Answered step by step

Verified Expert Solution

Question

1 Approved Answer

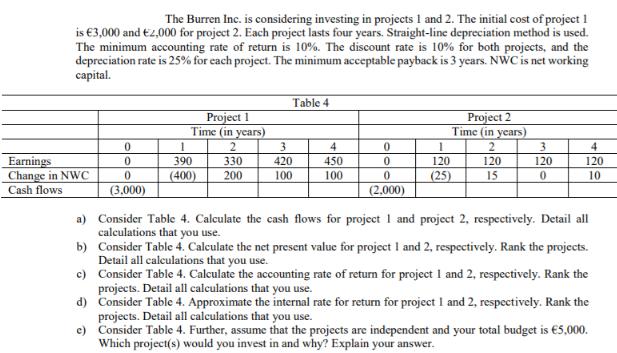

The Burren Inc. is considering investing in projects 1 and 2. The initial cost of project 1 is 3,000 and 2,000 for project 2.

The Burren Inc. is considering investing in projects 1 and 2. The initial cost of project 1 is 3,000 and 2,000 for project 2. Each project lasts four years. Straight-line depreciation method is used. The minimum accounting rate of return is 10%. The discount rate is 10% for both projects, and the depreciation rate is 25% for each project. The minimum acceptable payback is 3 years. NWC is net working capital. Earnings Change in NWC Cash flows a) b) c) d) c) 0 0 0 (3,000) Project 1 Time (in years) 2 1 390 330 (400) 200 Table 4 3 420 100 4 450 100 0 0 0 (2,000) Project 2 Time (in years) 1 120 (25) 2 120 15 3 120 0 4 120 10 Consider Table 4. Calculate the cash flows for project 1 and project 2, respectively. Detail all calculations that you use. Consider Table 4. Calculate the net present value for project 1 and 2, respectively. Rank the projects. Detail all calculations that you use. Consider Table 4. Calculate the accounting rate of return for project 1 and 2, respectively. Rank the projects. Detail all calculations that you use. Consider Table 4. Approximate the internal rate for return for project 1 and 2, respectively. Rank the projects. Detail all calculations that you use. Consider Table 4. Further, assume that the projects are independent and your total budget is 5,000. Which project(s) would you invest in and why? Explain your answer.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the cash flows for project 1 and project 2 we need to consider the earnings changes in net working capital NWC and the initial costs Fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started