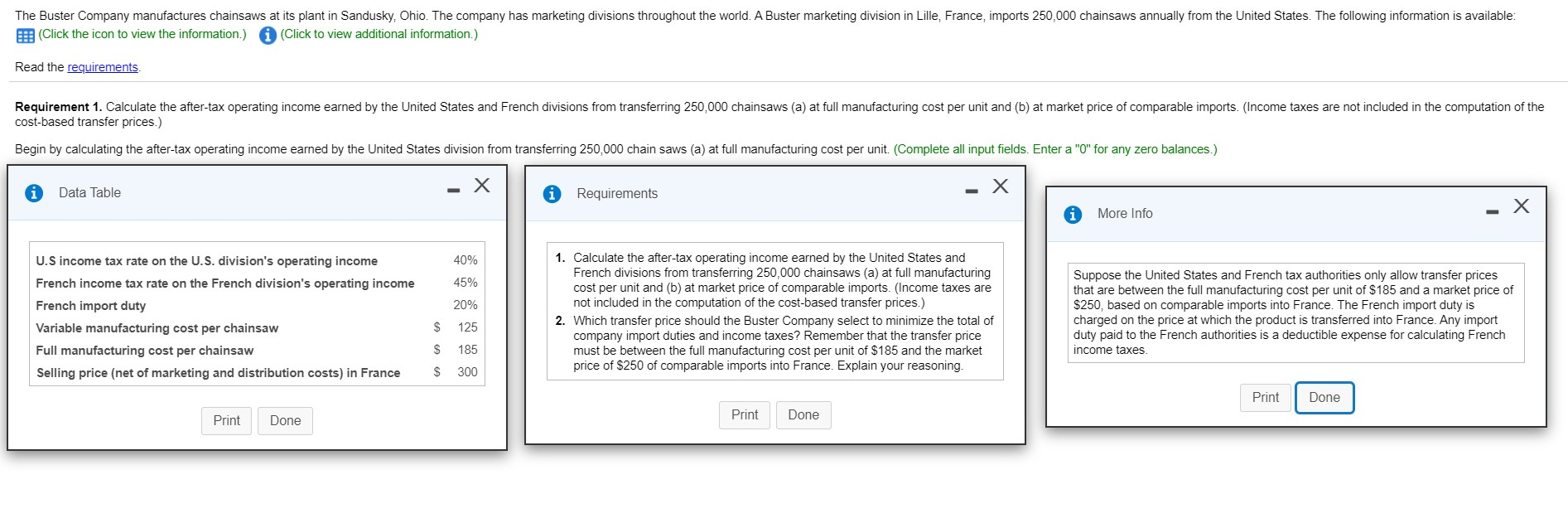

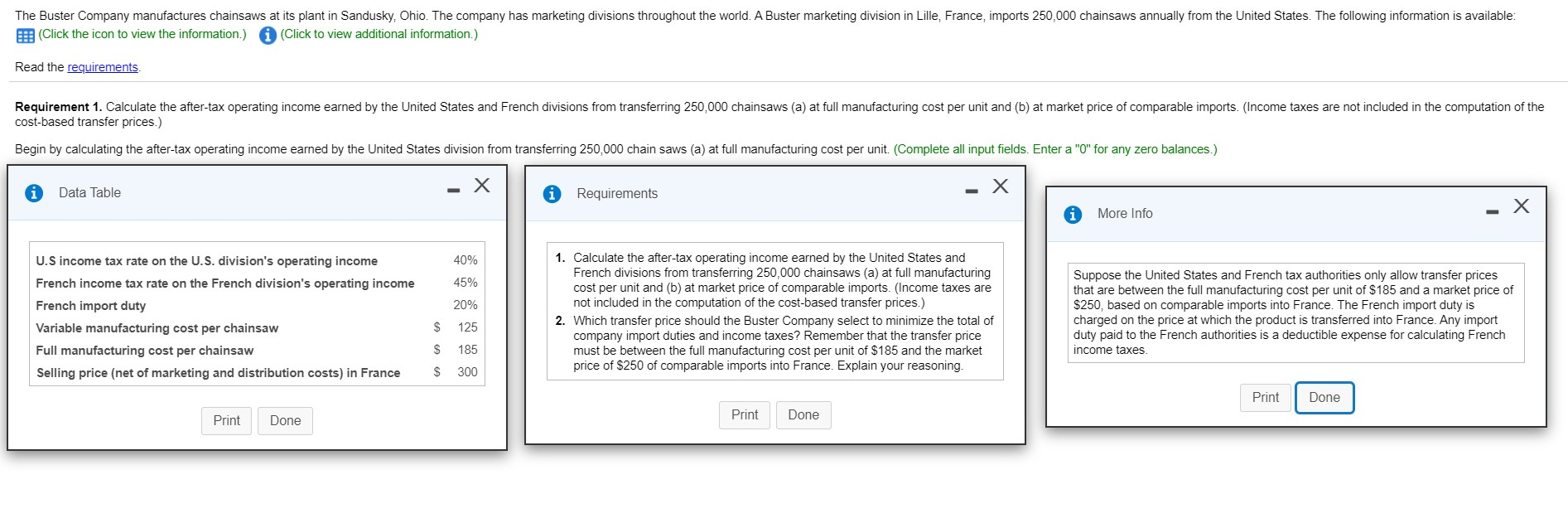

The Buster Company manufactures chainsaws at its plant in Sandusky, Ohio. The company has marketing divisions throughout the world. A Buster marketing division in Lille, France, imports 250,000 chainsaws annually from the United States. The following information is available: (Click the icon to view the information.) (Click to view additional information.) Read the requirements. Requirement 1. Calculate the after-tax operating income earned by the United States and French divisions from transferring 250,000 chainsaws (a) at full manufacturing cost per unit and (b) at market price of comparable imports. (Income taxes are not included in the computation of the cost-based transfer prices.) Begin by calculating the after-tax operating income earned by the United States division from transferring 250,000 chain saws (a) at full manufacturing cost per unit. (Complete all input fields. Enter a "0" for any zero balances.) * X Data Table i - Requirements A More Info 40% 45% 20% U.S income tax rate on the U.S. division's operating income French income tax rate on the French division's operating income French import duty Variable manufacturing cost per chainsaw Full manufacturing cost per chainsaw Selling price (net of marketing and distribution costs) in France 1. Calculate the after-tax operating income earned by the United States and French divisions from transferring 250,000 chainsaws (a) at full manufacturing cost per unit and (b) at market price of comparable imports. (Income taxes are not included in the computation of the cost-based transfer prices.) 2. Which transfer price should the Buster Company select to minimize the total of company import duties and income taxes? Remember that the transfer price must be between the full manufacturing cost per unit of $185 and the market price of $250 of comparable imports into France. Explain your reasoning. Suppose the United States and French tax authorities only allow transfer prices that are between the full manufacturing cost per unit of $185 and a market price of $250, based on comparable imports into France. The French import duty is charged on the price at which the product is transferred into France. Any import duty paid to the French authorities is a deductible expense for calculating French income taxes. 125 $ $ 185 300 Print Done Print Done Print Done The Buster Company manufactures chainsaws at its plant in Sandusky, Ohio. The company has marketing divisions throughout the world. A Buster marketing division in Lille, France, imports 250,000 chainsaws annually from the United States. The following information is available: (Click the icon to view the information.) (Click to view additional information.) Read the requirements. Requirement 1. Calculate the after-tax operating income earned by the United States and French divisions from transferring 250,000 chainsaws (a) at full manufacturing cost per unit and (b) at market price of comparable imports. (Income taxes are not included in the computation of the cost-based transfer prices.) Begin by calculating the after-tax operating income earned by the United States division from transferring 250,000 chain saws (a) at full manufacturing cost per unit. (Complete all input fields. Enter a "0" for any zero balances.) * X Data Table i - Requirements A More Info 40% 45% 20% U.S income tax rate on the U.S. division's operating income French income tax rate on the French division's operating income French import duty Variable manufacturing cost per chainsaw Full manufacturing cost per chainsaw Selling price (net of marketing and distribution costs) in France 1. Calculate the after-tax operating income earned by the United States and French divisions from transferring 250,000 chainsaws (a) at full manufacturing cost per unit and (b) at market price of comparable imports. (Income taxes are not included in the computation of the cost-based transfer prices.) 2. Which transfer price should the Buster Company select to minimize the total of company import duties and income taxes? Remember that the transfer price must be between the full manufacturing cost per unit of $185 and the market price of $250 of comparable imports into France. Explain your reasoning. Suppose the United States and French tax authorities only allow transfer prices that are between the full manufacturing cost per unit of $185 and a market price of $250, based on comparable imports into France. The French import duty is charged on the price at which the product is transferred into France. Any import duty paid to the French authorities is a deductible expense for calculating French income taxes. 125 $ $ 185 300 Print Done Print Done Print Done