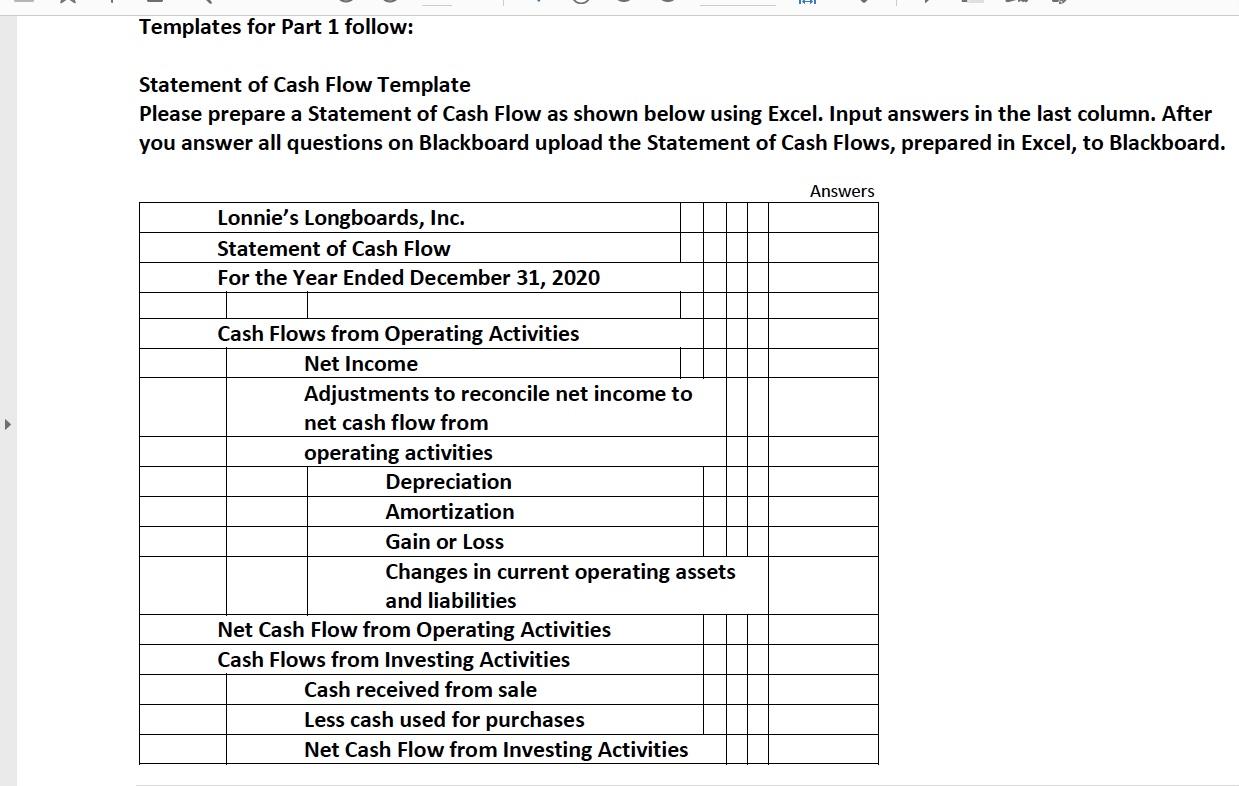

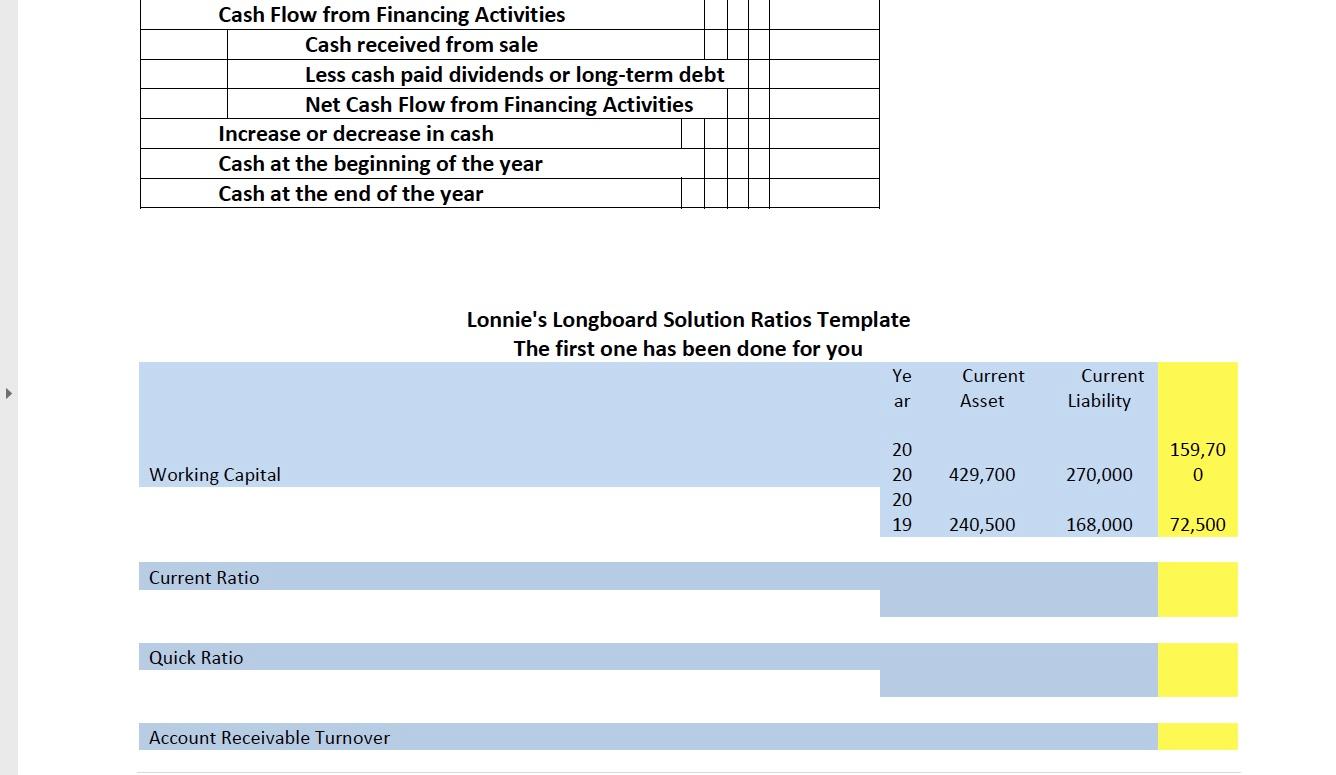

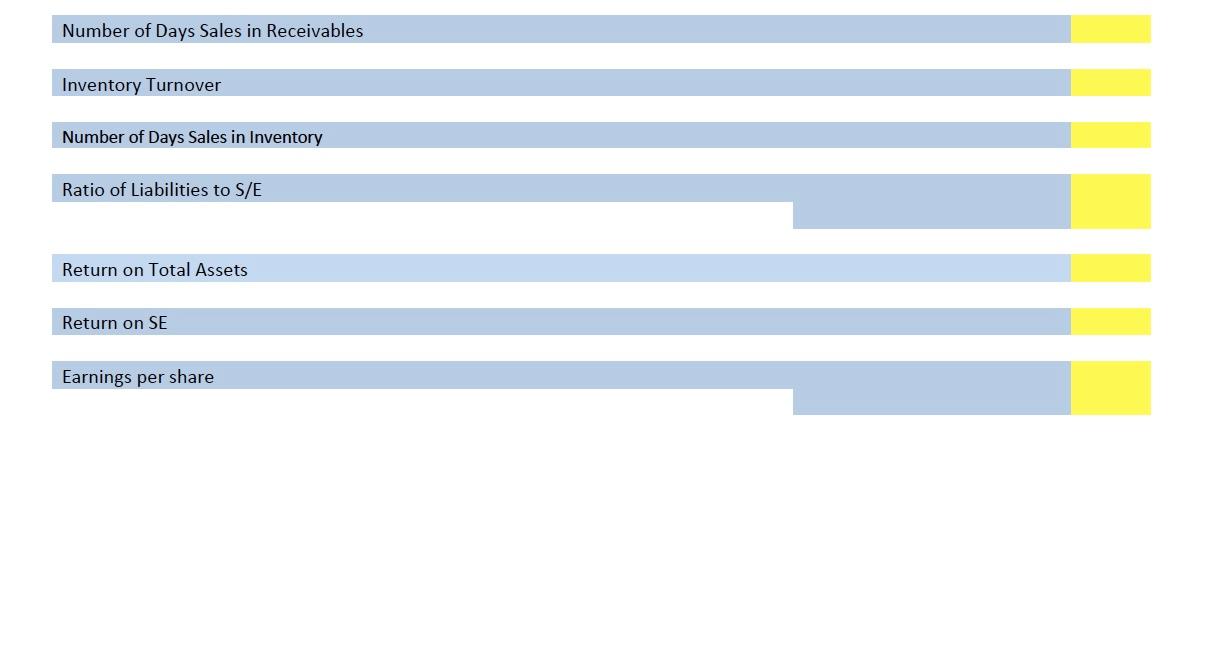

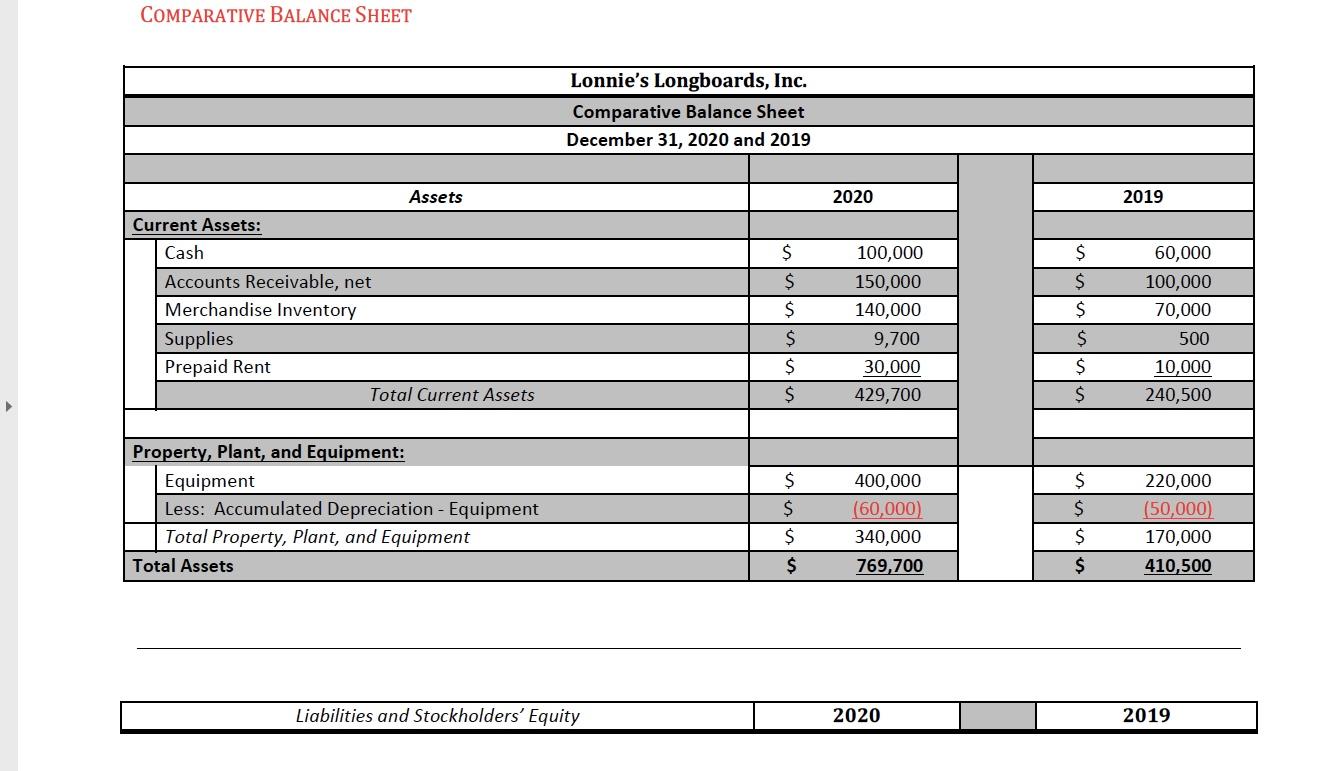

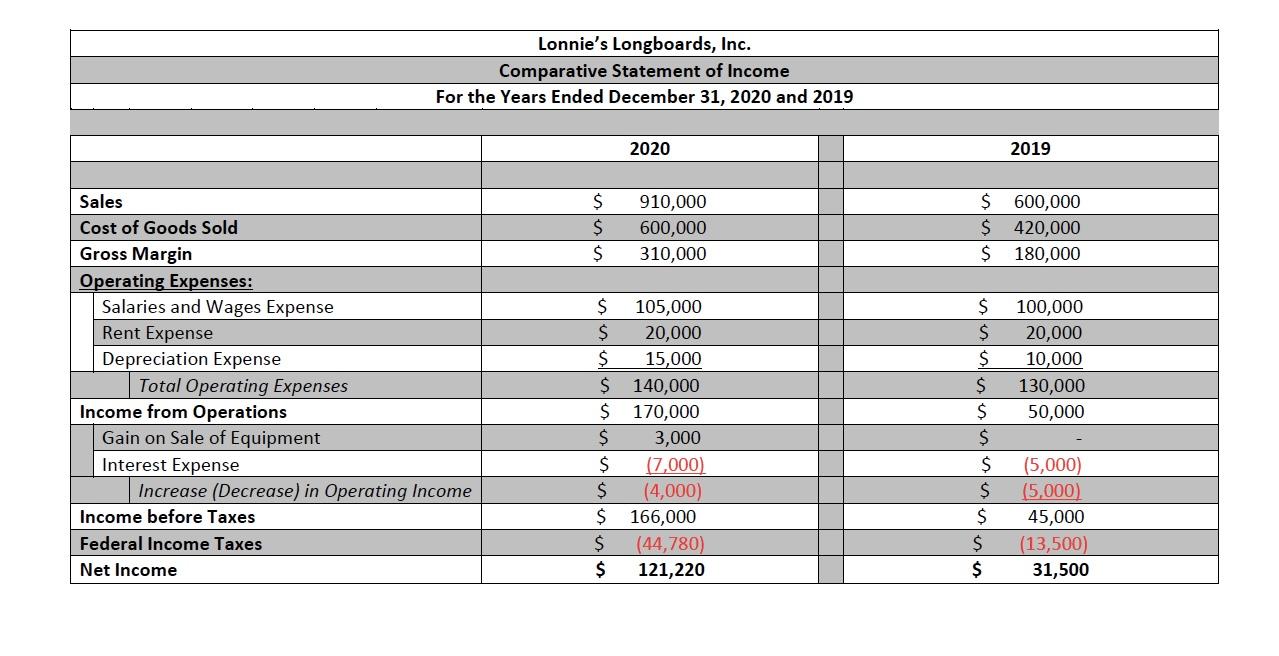

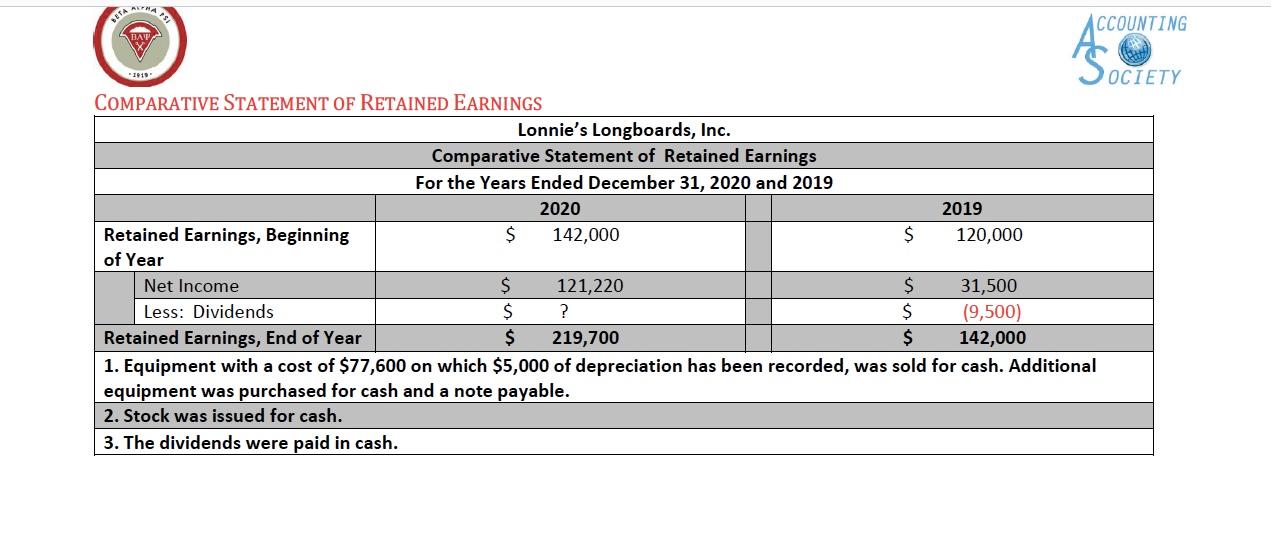

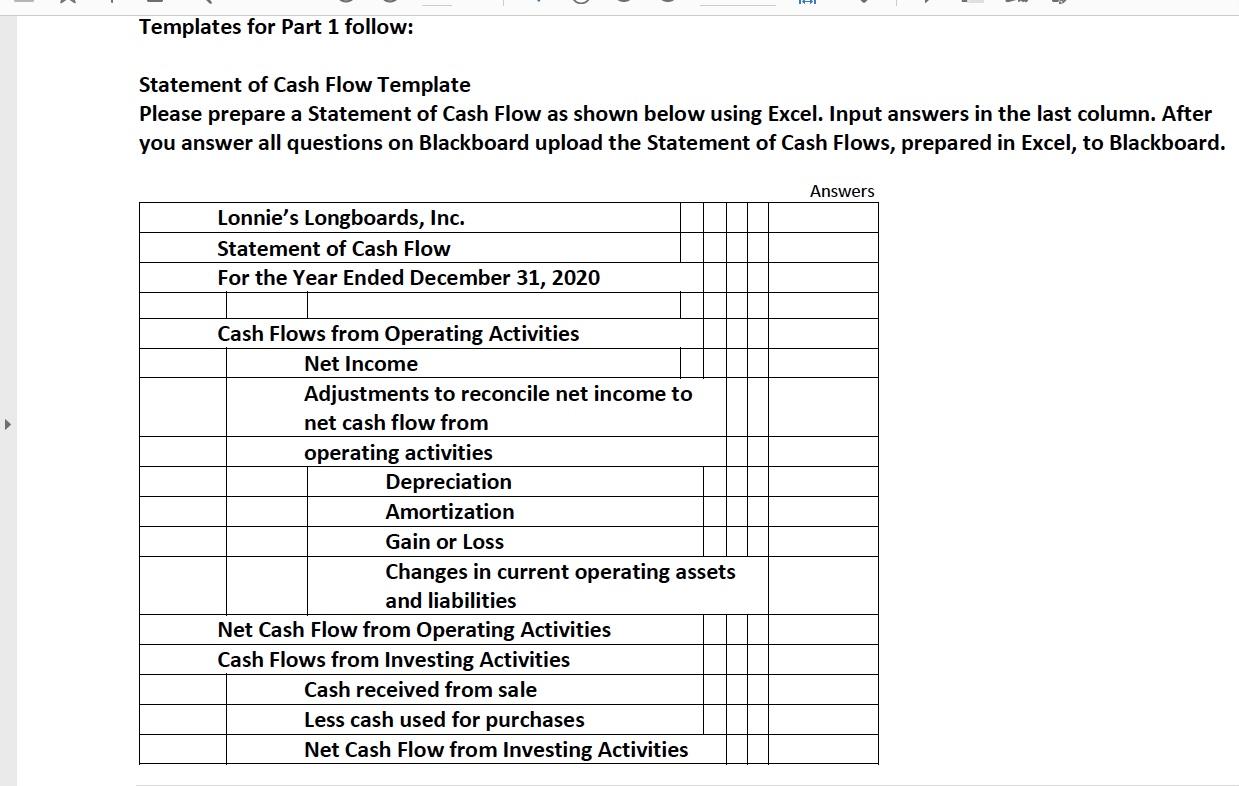

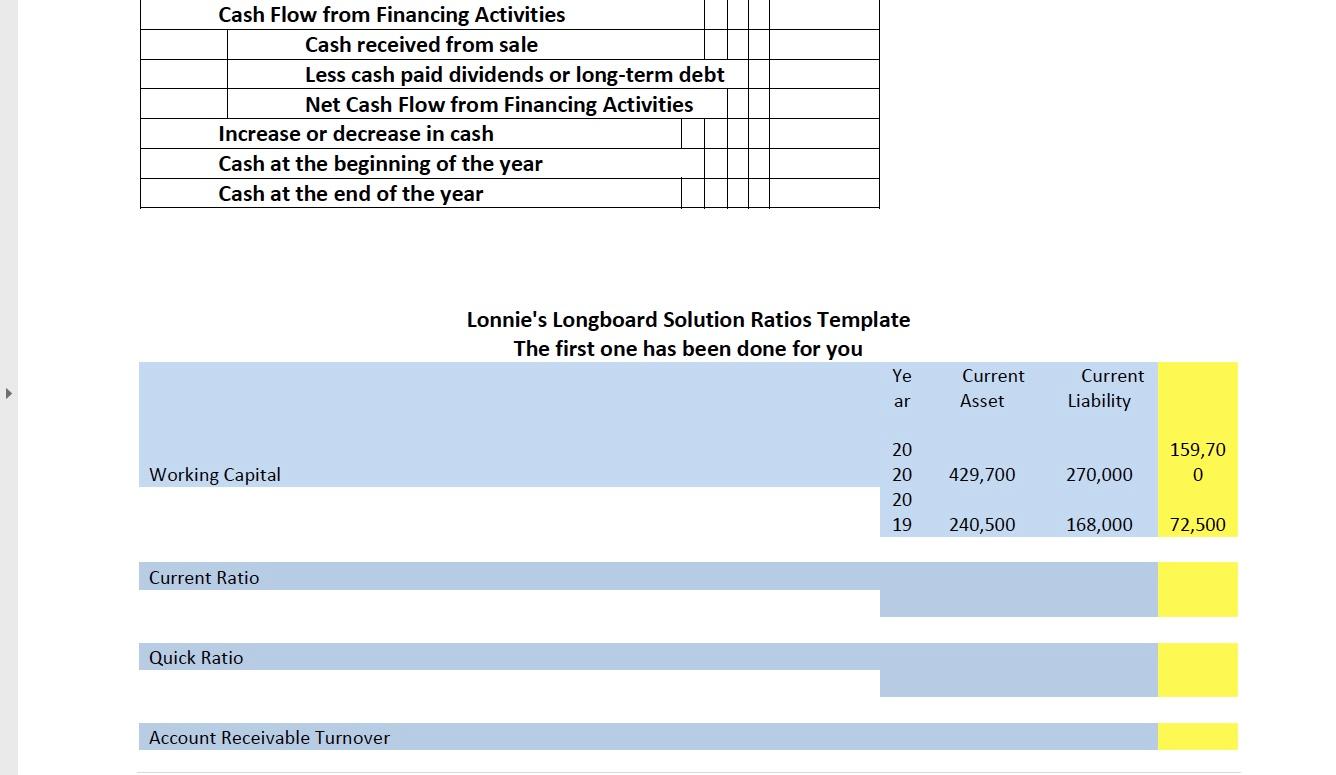

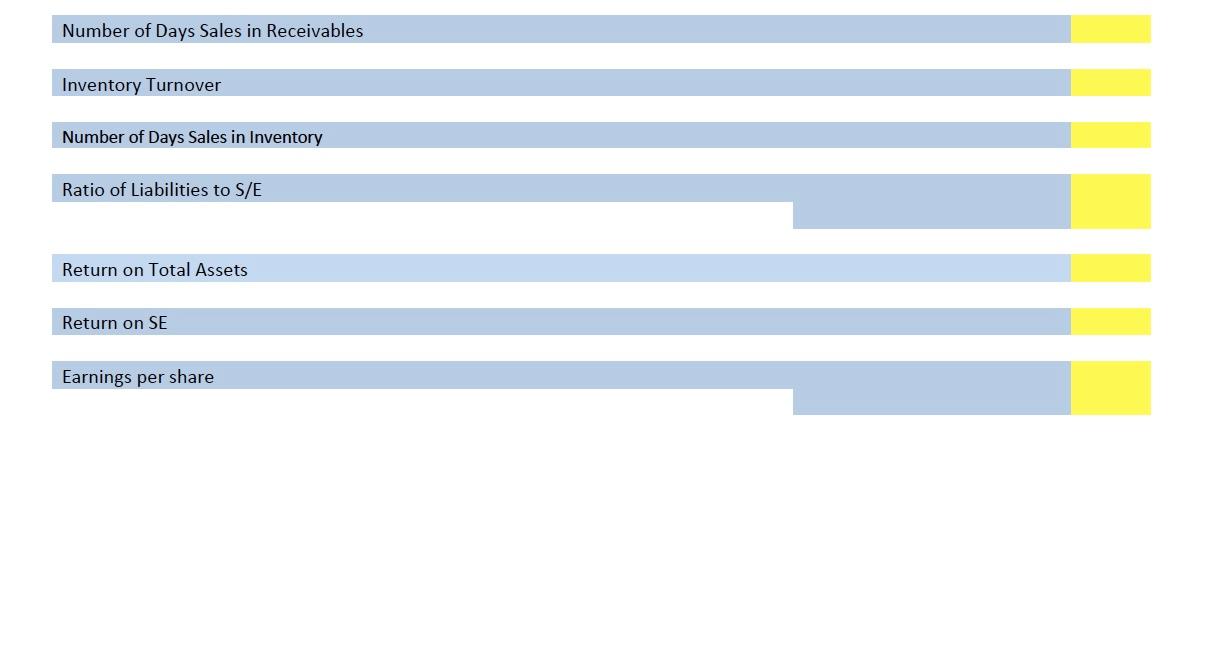

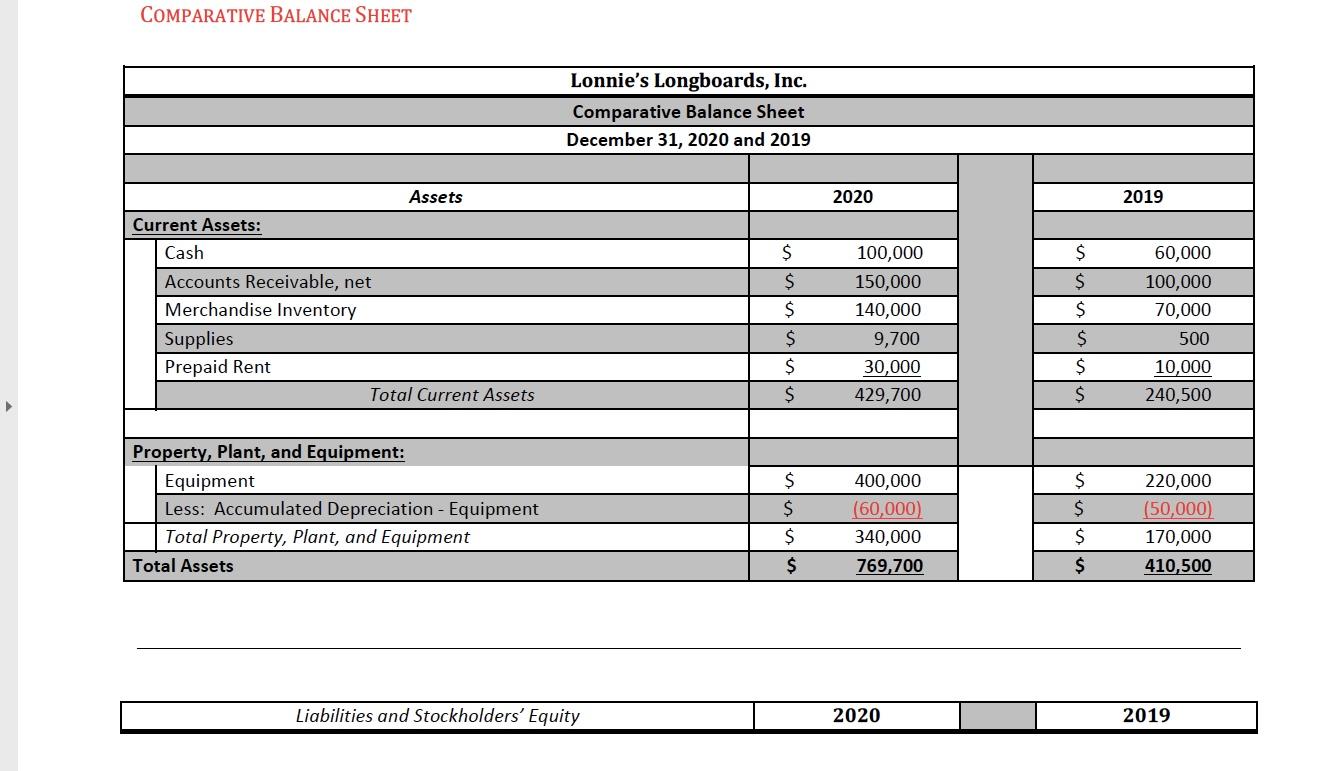

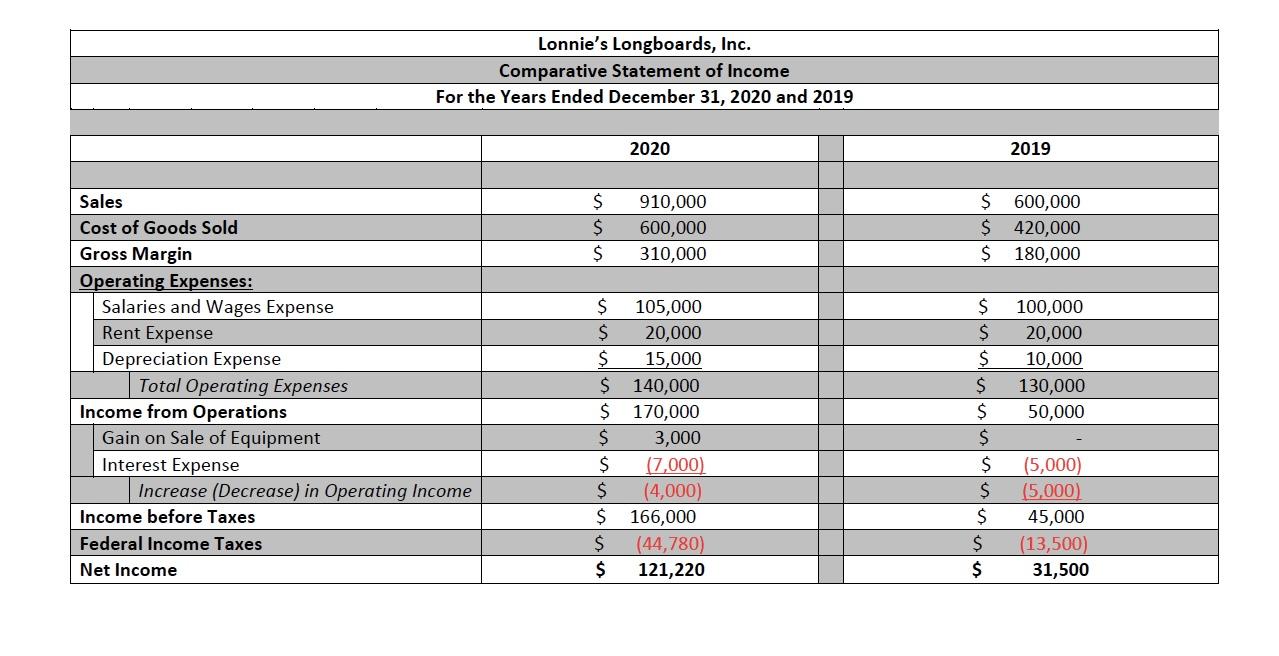

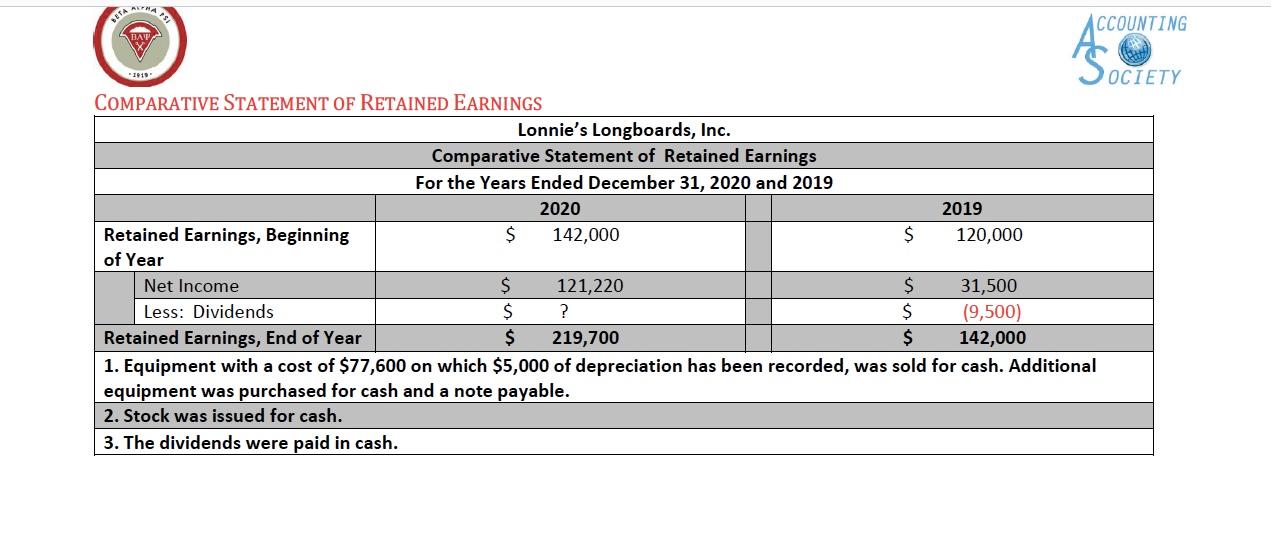

THE BUSINESS This practice set is designed in two parts. The first part provides a review of the financial statements of a corporation selling longboards. Lonnie's Longboards, Inc., primary operation is the sale of longboard skateboards. A financial analysis and Statement of Cash Flow will be required. In the second part, Lonnie's Longboard, Inc. will expand to include the manufacturing process of manufacturing the longboards. All cases of academic dishonesty will be reported to the Office of Student Life. PART ONE INSTRUCTIONS The financial information for the past two years (2020 and 2019) is provided. Using a spreadsheet application, such as Microsoft Excel, and the information from the previous years, provide the following: 1. Prepare a Statement of Cash Flows for the current year using the indirect method. Use the following template. 2. Using horizontal analysis, prepare a Comparative Balance Sheet. Copy the financial statements on Blackboard into an Excel spreadsheet and insert a column to add the percentages. 3. Using vertical analysis, prepare a Comparative Income Statement. Copy the financial statements on Blackboard into an Excel spreadsheet and insert a column to add the percentages. 4. Using the financial statements in the practice set (located on Blackboard), calculate the ratios below: (Use the following templates shown here in the practice set) a. Working Capital both years b. Current Ratio both years Quick ratio both years d. Accounts Receivable Turnover 2020 e. Number of Days Sales in Receivables 2020 (Company policy states 30 days in receivables) f. Inventory Turnover 2020 g. Number of Days Sales in Inventory 2020 (Company policy states 50 days to turn over inventory) h. Ratio of Liabilities to Stockholders' Equity 2020 i. Return on Total Assets 2020 j. Return on Stockholders' Equity 2020 C. k. Earnings Per Share 2019 and 2020 The financial statements provided in this practice set can also be downloaded from Blackboard. Download the Excel files (Income Statement and Balance Sheet) from Blackboard and add a column and calculate the ratios for the vertical and horizontal analysis. 5. Acting as an accounting advisor to the firm, prepare a memo in which you analyze the financial statements you prepared in step two and prepare an analysis of the company's financial position. Identify two strengths and two weaknesses in the company. Make two recommendations to improve the company's financial position. Be specific in each of the recommendations and use as many of the ratios calculated in a-k and the vertical and horizontal analysis to support your explanation and analysis. If you do not use the ratios in your answer you will not credit for the memo. The length should be no more than three paragraphs; one for strengths, one for weaknesses and one for recommendations. 6. Blackboard Instructions a. Memo analyzing the company's strengths and weaknesses with two recommendations. Write your memo in a Word document using ratios to analyze the strengths and weaknesses of the company. Make sure there are no spelling, grammatical, or punctuation errors. Once it is completed make sure that you print it out and then rewrite it in Blackboard. Add information concerning numbers using the format as shown here below and enter it into Blackboard as specified: b. When the answer is in units enter the number as is (See example below) i. 280 C. When the answer is for ratios (ie. Current ratio) and has a decimal take it out two decimal spaces (See example below) i. 280.89 d. When ratios are in days/times take out to two decimal places and write days or times after the number (See example below) i. 280.96 days or times e. When the answer is in dollars ALWAYS include a dollar sign, comma in the dollar amount and cents as shown below: i. $280.83 or $3,800.44 or $480.00 or $3,600.00 Please follow all instructions. If the answers are formatted incorrectly the answer will be counted wrong. Templates for Part 1 follow: Statement of Cash Flow Template Please prepare a Statement of Cash Flow as shown below using Excel. Input answers in the last column. After you answer all questions on Blackboard upload the Statement of Cash Flows, prepared in Excel, to Blackboard. Answers Lonnie's Longboards, Inc. Statement of Cash Flow For the Year Ended December 31, 2020 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to net cash flow from operating activities Depreciation Amortization Gain or Loss Changes in current operating assets and liabilities Net Cash Flow from Operating Activities Cash Flows from Investing Activities Cash received from sale Less cash used for purchases Net Cash Flow from Investing Activities Cash Flow from Financing Activities Cash received from sale Less cash paid dividends or long-term debt Net Cash Flow from Financing Activities Increase or decrease in cash Cash at the beginning of the year Cash at the end of the year Lonnie's Longboard Solution Ratios Template The first one has been done for you Ye Current Asset Current Liability ar 20 20 159,70 0 Working Capital 429,700 270,000 20 19 240,500 168,000 72,500 Current Ratio Quick Ratio Account Receivable Turnover Number of Days Sales in Receivables Inventory Turnover Number of Days Sales in Inventory Ratio of Liabilities to S/E Return on Total Assets Return on SE Earnings per share COMPARATIVE BALANCE SHEET Lonnie's Longboards, Inc. Comparative Balance Sheet December 31, 2020 and 2019 Assets 2020 2019 Current Assets: Cash Accounts Receivable, net Merchandise Inventory Supplies Prepaid Rent Total Current Assets $ $ $ $ $ 100,000 150,000 140,000 9,700 30,000 429,700 $ $ $ $ $ $ 60,000 100,000 70,000 500 10,000 240,500 $ Property, Plant, and Equipment: Equipment Less: Accumulated Depreciation - Equipment Total Property, Plant, and Equipment Total Assets $ $ $ $ 400,000 (60,000) 340,000 769,700 $ $ $ $ 220,000 (50,000) 170,000 410,500 Liabilities and Stockholders' Equity 2020 2019 Lonnie's Longboards, Inc. Comparative Statement of Income For the Years Ended December 31, 2020 and 2019 2020 2019 $ $ $ 910,000 600,000 310,000 $ $ $ 600,000 420,000 180,000 Sales Cost of Goods Sold Gross Margin Operating Expenses: Salaries and Wages Expense Rent Expense Depreciation Expense Total Operating Expenses Income from Operations Gain on Sale of Equipment Interest Expense Increase (Decrease) in Operating Income Income before Taxes Federal Income Taxes Net Income 100,000 20,000 10,000 130,000 50,000 $ 105,000 $ 20,000 $ 15,000 $ 140,000 $ 170,000 $ 3,000 $ (7,000) $ (4,000) $ 166,000 $ (44,780) $ 121,220 $ $ $ $ $ $ $ $ $ $ $ (5,000 (5,000) 45,000 (13,500) 31,500 CCOUNTING SOCIETY COMPARATIVE STATEMENT OF RETAINED EARNINGS Lonnie's Longboards, Inc. Comparative Statement of Retained Earnings For the Years Ended December 31, 2020 and 2019 2020 2019 Retained Earnings, Beginning $ 142,000 $ 120,000 of Year Net Income $ 121,220 $ 31,500 Less: Dividends $ ? $ (9,500) Retained Earnings, End of Year $ 219,700 $ 142,000 1. Equipment with a cost of $77,600 on which $5,000 of depreciation has been recorded, was sold for cash. Additional equipment was purchased for cash and a note payable. 2. Stock was issued for cash. 3. The dividends were paid in cash. THE BUSINESS This practice set is designed in two parts. The first part provides a review of the financial statements of a corporation selling longboards. Lonnie's Longboards, Inc., primary operation is the sale of longboard skateboards. A financial analysis and Statement of Cash Flow will be required. In the second part, Lonnie's Longboard, Inc. will expand to include the manufacturing process of manufacturing the longboards. All cases of academic dishonesty will be reported to the Office of Student Life. PART ONE INSTRUCTIONS The financial information for the past two years (2020 and 2019) is provided. Using a spreadsheet application, such as Microsoft Excel, and the information from the previous years, provide the following: 1. Prepare a Statement of Cash Flows for the current year using the indirect method. Use the following template. 2. Using horizontal analysis, prepare a Comparative Balance Sheet. Copy the financial statements on Blackboard into an Excel spreadsheet and insert a column to add the percentages. 3. Using vertical analysis, prepare a Comparative Income Statement. Copy the financial statements on Blackboard into an Excel spreadsheet and insert a column to add the percentages. 4. Using the financial statements in the practice set (located on Blackboard), calculate the ratios below: (Use the following templates shown here in the practice set) a. Working Capital both years b. Current Ratio both years Quick ratio both years d. Accounts Receivable Turnover 2020 e. Number of Days Sales in Receivables 2020 (Company policy states 30 days in receivables) f. Inventory Turnover 2020 g. Number of Days Sales in Inventory 2020 (Company policy states 50 days to turn over inventory) h. Ratio of Liabilities to Stockholders' Equity 2020 i. Return on Total Assets 2020 j. Return on Stockholders' Equity 2020 C. k. Earnings Per Share 2019 and 2020 The financial statements provided in this practice set can also be downloaded from Blackboard. Download the Excel files (Income Statement and Balance Sheet) from Blackboard and add a column and calculate the ratios for the vertical and horizontal analysis. 5. Acting as an accounting advisor to the firm, prepare a memo in which you analyze the financial statements you prepared in step two and prepare an analysis of the company's financial position. Identify two strengths and two weaknesses in the company. Make two recommendations to improve the company's financial position. Be specific in each of the recommendations and use as many of the ratios calculated in a-k and the vertical and horizontal analysis to support your explanation and analysis. If you do not use the ratios in your answer you will not credit for the memo. The length should be no more than three paragraphs; one for strengths, one for weaknesses and one for recommendations. 6. Blackboard Instructions a. Memo analyzing the company's strengths and weaknesses with two recommendations. Write your memo in a Word document using ratios to analyze the strengths and weaknesses of the company. Make sure there are no spelling, grammatical, or punctuation errors. Once it is completed make sure that you print it out and then rewrite it in Blackboard. Add information concerning numbers using the format as shown here below and enter it into Blackboard as specified: b. When the answer is in units enter the number as is (See example below) i. 280 C. When the answer is for ratios (ie. Current ratio) and has a decimal take it out two decimal spaces (See example below) i. 280.89 d. When ratios are in days/times take out to two decimal places and write days or times after the number (See example below) i. 280.96 days or times e. When the answer is in dollars ALWAYS include a dollar sign, comma in the dollar amount and cents as shown below: i. $280.83 or $3,800.44 or $480.00 or $3,600.00 Please follow all instructions. If the answers are formatted incorrectly the answer will be counted wrong. Templates for Part 1 follow: Statement of Cash Flow Template Please prepare a Statement of Cash Flow as shown below using Excel. Input answers in the last column. After you answer all questions on Blackboard upload the Statement of Cash Flows, prepared in Excel, to Blackboard. Answers Lonnie's Longboards, Inc. Statement of Cash Flow For the Year Ended December 31, 2020 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to net cash flow from operating activities Depreciation Amortization Gain or Loss Changes in current operating assets and liabilities Net Cash Flow from Operating Activities Cash Flows from Investing Activities Cash received from sale Less cash used for purchases Net Cash Flow from Investing Activities Cash Flow from Financing Activities Cash received from sale Less cash paid dividends or long-term debt Net Cash Flow from Financing Activities Increase or decrease in cash Cash at the beginning of the year Cash at the end of the year Lonnie's Longboard Solution Ratios Template The first one has been done for you Ye Current Asset Current Liability ar 20 20 159,70 0 Working Capital 429,700 270,000 20 19 240,500 168,000 72,500 Current Ratio Quick Ratio Account Receivable Turnover Number of Days Sales in Receivables Inventory Turnover Number of Days Sales in Inventory Ratio of Liabilities to S/E Return on Total Assets Return on SE Earnings per share COMPARATIVE BALANCE SHEET Lonnie's Longboards, Inc. Comparative Balance Sheet December 31, 2020 and 2019 Assets 2020 2019 Current Assets: Cash Accounts Receivable, net Merchandise Inventory Supplies Prepaid Rent Total Current Assets $ $ $ $ $ 100,000 150,000 140,000 9,700 30,000 429,700 $ $ $ $ $ $ 60,000 100,000 70,000 500 10,000 240,500 $ Property, Plant, and Equipment: Equipment Less: Accumulated Depreciation - Equipment Total Property, Plant, and Equipment Total Assets $ $ $ $ 400,000 (60,000) 340,000 769,700 $ $ $ $ 220,000 (50,000) 170,000 410,500 Liabilities and Stockholders' Equity 2020 2019 Lonnie's Longboards, Inc. Comparative Statement of Income For the Years Ended December 31, 2020 and 2019 2020 2019 $ $ $ 910,000 600,000 310,000 $ $ $ 600,000 420,000 180,000 Sales Cost of Goods Sold Gross Margin Operating Expenses: Salaries and Wages Expense Rent Expense Depreciation Expense Total Operating Expenses Income from Operations Gain on Sale of Equipment Interest Expense Increase (Decrease) in Operating Income Income before Taxes Federal Income Taxes Net Income 100,000 20,000 10,000 130,000 50,000 $ 105,000 $ 20,000 $ 15,000 $ 140,000 $ 170,000 $ 3,000 $ (7,000) $ (4,000) $ 166,000 $ (44,780) $ 121,220 $ $ $ $ $ $ $ $ $ $ $ (5,000 (5,000) 45,000 (13,500) 31,500 CCOUNTING SOCIETY COMPARATIVE STATEMENT OF RETAINED EARNINGS Lonnie's Longboards, Inc. Comparative Statement of Retained Earnings For the Years Ended December 31, 2020 and 2019 2020 2019 Retained Earnings, Beginning $ 142,000 $ 120,000 of Year Net Income $ 121,220 $ 31,500 Less: Dividends $ ? $ (9,500) Retained Earnings, End of Year $ 219,700 $ 142,000 1. Equipment with a cost of $77,600 on which $5,000 of depreciation has been recorded, was sold for cash. Additional equipment was purchased for cash and a note payable. 2. Stock was issued for cash. 3. The dividends were paid in cash