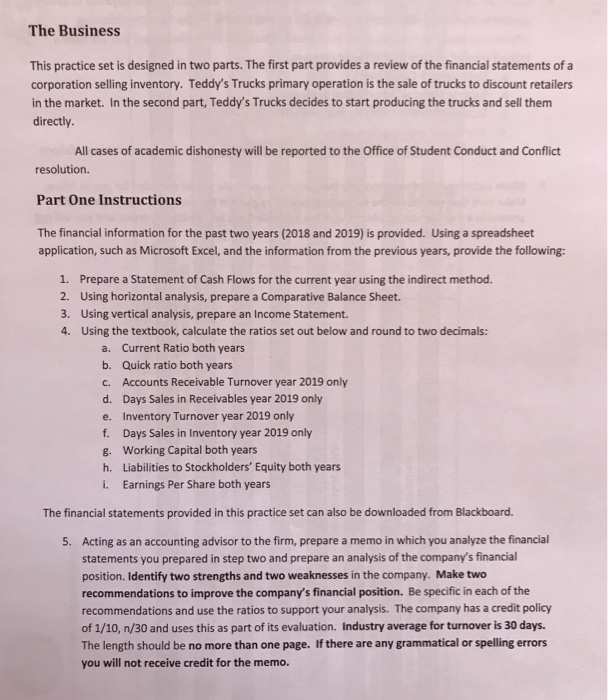

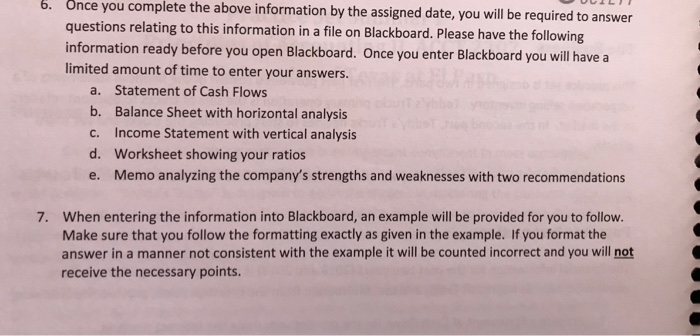

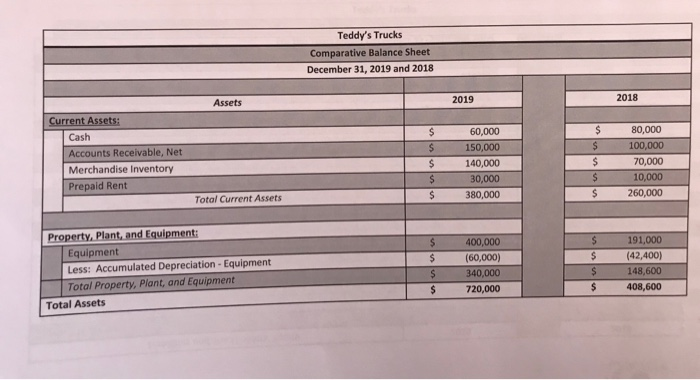

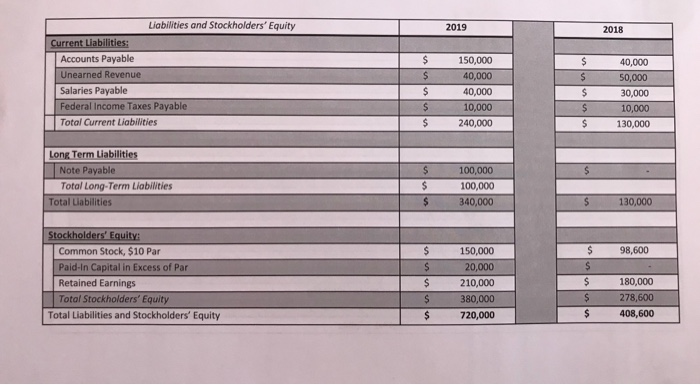

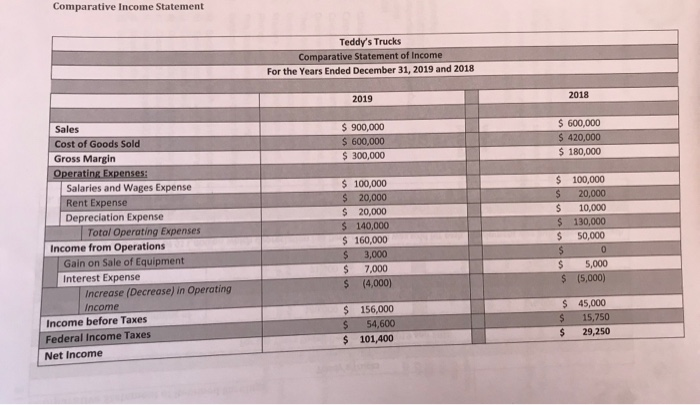

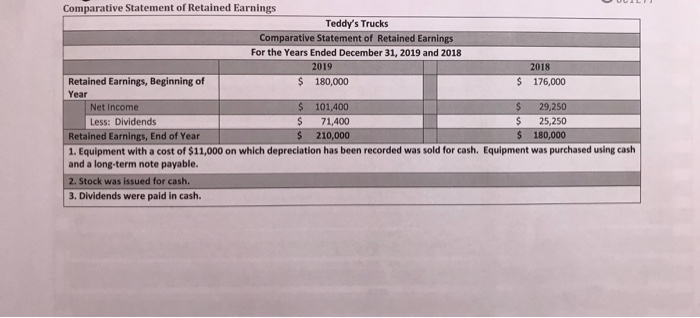

The Business This practice set is designed in two parts. The first part provides a review of the financial statements of a corporation selling inventory. Teddy's Trucks primary operation is the sale of trucks to discount retailers in the market. In the second part, Teddy's Trucks decides to start producing the trucks and sell them directly. All cases of academic dishonesty will be reported to the Office of Student Conduct and Conflict resolution. Part One Instructions The financial information for the past two years (2018 and 2019) is provided. Using a spreadsheet application, such as Microsoft Excel, and the information from the previous years, provide the following: Prepare a Statement of Cash Flows for the current year using the indirect method. 1. 2. Using horizontal analysis, prepare a Comparative Balance Sheet. Using vertical analysis, prepare an Income Statement. 3. Using the textbook, calculate the ratios set out below and round to two decimals: 4. Current Ratio both years a. Quick ratio both years b. Accounts Receivable Turnover year 2019 only c. Days Sales in Receivables year 2019 only d. Inventory Turnover year 2019 only Days Sales in Inventory year 2019 only Working Capital both years Liabilities to Stockholders' Equity both years e. f. g. h. Earnings Per Share both years i The financial statements provided in this practice set can also be downloaded from Blackboard. 5. Acting as an accounting advisor to the firm, prepare a memo in which you analyze the financial statements you prepared in step two and prepare an analysis of the company's financial position. Identify two strengths and two weaknesses in the company. Make two recommendations to improve the company's financial position. Be specific in each of the recommendations and use the ratios to support your analysis. The company has a credit policy of 1/10, n/30 and uses this as part of its evaluation. Industry average for turnover is 30 days. The length should be no more than one page. If there are any grammatical or spelling errors you will not receive credit for the memo. 6. Once you complete the above information by the assigned date, you will be required to answer questions relating to this information in a file on Blackboard. Please have the following information ready before you open Blackboard. Once you enter Blackboa rd you will have a limited amount of time to enter your answers. Statement of Cash Flows a. b. Balance Sheet with horizontal analysis Income Statement with vertical analysis c. d. Worksheet showing your ratios Memo analyzing the company's strengths and weaknesses with two recommendations e. When entering the information into Blackboard, an example will be provided for you to follow. Make sure that you follow the formatting exactly as given in the example. If you format the answer in a manner not consistent with the example it will be counted incorrect and you will not receive the necessary points. 7. Teddy's Trucks Comparative Balance Sheet December 31, 2019 and 2018 2018 2019 Assets Current Assets: 80,000 60,000 Cash $ 100,000 150,000 Accounts Receivable, Net 70,000 140,000 Merchandise Inventory 10,000 $ 30,000 Prepaid Rent $ 260,000 380,000 Total Current Assets Property, Plant, and Equipment 191,000 400,000 Equipment Less: Accumulated Depreciation- Equipment (42,400) (60,000) S 148,600 S 340,000 Total Property, Plant, and Equipment 408,600 720,000 Total Assets Ligbilities and Stockholders' Equity 2019 2018 Current Liabilities: Accounts Payable 150,000 40,000 Unearned Revenue S 40,000 50,000 Salaries Payable S 40,000 30,000 Federal Income Taxes Payable 10,000 S 10,000 Total Current Liabilities 240,000 S 130,000 Long Term Liabilities Note Payable 100,000 Total Long-Term Liabilities 100,000 130,000 Total Liabilities 340,000 Stockholders' Equity: 98,600 Common Stock, $10 Par 150,000 S Paid-In Capital in Excess of Par 20,000 180,000 Retained Earnings 210,000 S 278,600 Total Stockholders' Equity S 380,000 $ 408,600 Total Liabilities and Stockholders' Equity $ 720,000 Comparative Income Statement Teddy's Trucks Comparative Statement of Income For the Years Ended December 31, 2019 and 2018 2019 2018 Sales $ 600,000 $ 420,000 900,000 Cost of Goods Sold $ 600,000 Gross Margin $300,000 $180,000 Operating Expenses: Salaries and Wages Expense $ 100,000 $ 20,000 $ 20,000 $ 140,000 $ 160,000 S 100,000 Rent Expense 20,000 Depreciation Expense Total Operating Expenses $ 10,000 $ 130,000 50,000 Income from Operations 3,000 Gain on Sale of Equipment 5,000 $ (5,000) 7,000 Interest Expense Increase (Decrease) in Operating S (4,000) Income $ 45,000 $ 156,000 Income before Taxes 15,750 S 54,600 Federal Income Taxes 29,250 $ 101,400 Net Income Comparative Statement of Retained Earnings Teddy's Trucks Comparative Statement of Retained Earnings For the Years Ended December 31, 2019 and 2018 2019 2018 Retained Earnings, Beginning of 180,000 176,000 Year $ 101,400 S 29,250 Net Income Less: Dividends 25,250 $ 180,000 71,400 Retained Earnings, End of Year 210,000 1. Equipment with a cost of $11,000 on which depreciation has been recorded was sold for cash. Equipment was purchased using cash and a long-term note payable. 2. Stock was issued for cash. 3. Dividends were paid in cash