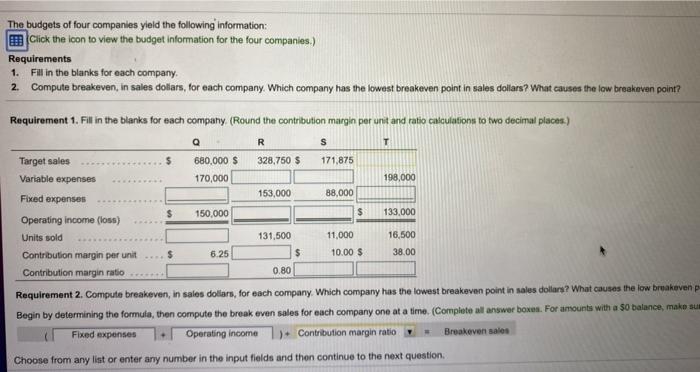

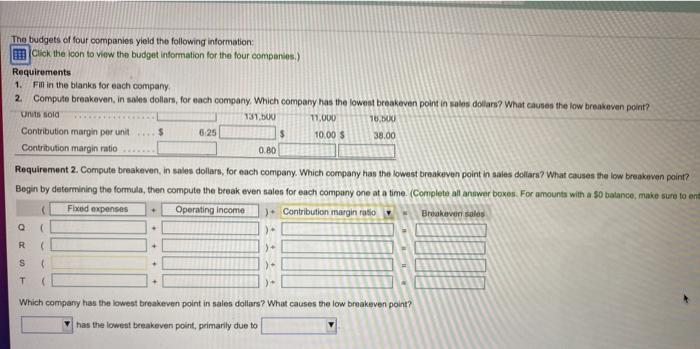

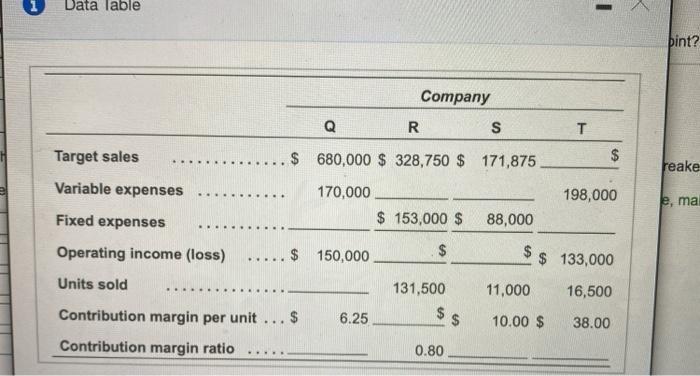

The budgets of four companies yield the following information: Click the icon to view the budget information for the four companies.) Requirements 1. Fill in the blanks for each company 2. Compute breakeven, in sales dollars, for each company. Which company has the lowest breakeven point in sales dollars? What causes the low breakeven point? Requirement 1. Fill in the blanks for each company (Round the contribution margin per unit and ratio calculations to two decimal places) Q R S T Target sales 680,000 $ 328,750 $ 171,875 Variable expenses 170,000 198,000 Fixed expenses 153,000 88,000 $ 150,000 $ Operating income (los) 133.000 Units sold 131,500 11,000 16,500 Contribution margin per unit $ 6.25 $ 10.00 $ 38.00 Contribution margin ratio 0.80 Requirement 2. Compute breakeven, in sales dollars, for each company. Which company has the lowest breakeven point in sales dollars? What causes the low breakeven p Begin by determining the formula, then compute the break even sales for each company one at a time. (Complete all answer boxes. For amounts with a $0 balance, make su Fixed expenses Operating incomeContribution margin ratio Breakeven sales Choose from any list or enter any number in the input fields and then continue to the next question The budgets of four companies yield the following information Click the icon to view the budget information for the four companies.) Requirements 1. Fin in the blanks for each company 2. Compute breakeven, in sales dollars, for each company. Which company has the lowest breakeven point in sales dollars? What causes the low breakeven point? Units sold 131.00 11,000 10.BOX Contribution margin per unit 6:25 $ 10.00 $ 38.00 Contribution margin ratio 0.80 Requirement 2. Compute breakeven, in sales dollars, for each company. Which company has the lowest breakeven point in sales dollars? What causes the low breakeven point? Begin by determining the formula, then compute the break even sales for each company one at a time. (Complete all answer boxes. For amounts with a so balance, make sure to on Fixed expenses Operating income 3. Contribution margin ratio Breakover sales . 09 ) ) T Which company has the lowest breakeven point in sales dollars? What causes the low breakeven point? has the lowest breakeven point, primarily due to Data Table bint? Company Q R S T Target sales $ 680,000 $ 328,750 $ 171,875 $ reake Variable expenses . 198,000 170,000 $ 153,000 $ e, ma Fixed expenses 88,000 ---- Operating income (loss) ... $ 150,000 $ $ $ 133,000 Units sold 11,000 16,500 131,500 $s 6.25 10.00 $ Contribution margin per unit ... $ Contribution margin ratio 38.00 0.80