Question

The Burn Company was incorporated on June 1, 20X0. Burn had 200 holders of common stock. Rhonda Burn, the president and CEO, held 56% of

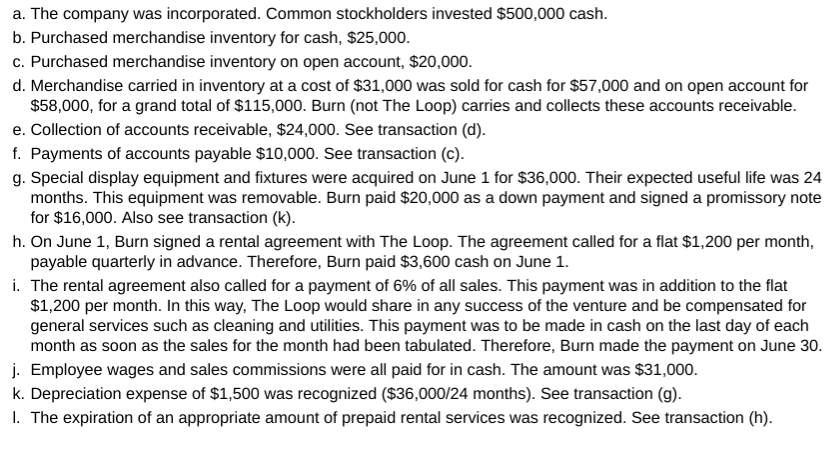

The Burn Company was incorporated on June 1, 20X0. Burn had 200 holders of common stock. Rhonda Burn, the president and CEO, held 56% of the shares. The company rented space in chain discount stores and specialized in selling ladies' accessories. Burn's first location was in a store that was part of The Loop in Cleveland. The following events occurred during June:

REQUIREMENTS:

REQUIREMENTS:

1. Prepare an analysis of Burn Company's transactions.

2. Prepare a balance sheet as of June 30, 20X0, and an income statement for the month of June. Ignore income taxes.

3. Given these sparse facts, analyze Burn's performance for June and its financial position as of June 30, 20X0.

a. The company was incorporated. Common stockholders invested $500,000 cash b. Purchased merchandise inventory for cash, $25,000 c. Purchased merchandise inventory on open account, $20,000 d. Merchandise carried in inventory at a cost of $31,000 was sold for cash for $57,000 and on open account for $58,000, for a grand total of $115,000. Burn (not The Loop) carries and collects these accounts receivable e. Collection of accounts receivable, $24,000. See transaction (d) f. Payments of accounts payable $10,000. See transaction (c) g. Special display equipment and fixtures were acquired on June 1 for $36,000. Their expected useful life was 24 months. This equipment was removable. Burn paid $20,000 as a down payment and signed a promissory note for $16,000. Also see transaction (k) h. On June 1, Burn signed a rental agreement with The Loop. The agreement called for a flat $1,200 per month payable quarterly in advance. Therefore, Burn paid $3,600 cash on June 1. i. The rental agreement also called for a payment of 6% of all sales. This payment was in addition to the flat $1,200 per month. In this way, The Loop would share in any success of the venture and be compensated for general services such as cleaning and utilities. This payment was to be made in cash on the last day of each month as soon as the sales for the month had been tabulated. Therefore, Burn made the payment on June 30 j. Employee wages and sales commissions were all paid for in cash. The amount was $31,000 k. Depreciation expense of $1,500 was recognized ($36,000/24 months). See transaction (g) I. The expiration of an appropriate amount of prepaid rental services was recognized. See transaction (h)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started