchases and beginning and ending inventory of direct materials:

Plastic $6.00 per lb. Foam lining $4.00 per lb. - Direct labor requirements:

Batting helmet: Molding Department 0.20 hr. at $20 per hr. Assembly Department 0.50 hr. at $14 per hr. Football helmet: Molding Department 0.50 hr. at $20 per hr. Assembly Department 1.80 hrs. at $14 per hr. - Estimated factory overhead costs for March:

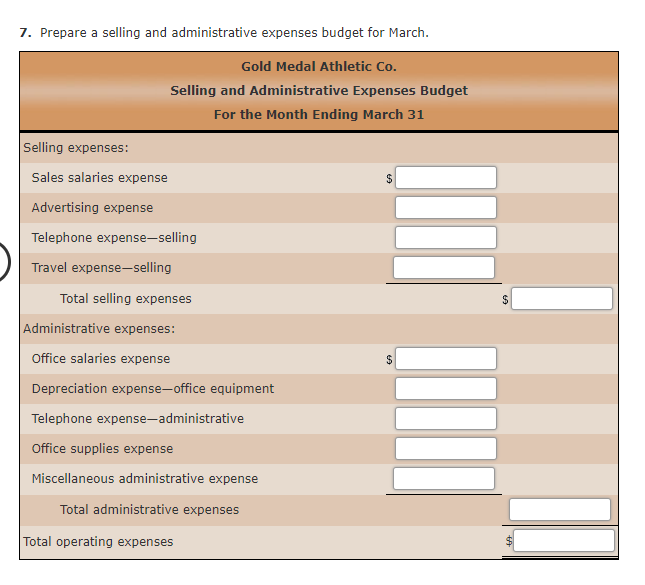

Indirect factory wages $86,000 Depreciation of plant and equipment 12,000 Power and light 4,000 Insurance and property tax 2,300 - Estimated operating expenses for March:

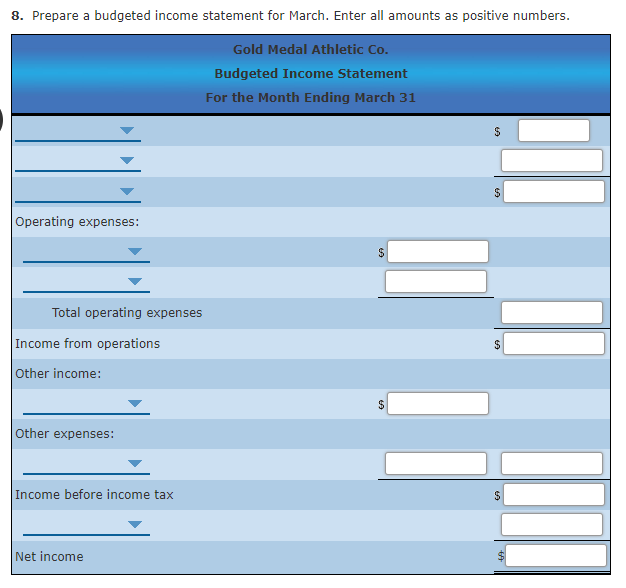

Sales salaries expense $184,300 Advertising expense 87,200 Office salaries expense 32,400 Depreciation expenseoffice equipment 3,800 Telephone expenseselling 5,800 Telephone expenseadministrative 1,200 Travel expenseselling 9,000 Office supplies expense 1,100 Miscellaneous administrative expense 1,000 - Estimated other income and expense for March:

Interest revenue $940 Interest expense 872 - Estimated tax rate: 30%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started