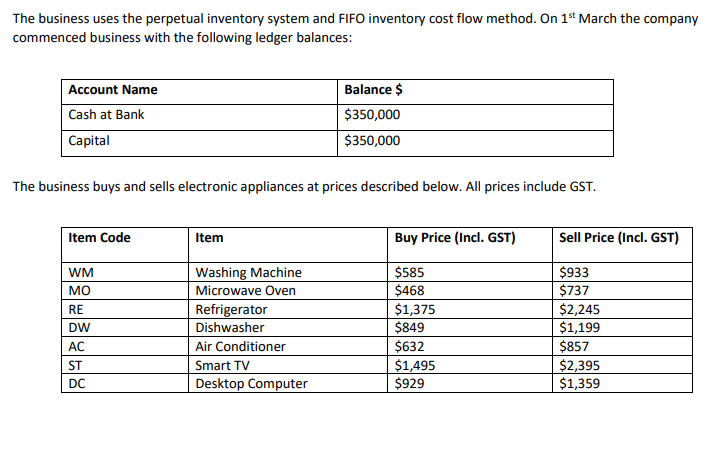

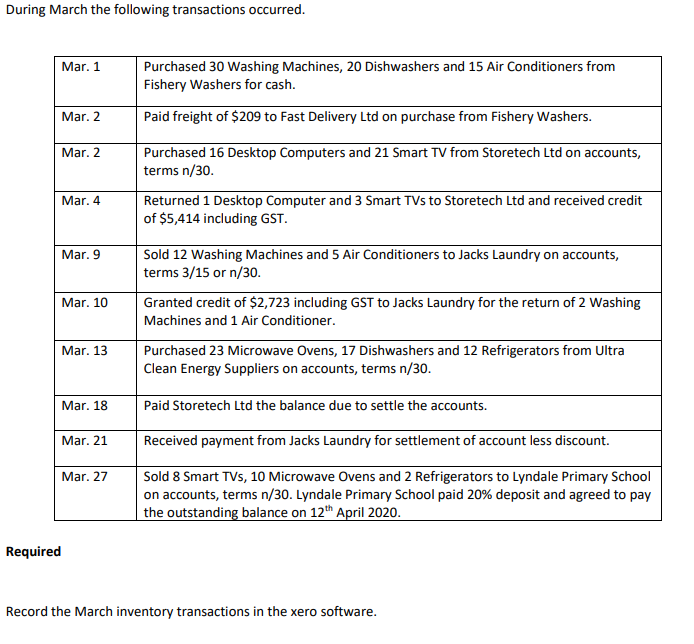

The business uses the perpetual inventory system and FIFO inventory cost flow method. On 1st March the company commenced business with the following ledger balances: Account Name Cash at Bank Capital Balance $ $350,000 $350,000 The business buys and sells electronic appliances at prices described below. All prices include GST. Item Code Item Buy Price (Incl. GST) Sell Price (Incl. GST) WM MO RE DW AC ST DC Washing Machine Microwave Oven Refrigerator Dishwasher Air Conditioner Smart TV Desktop Computer $585 $468 $1,375 $849 $632 $1,495 $929 $933 $737 $2,245 $1,199 $857 $2,395 $1,359 During March the following transactions occurred. Mar. 1 Purchased 30 Washing Machines, 20 Dishwashers and 15 Air Conditioners from Fishery Washers for cash. Mar. 2 Paid freight of $209 to Fast Delivery Ltd on purchase from Fishery Washers. Mar. 2 Mar. 4 Mar. 9 Purchased 16 Desktop Computers and 21 Smart TV from Storetech Ltd on accounts, terms n/30. Returned 1 Desktop Computer and 3 Smart TVs to Storetech Ltd and received credit of $5,414 including GST. Sold 12 Washing Machines and 5 Air Conditioners to Jacks Laundry on accounts, terms 3/15 or n/30. Granted credit of $2,723 including GST to Jacks Laundry for the return of 2 Washing Machines and 1 Air Conditioner. Purchased 23 Microwave Ovens, 17 Dishwashers and 12 Refrigerators from Ultra Clean Energy Suppliers on accounts, terms n/30. Mar. 10 Mar. 13 Mar. 18 Paid Storetech Ltd the balance due to settle the accounts. Received payment from Jacks Laundry for settlement of account less discount. Mar. 21 Mar. 27 Sold 8 Smart TVs, 10 Microwave Ovens and 2 Refrigerators to Lyndale Primary School on accounts, terms n/30. Lyndale Primary School paid 20% deposit and agreed to pay the outstanding balance on 12th April 2020. Required Record the March inventory transactions in the xero software. The business uses the perpetual inventory system and FIFO inventory cost flow method. On 1st March the company commenced business with the following ledger balances: Account Name Cash at Bank Capital Balance $ $350,000 $350,000 The business buys and sells electronic appliances at prices described below. All prices include GST. Item Code Item Buy Price (Incl. GST) Sell Price (Incl. GST) WM MO RE DW AC ST DC Washing Machine Microwave Oven Refrigerator Dishwasher Air Conditioner Smart TV Desktop Computer $585 $468 $1,375 $849 $632 $1,495 $929 $933 $737 $2,245 $1,199 $857 $2,395 $1,359 During March the following transactions occurred. Mar. 1 Purchased 30 Washing Machines, 20 Dishwashers and 15 Air Conditioners from Fishery Washers for cash. Mar. 2 Paid freight of $209 to Fast Delivery Ltd on purchase from Fishery Washers. Mar. 2 Mar. 4 Mar. 9 Purchased 16 Desktop Computers and 21 Smart TV from Storetech Ltd on accounts, terms n/30. Returned 1 Desktop Computer and 3 Smart TVs to Storetech Ltd and received credit of $5,414 including GST. Sold 12 Washing Machines and 5 Air Conditioners to Jacks Laundry on accounts, terms 3/15 or n/30. Granted credit of $2,723 including GST to Jacks Laundry for the return of 2 Washing Machines and 1 Air Conditioner. Purchased 23 Microwave Ovens, 17 Dishwashers and 12 Refrigerators from Ultra Clean Energy Suppliers on accounts, terms n/30. Mar. 10 Mar. 13 Mar. 18 Paid Storetech Ltd the balance due to settle the accounts. Received payment from Jacks Laundry for settlement of account less discount. Mar. 21 Mar. 27 Sold 8 Smart TVs, 10 Microwave Ovens and 2 Refrigerators to Lyndale Primary School on accounts, terms n/30. Lyndale Primary School paid 20% deposit and agreed to pay the outstanding balance on 12th April 2020. Required Record the March inventory transactions in the xero software