Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Bunson Machining Company is considering purchasing a new set of machine tools to process special orders. The following financial information is available: *

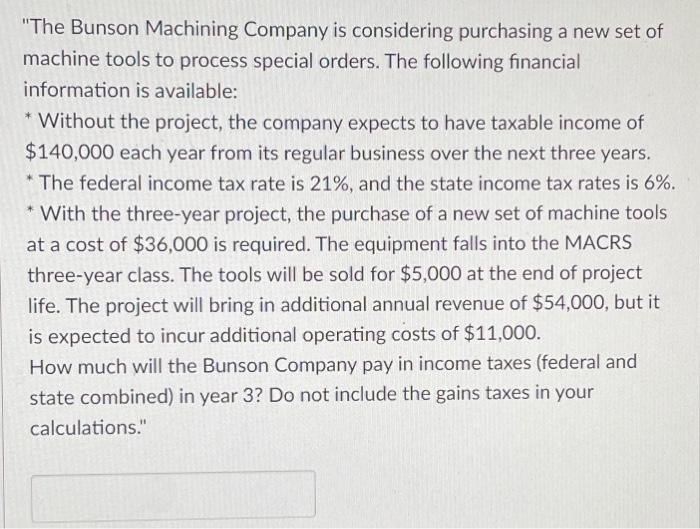

"The Bunson Machining Company is considering purchasing a new set of machine tools to process special orders. The following financial information is available: * Without the project, the company expects to have taxable income of $140,000 each year from its regular business over the next three years. * The federal income tax rate is 21%, and the state income tax rates is 6%. * With the three-year project, the purchase of a new set of machine tools at a cost of $36,000 is required. The equipment falls into the MACRS three-year class. The tools will be sold for $5,000 at the end of project life. The project will bring in additional annual revenue of $54,000, but it is expected to incur additional operating costs of $11,000. How much will the Bunson Company pay in income taxes (federal and state combined) in year 3? Do not include the gains taxes in your calculations."

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Details relating to a project which involves an purchase of tools is provided on the details It is required to compute the income tax payable at the e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60d452b0810fd_227535.pdf

180 KBs PDF File

60d452b0810fd_227535.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started